Attività esercitata

Per servizio di crowdfunding si intende, ai sensi del Regolamento (UE) 2020/1503 (c.d. Regolamento ECSP), l'abbinamento tra interessi a finanziare attività economiche di investitori e titolari di progetti, tramite l'utilizzo di una piattaforma di crowdfunding, che consiste in una delle seguenti attività:

- intermediazione nella concessione di prestiti (c.d. lending-based crowdfunding);

- collocamento senza impegno irrevocabile di valori mobiliari e strumenti ammessi a fini di crowdfunding emessi da titolari di progetti o società veicolo e ricezione e trasmissione degli ordini di clienti relativamente a tali valori mobiliari e strumenti (c.d. investment-based crowdfunding).

I servizi di crowdfunding possono essere offerti da gestori specializzati, da banche, SIM, istituti di pagamento, istituti di moneta elettronica e intermediari finanziari ex art. 106 TUB congiuntamente alle attività loro proprie.

I gestori delle piattaforme possono anche offrire ulteriori servizi - previsti dal Regolamento ECSP - quali, ad esempio, la gestione di una bacheca elettronica, l'applicazione di punteggi di affidabilità creditizia, il suggerimento del prezzo e/o del tasso di interesse delle offerte di crowdfunding.

La prestazione dei servizi di crowdfunding è disciplinata, oltre che dal Regolamento ECSP, dalle norme tecniche di regolamentazione e di attuazione (regulatory technical standard - RTS e implementing technical standard - ITS) adottate dalla Commissione europea su proposta dell'Autorità bancaria europea (European Banking Authority - EBA) e dell'Autorità europea degli strumenti finanziari e dei mercati (European Securities and Markets Authority - ESMA. La disciplina è integrata da disposizioni attuative emanate - nei limiti consentiti dalle norme europee, direttamente applicabili - dalla Banca d'Italia e dalla Consob, secondo le rispettive competenze (cfr. infra sezione Normativa). L'ESMA, inoltre, sul proprio sito pubblica Q&A per fornire chiarimenti sulle disposizioni in materia di fornitori europei di servizi di crowdfunding per le imprese.

Tenuto conto che la disciplina del crowdfunding per le imprese è armonizzata, il fornitore, una volta autorizzato, può prestare i servizi di crowdfunding in uno Stato membro diverso da quello in cui è stata concessa l'autorizzazione, previa notifica alla Consob, autorità designata quale punto di contatto unico in conformità dell'art. 29, par. 2, del Regolamento ECSP.

Procedimento autorizzativo

La Banca d'Italia e la Consob sono le autorità competenti per l'autorizzazione e la supervisione dei fornitori di servizi di crowdfunding ai sensi dell'art. 4-sexies.1, comma 2, del TUF, secondo criteri di vigilanza per finalità. In particolare, per quanto riguarda il rilascio dell'autorizzazione:

- la Consob, sentita la Banca d'Italia, autorizza i gestori specializzati di piattaforme di crowdfunding e le SIM che vogliono prestare detti servizi;

- la Banca d'Italia, sentita la Consob, autorizza come fornitori di servizi di crowdfunding banche, istituti di pagamento, istituti di moneta elettronica e gli intermediari finanziari ex art. 106 TUB.

Lo scambio di informazioni tra le Autorità nell'ambito del procedimento autorizzativo è regolato da un apposito protocollo d'intesa.

Le istanze, predisposte mediante l'apposito modulo (cfr. sezione Materiali), vanno trasmesse, unitamente ai relativi allegati, alla Consob o alla Banca d'Italia in base ai criteri sopra individuati. L'inoltro delle istanze alla Banca d'Italia avviene via pec (cfr. sezione Contatti).

Prima dell'inoltro formale di una istanza, gli operatori possono contattare la Consob o la Banca d'Italia (cfr. sezione Contatti) e chiedere un incontro per illustrare le principali caratteristiche dell'iniziativa. Gli incontri, non obbligatori, sono un ausilio per gli operatori. Le interlocuzioni in questa fase non rilevano per il decorso dei termini.

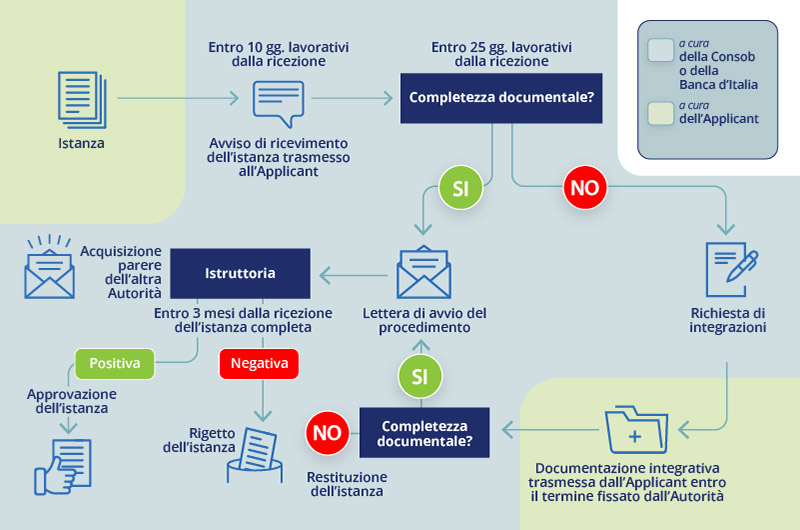

Il procedimento di autorizzazione (vedi infografica) ha una durata complessiva di 3 mesi, decorrente dalla data di ricezione dell'istanza completa.

La Banca d'Italia e la Consob valutano la completezza della domanda entro 25 giorni lavorativi dalla data di ricezione; se la domanda risulta incompleta, l'Autorità competente al rilascio dell'autorizzazione fissa un termine entro il quale il candidato fornitore di servizi di crowdfunding è tenuto a trasmettere le informazioni mancanti. Se, trascorso tale termine, la domanda risulta ancora incompleta, l'istanza può essere rifiutata e, in tal caso, i documenti sono restituiti al candidato istante.

Se la domanda è completa, l'Autorità competente ne informa immediatamente il candidato fornitore di servizi di crowdfunding e ha 3 mesi per provvedere nel merito. L'Autorità tenuta al rilascio del parere lo adotta entro 45 giorni dalla data di ricevimento dell'istanza completa. La decisione finale è notificata al fornitore entro i successivi tre giorni lavorativi.

Al procedimento si applicano le indicazioni procedurali dettate da:

- Regolamento ECSP;

- Regolamento delegato (UE) 2022/2112;

- Regolamento della Consob in materia di servizi di crowdfunding;

- Disposizioni della Banca d'Italia di attuazione dell'articolo 4-sexies.1 del TUF;

- Protocollo di intesa concluso tra Consob e Banca d'Italia.

Per ulteriori chiarimenti sul procedimento amministrativo consulta la sezione FAQ.

Requisiti

I fornitori di servizi di crowdfunding per le imprese sono persone giuridiche stabilite nel territorio dell'Unione europea, autorizzate ai sensi del Regolamento ECSP.

Salve le specifiche discipline di settore applicabili agli intermediari vigilati che intendano fornire servizi di crowdfunding, i requisiti sono elencati all'art. 12 del Regolamento ECSP e comprendono tra l'altro:

- il possesso dei requisiti previsti dalla normativa per i partecipanti al capitale che detengono, direttamente o indirettamente, almeno il 20% del capitale sociale o dei diritti di voto;

- il possesso dei requisiti previsti dalla normativa per gli esponenti aziendali;

- il rispetto dei requisiti prudenziali nel triennio previsionale tramite fondi propri e/o una polizza assicurativa (o garanzia analoga);

- l'adozione di assetti di governance e struttura organizzativa complessivamente adeguati rispetto all'attività;

- la definizione del processo per lo svolgimento delle verifiche nei confronti dei titolari di progetti previste dalla normativa.

All'istanza vanno allegati documenti specifici, indicati nella normativa di riferimento (cfr. sezione Normativa) e nel modulo di istanza (cfr. FAQ).

L'autorizzazione può essere rifiutata qualora esistano ragioni obiettive e dimostrabili per ritenere che l'organo di gestione del candidato fornitore di servizi di crowdfunding potrebbe compromettere la sua gestione efficace, sana e prudente e la sua continuità operativa, nonché un'adeguata considerazione degli interessi dei clienti e dell'integrità del mercato.

Contatti

Per la presentazione di istanze di autorizzazione come fornitori di servizi di crowdfunding per le imprese (solo via pec), di eventuali richieste di interlocuzione informale o di chiarimenti è possibile contattare la Banca d'Italia e la Consob ai seguenti indirizzi:

- per la Banca d'Italia, Servizio Rapporti Istituzionali di Vigilanza, Divisione Costituzioni banche e altri intermediari:

- per la Consob, visitare la sezione "Contatti" del sito istituzionale.

Le richieste di chiarimenti e i quesiti relativi ad aspetti già chiariti sul sito non avranno riscontro.

Adempimenti successivi alla autorizzazione

Successivamente al rilascio dell'autorizzazione, il fornitore di servizi di crowdfunding per le imprese è iscritto nel registro tenuto dall'ESMA ai sensi dell'art. 14 del Regolamento ECSP. La Consob - in qualità di Autorità designata come punto unico di contatto - trasmette all'ESMA le informazioni necessarie.

Una volta autorizzato, il fornitore è tenuto ad avviare l'operatività entro 18 mesi e ad adempiere agli obblighi informativi di cui alle Disposizioni della Banca d'Italia di attuazione dell'articolo 4-sexies.1 del TUF e al Regolamento della Consob in materia di servizi di crowdfunding.

Per i controlli di competenza dell'Istituto il fornitore viene assegnato all'unità della Banca d'Italia competente per la supervisione ed è sottoposto ai poteri di vigilanza previsti dall'art. 4-sexies.1 del TUF.

YouTube

YouTube  X - Banca d’Italia

X - Banca d’Italia  Linkedin

Linkedin