Banca d'Italia authorizes market access for entities wishing to carry out licensed banking and financial activities that meet the relevant legal requirements, with a view to ensuring the sound and prudent management of financial intermediaries and the overall stability, effectiveness and competitiveness of the financial system. In this capacity, it performs the following functions:

- it submits bank licensing applications to the ECB, in accordance with the provisions of Regulation (EU) 1024/2013;

- it authorizes financial intermediaries under Article 106 of the Consolidated Law on Banking (Testo Unico Bancario, TUB) including loan guarantee schemes, pawnbrokers and trust companies; asset managers (SGRs, SICAFs, SICAVs); payment institutions (PIs); electronic money institutions (EMIs); and credit servicers;

- it authorizes the registration of microcredit companies in the list under Article 111 of the TUB, pending the establishment of a special body responsible for managing and supervising these companies;

- it authorizes, in agreement with CONSOB, specialized issuers of asset-referenced tokens (ARTs) to offer these tokens to the public and to seek their admission to trading, in accordance with the Markets in Crypto-Assets (MiCA) Regulation.

Investment firms, crowdfunding service providers and specialized crypto-asset service providers (CASPs) under the MiCA Regulation are licensed by CONSOB. For the purpose of issuing licences, CONSOB requests the opinion of Banca d'Italia.

Specific information on how Banca d'Italia authorizes the different categories of intermediaries is available in the dedicated sections, which can be accessed from the links in the table below. For MiCAR intermediaries, please refer also to the dedicated page.

| Intermediary | Activities | Duration | Competent authority |

|---|---|---|---|

| Banks | Collecting savings from the general public and granting loans | 180 days | European Central Bank / Banca d'Italia |

| Financial intermediaries | Lending in any form | 180 days | Banca d'Italia |

| Loan guarantee schemes | Lending and issuing collective guarantees for exposures | 180 days | Banca d'Italia |

| Trust companies | Safekeeping and administering assets entrusted to them by trustors based on a fiduciary mandate | 180 days | Banca d'Italia |

| Pawnbrokers | Short-term financing to natural persons against pledged movable assets | 180 days | Banca d'Italia |

| Microcredit operators | Loans for small amounts combined with the provision of ancillary services | 90 days | Banca d'Italia |

| Payment Institutions | Payment services | 90 days | Banca d'Italia |

| Electronic Money Institutions | Issuing e-Money | 90 days | Banca d'Italia |

| Asset managers (SGRs, SICAVs, SICAFs) | Asset management | 90 days | Banca d'Italia (after consulting CONSOB) |

| Specialized ART issuers | Issuance, offering to the public and seeking admission to trading of asset-referenced tokens (ARTs) | 105 working days | Banca d'Italia in agreement with CONSOB |

| Credit servicers | Management of bad loans | 90 days | Banca d'Italia |

The regulation applicable to financial intermediaries subject to licensing by Banca d'Italia is available on Banca d'Italia's website. Supervisory publications and regulations are listed by sector, year and topic on the 'Banking and Financial Supervision' page. In addition, an e-mail alert service provides continuously the latest news and information.

The licensing procedure

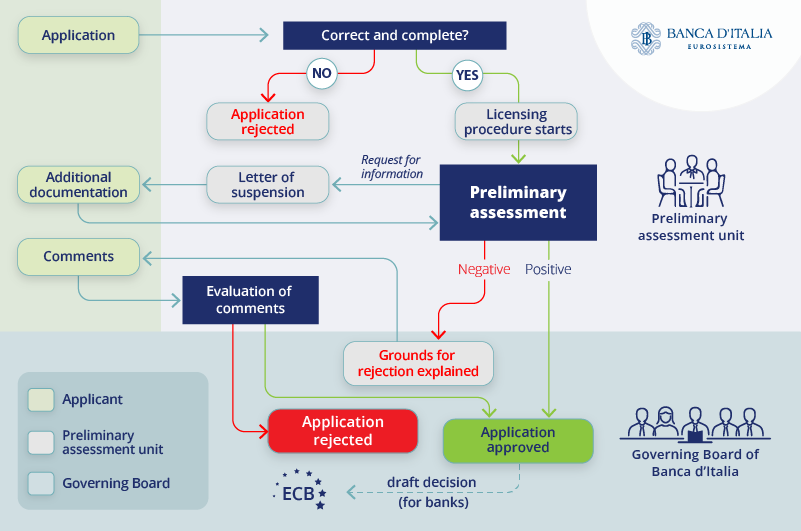

The licensing procedure (see infographic) only starts once Banca d'Italia has received a correct and complete application. If these requirements are not met, the procedure will not start and the applicant will be informed of the reasons why the application is considered incorrect or incomplete.

Licensing applications must be submitted by certified email (PEC, see the Contacts section below). Applications for banking licences must be submitted via the Banking supervision portal or IMAS portal, as required by Banca d'Italia's Regulation of 23 December 2021 (only in Italian).

Before submitting an application, intermediaries may contact Banca d'Italia (see the Contacts section) and request a meeting to discuss their applications. These meetings are intended to assist applicants and are not compulsory. They do not count towards the application deadlines.

During the licensing procedure, Banca d'Italia may request additional information and certifications, carry out appraisals and investigations, and obtain the opinion of domestic and foreign authorities. Where provided for by law, the procedure may be suspended. Applications may be suspended for up to 180 days, after which the remaining time of the original deadline will resume.

Depending on the outcome of its preliminary assessment, Banca d'Italia will proceed as follows:

- positive outcome: Banca d'Italia grants the licence or, for banks, notifies the ECB of its proposal to grant the banking licence. The licence may be subject to restrictions or recommendations on measures to take to ensure compliance with prudential rules and sound and prudent management;

- negative outcome: before rejecting an application, Banca d'Italia notifies the applicant of the reasons for its decision. This notification suspends the procedure. Over the following 10 days, the applicant has the right to make its remarks in writing. The procedure resumes 10 days after the receipt of the applicant's reply or, in the absence of a reply, 10 days after Banca d'Italia's notification. If the grounds for rejection are confirmed, the final rejection decision will state the reasons for not accepting the applicant's remarks, if any, and any further reasons arising from these remarks.

The following provisions apply to the licensing procedure:

- Banca d'Italia Regulation under Law 241/1990 (only in Italian); the deadlines are indicated in List 1a and List 1b;

- agreements signed with other authorities;

- supervisory rules and regulations applicable to each intermediary.

For specific information relating to the licensing procedures for banks, please see the dedicated section.

Contacts

For licences to operate in the banking and financial markets under Banca d'Italia's remit, please contact the Supervisory Institutional Relations Directorate, New Banks and Financial Intermediaries Division, at the following email addresses:

- email: Servizio.Riv.Costituzioni@bancaditalia.it

- certified email (PEC): riv@pec.bancaditalia.it

Emails can be sent to the above addresses to request meetings or ask for clarifications strictly relating to the licensing process. Requests must include the applicant's contact information (email, certified email, mobile number, or other telephone number). For queries of a general nature relating to Banca d'Italia regulations, please see the dedicated page (only in Italian). For further details on the administrative procedure, please see the FAQs below.

Please note: questions regarding matters already covered on Banca d'Italia's website will not be answered.

Applications from non-bank intermediaries must be submitted to Banca d'Italia by PEC. In accordance with Banca d'Italia's Regulation of 23 December 2021 (only in Italian), banks must use the IMAS Portal.

When the application involves innovative initiatives in the fields of financial and payment services, and where certain requirements are met, it is possible to utilize the following innovation facilitators: Fintech Channel, Regulatory Sandbox and Milano Hub. Each of these has specific requirements, which are outlined in the respective sections.

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin