Institutional action

Banca d'Italia's decisions and actions are primarily aimed at pursuing monetary stability and the stability of the financial system, as a whole and in its individual components (i.e. intermediaries, operators, and trading and post-trading infrastructures). With regard to these objectives, its institutional functions fall into four areas: money, the financial system, research and statistics and services for the State.

The new features for this year are described for each area, and the main functions performed are shown in the final boxes.

Money

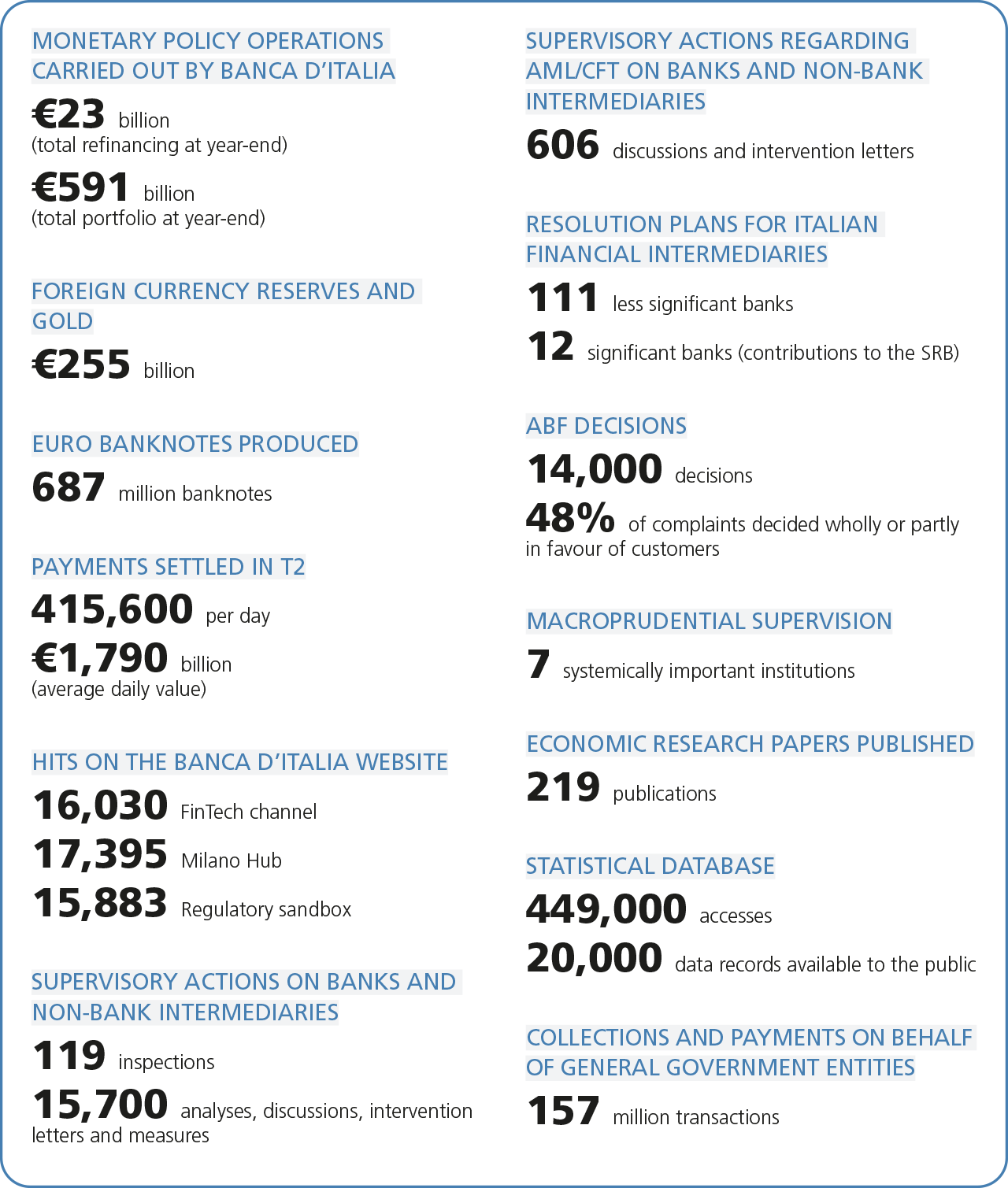

Monetary policy. - In light of the gradual improvement in the inflation outlook, the ECB Governing Council eased the degree of monetary policy tightening in 2024, reducing the official rates from June onwards. The decrease in interest rates was accompanied by a contraction in the stocks of securities held by central banks caused by the reduction in and subsequent discontinuation of reinvestments under the pandemic emergency purchase programme (PEPP), as well as by the gradual maturity of securities under the asset purchase programme (APP). Banca d'Italia's monetary policy securities portfolio amounted to around €591 billion at the end of the year (€657 billion at the end of 2023).

In 2024, the Governing Council formalized the new operational framework for monetary policy, which was already in use, by stabilizing its key parameters. Specifically, the Eurosystem will continue to steer its monetary policy stance by means of the deposit facility rate; liquidity will be provided via a wide variety of instruments, which will include, in a later phase, structural refinancing operations and a structural securities portfolio. This framework will be reviewed by end-2026.

Foreign currency reserves and gold. - Foreign currency operations worth €3.7 billion (€7.6 billion in 2023) were carried out to cover Italy's foreign currency payments and receipts and to manage Banca d'Italia's foreign currency reserves. As at 31 December 2024, the value of the gold reserves and net assets denominated in foreign currencies stood at €254.7 billion, up by €55 billion compared with the end of 2023, mainly because of the increase in the price of gold.

Banknotes. - Banca d'Italia produced 687 million euro banknotes in 2024. It was also involved in the production of test banknotes and in co-operation projects with other national central banks (NCBs), for a total of 129 million banknotes. The Bank continued to carry out research and development in support of the Eurosystem. Work continued in 2024 on changes to cash access points and on their distribution throughout Italy; the Bank continued to participate in activities in international forums relating to access to and acceptance of cash as a means of payment.

Payment systems. - The TARGET services have grown in terms of settled transactions: an average of 415,600 payments were made per day (404,000 in 2023) in the T2 system, 791,400 (699,900 in 2023) in T2S and 1.3 million (1.1 million in 2023) in TIPS; the latter has also been settling payments in Swedish krona since February 2024. In line with the G20 agenda for cross-border payments, work has started on enabling cross-currency payments to be settled in TIPS. Work continued at Eurosystem level to realize the Eurosystem Collateral Management System (ECMS), which will be launched on 16 June 2025.

The digital euro. - The preparation phase for the digital euro project, which will end in 2025, has continued. There has been progress in drawing up technical standards to govern the provision of associated services and in the selection of potential suppliers for the technology platform.

Market supervision and payment systems and instruments oversight. - There was more assessment and control of the risks and of the safeguards adopted by the financial markets, related infrastructures and payment systems, with a particular focus on strengthening operational and digital resilience. Work continued on supporting the integration of Italian market infrastructures into the Euronext Group, as well as on contributing to regulatory changes to promote financial innovation at European and national level and to broaden supervision of European central counterparties. Efforts were further stepped up for the cyber resilience of the financial system. Oversight focused on both the proper functioning of payment instruments, payment services and the relative circuits, and on national and European payment systems. Market monitoring and analysis mainly dealt with the efficiency and safety of the sector. The Italian Payments Committee and the innovation facilitators managed by the Bank continued with their initiatives: the FinTech Channel, with 47 discussions with various operators; Milano Hub, with 11 projects admitted from 26 applications; and the regulatory sandbox, which closed the second application window.

WHAT BANCA D'ITALIA DOES

Money

MONETARY POLICY - The Bank contributes to the Eurosystem's decisions in terms of pursuing the primary objective of price stability. In order to steer inflation towards the target, the Eurosystem intervenes with measures via which it either injects or withdraws liquidity from the banking system.

FOREIGN CURRENCY RESERVES AND GOLD - The Bank administers the country's official reserves consisting of foreign currency and gold assets, which are an integral part of the Eurosystem's reserves.

BANKNOTES AND COINS - The Bank produces annually the amount of banknotes established by the Eurosystem, puts them into circulation and checks the returned banknotes, managing the withdrawal and destruction of any that are no longer fit for circulation.

PAYMENT SYSTEMS - The Bank manages the Eurosystem's payment infrastructures: T2 for settlement of wholesale payments, TARGET2-Securities (T2S) for settlement of securities transactions and TARGET Instant Payment Settlement (TIPS) for instant payments and the national BI-COMP clearing system.

DIGITAL EURO PROJECT - The Bank is part of the project for introducing central bank digital currency.

MARKET SUPERVISION AND PAYMENT SYSTEMS AND INSTRUMENTS OVERSIGHT - The Bank helps to ensure monetary and financial stability and an efficient and safe payment system.

The financial system

Supervision of banking and financial intermediaries. - In 2024, the prudential supervision of banks and other intermediaries mainly concerned: (a) credit risks, with detailed analysis on managing non-performing loans and on the effectiveness of securitizations; (b) liquidity and interest rate risks, also taking into account the effects of the maturing of targeted longer-term refinancing operations; (c) IT risk and the implications relating to both new technologies and to outsourcing IT services; (d) capital adequacy and business models; (e) climate risk and sustainable finance; and (f) corporate governance structures. More than 10,600 supervisory and remedial actions were carried out on banks and over 4,000 on other non-bank financial intermediaries. Banca d'Italia also contributed to the analysis of and the debate on drawing up policies, international standards and European regulations; in addition, it issued new provisions and updated the existing ones to bring the national framework into line with the European regulatory framework.

Supervision for countering money laundering and terrorism financing. - As regards anti-money laundering, Banca d'Italia took part in the work coordinated by the European Banking Authority, (EBA) to draft the secondary legislation needed to implement the new European regulatory and institutional framework. It worked on revising the national rules to include crypto-asset service providers among the intermediaries subject to anti-money laundering supervision by the Bank. Both on- and off-site inspections were carried out by the Financial Intelligence Unit for Italy (UIF), which is part of Banca d'Italia but has a specific regime of autonomy; its work is described in the relevant Annual Report). The Bank carried out more than 600 supervisory and remedial actions and 43 on-site inspections in 2024.

Consumer protection and financial education. - Supervisory work was carried out on- and off-site in 2024, as a result of which banks were asked to refund €54 million to customers. The Bank reviewed around 14,700 customer reports (13,800 in 2023), with an average response time of 13 days. The Banking and Financial Ombudsman (ABF) decided on almost 14,000 complaints (15,000 in 2023), recognizing 48 per cent of them in full or in part. As regards financial education, there were more projects aimed at specific population groups, activities for schools and information campaigns. The Bank collaborated with the competent ministries in all these areas and took part in the main national and international thematic groups and forums.

Crisis management. - In its role as national resolution authority, Banca d'Italia took part in the activities of various institutions in 2024, participating in the work on revising the crisis management and deposit protection legislation. Cooperation with the Single Resolution Board (SRB) continued on resolution planning for significant banks, and the planning cycle for less significant banks was completed. Within the SRB, the Bank helped to draft 12 resolution plans for Italian significant banks and approved 111 plans for less significant banks. The Bank also initiated two new compulsory administrative liquidation procedures in 2024; there were 38 under way at the end of the year, involving 19 banks, seven investment firms, one investment firm's parent company, eight asset management companies, one payment institution, one factoring firm and one financial firm. There were 19 supervised voluntary liquidations (of which one began in 2024): 2 for banks and 17 for other intermediaries.

Financial stability and macroprudential policies. - In 2024, Banca d'Italia carried out wide-ranging analyses of the vulnerability of firms and households, the quality of bank lending and the risks connected with market performance. The Bank took into account banks' good conditions in terms of both income and capital as well, requiring all banks and banking groups authorized to operate in Italy to set up a systemic risk buffer. Lastly, it took part in the work on financial stability in various forums for international cooperation.

WHAT BANCA D'ITALIA DOES

The financial system

SUPERVISION OF BANKING AND FINANCIAL INTERMEDIARIES - The Bank is the supervisory authority that safeguards the soundness of banks and other financial intermediaries, protects savings and ensures the stability of the financial system. The powers over banks and investment firms are exercised within the limits of and in accordance with the arrangements established by the Single Supervisory Mechanism (SSM), in force among the euro-area countries in which Banca d'Italia participates.

SUPERVISION FOR COUNTERING MONEY LAUNDERING AND TERRORISM FINANCING - The Bank has regulatory, control and sanctioning powers vis-à-vis banking and financial intermediaries.

PREVENTION OF MONEY LAUNDERING AND TERRORISM FINANCING IN ITALY - The Financial Intelligence Unit for Italy (UIF) is internal but autonomous; it analyses reports of suspected money laundering and terrorism financing transactions and sends the results of the analyses to the competent authorities.

CONSUMER PROTECTION AND FINANCIAL EDUCATION - The Bank promotes consumer protection and financial education through the regulation and supervision of intermediaries' behaviour, and also provides individual protection services and fosters initiatives to support financial education.

CRISIS MANAGEMENT - The Bank is Italy's national resolution and crisis management authority, which deals with bank failures in an orderly manner while safeguarding financial stability and reducing the costs for society. These powers are exercised within the limits of and in accordance with the arrangements established by the Single Resolution Mechanism (SRM), in force among euro-area countries.

FINANCIAL STABILITY AND MACROPRUDENTIAL POLICIES - The Bank pursues financial stability by carrying out macroprudential oversight of the financial system as a whole in order to mitigate systemic risks.

Research and statistics

Economic research and international cooperation. - Research focused on developments in the main macroeconomic variables, with particular reference to the timing, manner and intensity of the transmission of shocks, as well as to the role of expectations, wage growth, productivity and profit margins. The monetary policy implications of the new macroeconomic environment, characterized by high inflation, low growth and significant changes in the economy and financial markets, were also examined, with regard to both the monetary policy stance and the assessment of its transmission, also in light of the strategy and operational framework reviews. Banca d'Italia published 128 research papers in 2024, as part of its main series, and 91 external contributions, such as articles published in scientific journals. In the context of international cooperation, Banca d'Italia co-chaired the G7 Finance Track, together with the Ministry of Economy and Finance (MEF), and took part in various G20 initiatives. Technical cooperation in favour of emerging countries continued: some 100 initiatives were carried out, involving roughly 1,000 experts from 77 countries.

Statistics. - The public's interest in statistics released by Banca d'Italia grew in 2024: downloads of periodical statistical publications (from 616,000 to 817,000) and accesses to the Statistical Database (BDS, from 345,000 to 449,000) both increased by almost one third. More than 26,500 questionnaires were administered to firms, households and other economic operators. Cooperation with Istat was also stepped up to improve the consistency between external statistics and the national accounts.

WHAT BANCA D'ITALIA DOES

Research and statistics

ECONOMIC ANALYSIS AND RESEARCH - The Bank carries out economic analysis and research to support the Bank's action in the field of monetary policy, the pursuit of financial stability, international cooperation, and advice to Parliament and the Government.

STATISTICS - The Bank deals with collecting, compiling and disseminating statistics on money, credit, finance, payment systems, the balance of payments, the financial accounts and the public finances.

Services for the State

Services for the State. - The Bank carried out around 48 million collection and payment transactions on behalf of general government and more than 109 million on behalf of other public sector entities; it also managed the placement of government bonds on behalf of the MEF for a total nominal value of €546 billion. The ReTes system became operational at the beginning of 2025. ReTes is an extensive programme for re-engineering treasury procedures, enabling significant streamlining of processes, phasing out obsolete instruments and introducing a single standard for interaction with general government.

WHAT BANCA D'ITALIA DOES

Services for the State

As State treasurer, the Bank executes all the payment orders of the general government, receives any sums owed to them in whatever capacity, and records all such operations; it works with the Ministry of Economy and Finance on managing liquidity and public debt.

The main results for the year

The functioning of the Bank

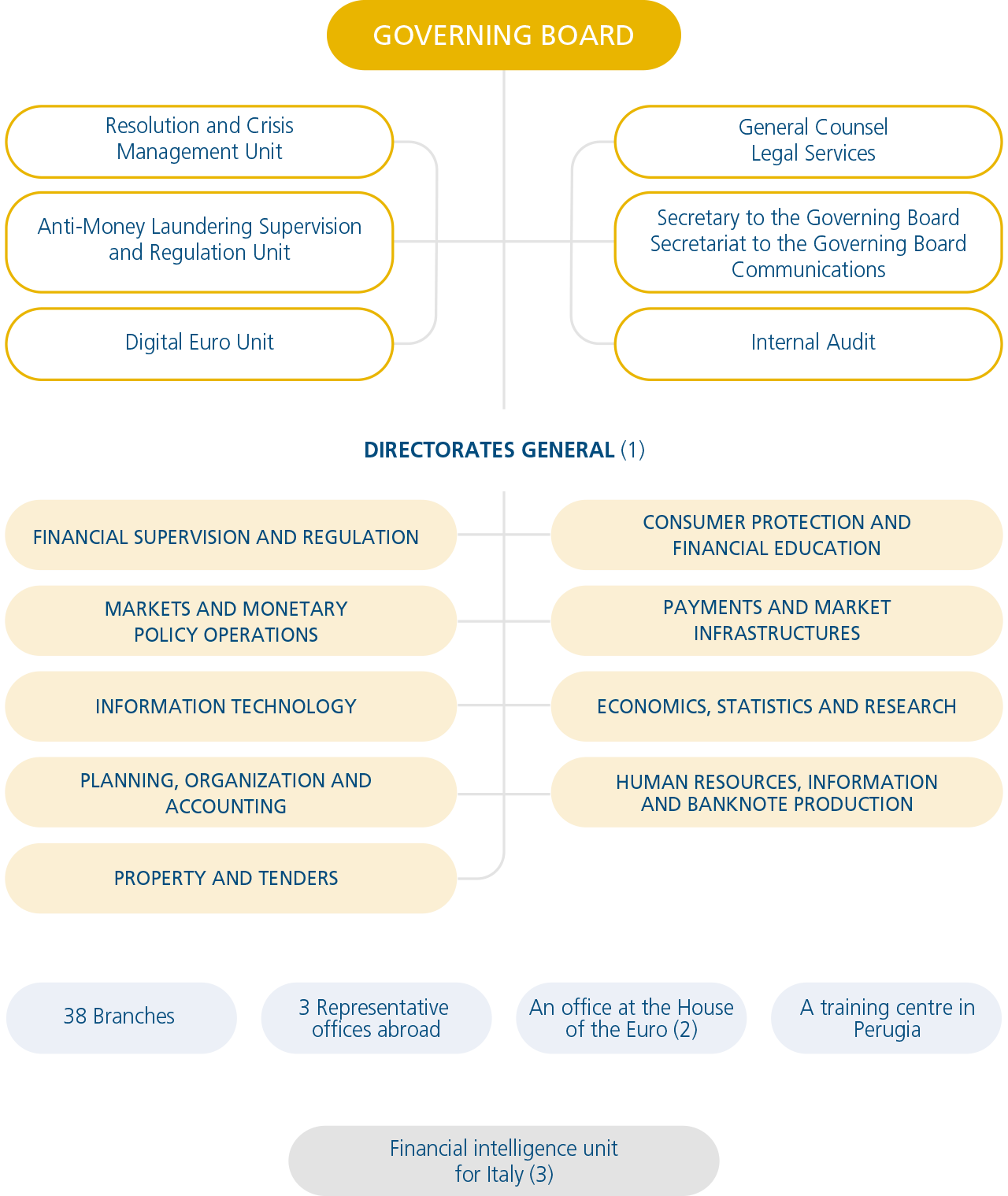

Governance. - Banca d'Italia is an institution governed by public law. The governing bodies are: the Governor, the Governing Board, the Senior Deputy Governor and the Deputy Governors, the Board of Directors, the Board of Auditors, and the Meeting of Shareholders.

The mandate of Deputy Governor Alessandra Perrazzelli, who was appointed by the Presidential Decree of 3 May 2019, published in the Gazzetta Ufficiale della Repubblica Italiana on 28 May 2019, came to an end on 9 May 2025. At its extraordinary meeting on 15 May 2025, the Board of Directors nominated Sergio Nicoletti Altimari, Director General for Economics, Statistics and Research as the new Deputy Governor, to be approved through the usual government channels.

In February 2025, Francesco Argiolas and Massimo Luciani, members of the Boards of Regents, resigned from the Cagliari and Rome branches, respectively; the procedures for the new nominations are under way. The Shareholders' Meeting renewed the Board of Statutory Auditors on 31 March 2025, confirming all the Statutory Auditors and alternates in office.

Organizational measures. - A number of measures were implemented over the year to update the organizational structure. Two Units were set up: one to support Banca d'Italia's role as part of the Eurosystem's digital euro project and the other to take care of the design, implementation and testing of the Bank's third data centre. The Directorate General for Markets and Payment Systems was split into two new directorates general, the first for markets and monetary policy operations and the second for payments and market infrastructures. In January 2025, the Board of Directors approved the plan for developing and updating the branch network, with the objectives of: (a) enhancing the role of branches in activities of strategic importance; (b) strengthening the relationship between the Bank and the various entities across Italy; and (c) improving coordination between the branches and the central administration, and the balance between operations and resources. As part of making the network as a whole more efficient and streamlined, the branches in Brescia and Livorno will be closed and the number of branches will therefore go down from 38 to 36. Alongside the project are some internal communication initiatives and listening and consulting campaigns that target the staff involved. Lastly, in April 2025, the Board of Directors decided to move: the management of monetary circulation to the Directorate General for Payments and Market Infrastructures, to promote a unified management of elements relating to the payments sector and to optimize the connection of the most innovative tools with traditional ones, and banknote production to the Directorate General for Human Resources and Information - which is to be renamed as Human Resources, Information and Banknote Production - given the increased importance of management issues for the banknote function. The Directorate General for Monetary Circulation will be superseded as a result of this intervention. The organizational change is currently being implemented.

(1) New set-up for Directorate Generals approved by the Board of Directors on 30 April 2025. - (2) The House of the Euro, established in Brussels, hosts experts from the ECB and NCBs in order to step up cooperation on matters of common interest, such as banking and financial regulation and the National Recovery and Resilience Plan (NRRP). - (3) The Financial Intelligence Unit for Italy (UIF), established pursuant to Legislative Decree 231/2007, is an independent body that performs its functions in full autonomy.

Human resources. - At the end of 2024, Banca d'Italia had 7,027 employees (up by 59 employees on the previous year), as a result of the increase in staff at its head office (120 additional employees, for a total of 4,804 at the end of 2024) and a reduction in staff, both at branches (37 fewer employees, 1,944 at the end of the year) and on temporary secondments or on leave at other bodies and organizations (24 fewer employees, 275 at the end of the year); the number of people at the representative offices abroad remained unchanged (four employees).

IT resources. - To expand the scope of the Bank's digital transformation and to increase its capacity to innovate, new projects were launched to use artificial intelligence and machine learning models and techniques, and the use of cloud services was extended.

Logistical resources. - The process for streamlining and renewing the Bank's real estate assets continued. From 2014 to the end of 2024, the sales of about 72 per cent of the buildings no longer used for institutional purposes were arranged.

The internal control system. - Some 55 incidents were detected under the operational risk management framework, only one of which had a high impact. Around 300 tests were conducted for business continuity purposes. Lastly, the Internal Audit, which is the third pillar of the internal control system, performed 37 audits on processes, structures and IT systems.

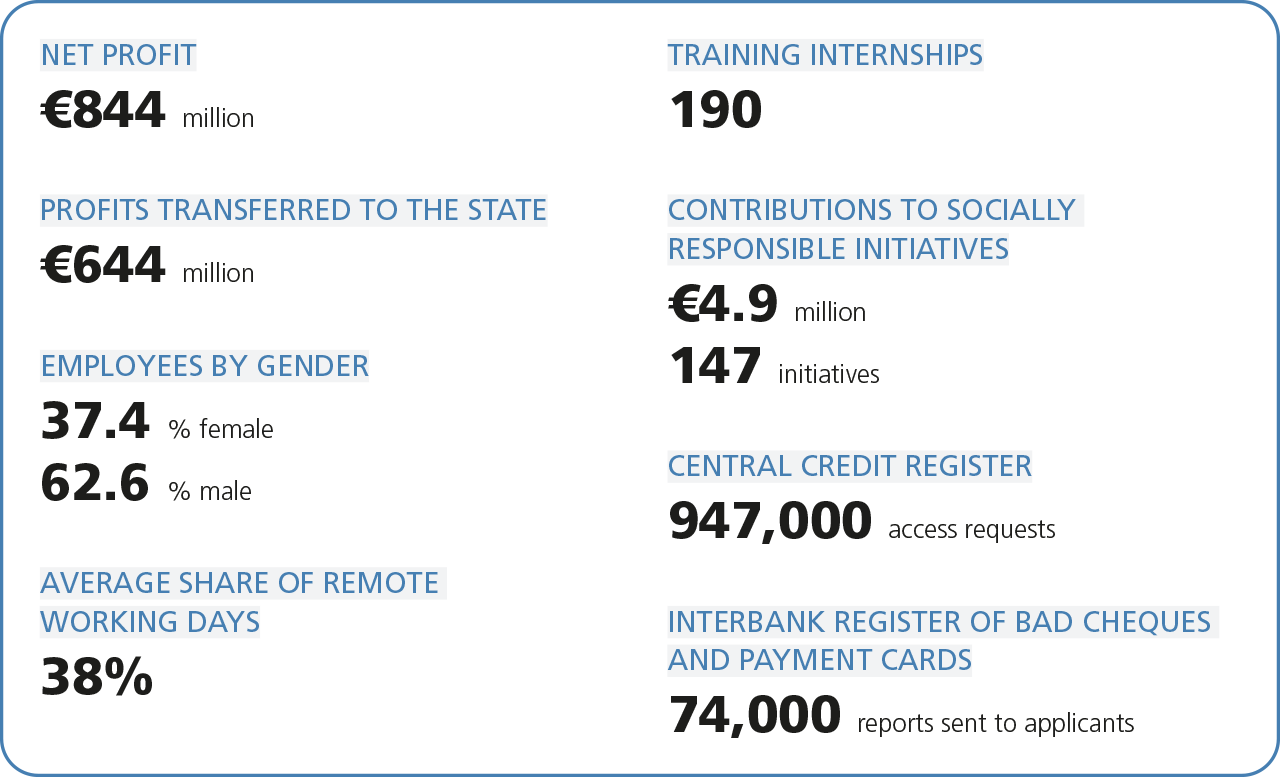

Economic results and operating costs. - The Bank's financial resources come from monetary policy operations, from the management of foreign currency reserves (including gold), from the securities portfolio held for investment purposes and from the services provided. The financial result for 2024, prior to the release of the general risk provision and before tax, was negative by €7,319 million, mainly because of the impact of interest rates on the Bank's profitability. As a result of the release of €5,800 million from the general risk provision and the positive contribution from the taxes for the year amounting to €2,363 million, the financial year 2024 closed with a net profit of €844 million.

The use of these resources in the Bank's activities. - assessed using the cost accounting criteria shared with the other Eurosystem central banks and therefore not in line with the balance sheet figure - stood at €1,782 million, down by 1 per cent in nominal terms and by 2 per cent net of inflation compared with the previous year. Around 63 per cent of total costs are labour-related, while the remainder is linked to the costs of goods and services. Among the latter, the costs for the actual consumption of raw materials in banknote production fell, while the cost of participating in Single Supervisory Mechanism (SSM) statistical projects rose because payments were released that had been pending until the criteria for sharing costs between NCBs and supervisory authorities were approved. Overall, 58 per cent of the costs relate directly to institutional activities, while the remaining part is for cross-cutting activities to support the former (13 per cent is just for IT activities).

Commitment to environmental, social and governance sustainability

Banca d'Italia recognizes the importance of sustainability issues in the exercise of its functions and draws up strategies, policies, actions and metrics on which to base its commitment to sustainable development and to manage the (current and potential) impacts on the environment, society and governance, as well as the associated financial risks. The data are structured along the lines of the standards established by the European Financial Reporting Advisory Group (EFRAG).

Environment

Banca d'Italia promotes sustainability issues in its institutional tasks and investment choices. It is also committed to steadily reducing its environmental and carbon footprint.

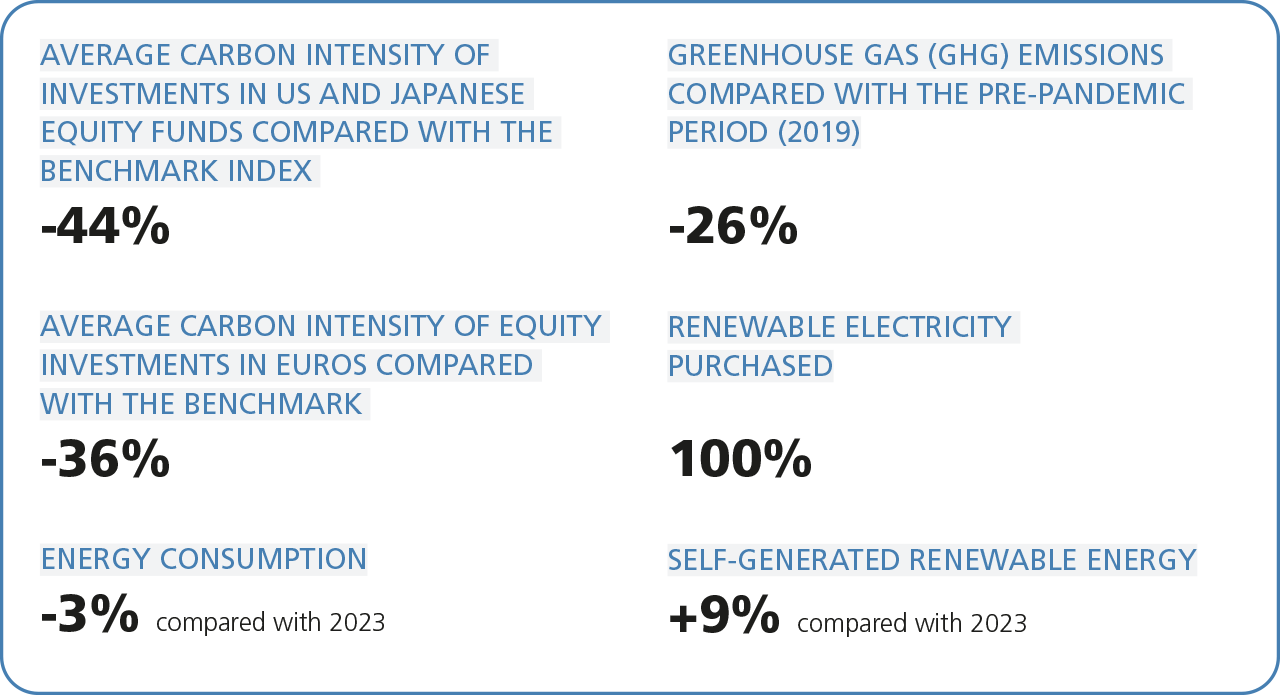

Sustainable finance. - As a monetary authority, investor, supervisory authority over financial intermediaries, and a research institution, the Bank contributes to the development of sustainable finance; it dedicated a specific line of action to this objective in the 2023-2025 Strategic Plan.

The Bank, together with the other euro-area NCBs, helps to draw up the Eurosystem's action plan designed to include climate change considerations in its monetary policy strategy. The measures were outlined in 2022 and promote the integration of environmental factors into macroeconomic analysis models, into the estimation of risks to the Eurosystem's balance sheet and into the management of corporate bonds purchased for monetary policy portfolios. These measures are designed in line with the primary objective of price stability.

As an investor, the Bank has integrated sustainability criteria into the management of investment portfolios, in step with its Responsible Investment Charter. The methodologies used and the results achieved are described in the Annual report on sustainable investment and climate-related risks.

In the area of supervision of banking and non-bank intermediaries, the Bank's policy aims to verify and raise supervised entities' awareness of environmental risks, as well as to keep supervisory methodologies continually updated. The Bank is involved in adapting the regulations at international and European level to incorporate climate-related and environmental risks into prudential requirements and into intermediaries' risk management.

In 2024, the supervisory dialogue with less significant banks and non-bank intermediaries on climate-related and environmental risks focused on monitoring the implementation of the action plans for the three years 2023-25, formulated by banks to align with supervisory expectations. The findings of the analyses carried out and the updating of the good practices observed were summarized in a document published in May 2025. A document was published in December 2024 - prepared by the Platform on Sustainable Finance, chaired by the MEF - to support small and medium-sized enterprises in collecting and producing data on environmental, social and governance impacts, thereby facilitating dialogue with banks on sustainability issues and making access to funding easier.

The importance of environmental sustainability and ecological transition issues for Banca d'Italia is also reflected in the commitment made in the 2023-2025 Strategic Plan to broaden economic research in these areas, also in cooperation with external institutions and the academic world.

Specific initiatives for adults and schools are being promoted in the area of financial education to explain the topics of sustainable finance using clear language; there is a section on this topic on the Economics for everyone portal.

The Bank's environmental footprint. - The Bank is committed to steadily reducing its impact on the environment. One line of action in the 2023-2025 Strategic Plan is dedicated to preparing a long-term plan, which is currently being drawn up, to achieve zero net greenhouse gas emissions in its own operations.

Initiatives to improve energy efficiency and decarbonize Bank-owned buildings continued, for example through interventions on electrical and air conditioning systems, the gradual installation of photovoltaic systems and the adoption of management measures. Banca d'Italia has purchased electricity exclusively from renewable sources since 2013 in order to incentivize these production methods.

With the aim of promoting more sustainable mobility, additional charging points for electric vehicles have been installed on Bank-owned property. Methane-powered buses, which are less polluting, are gradually being introduced into the Bank's fleet of shuttle buses.

Total greenhouse gas emissions increased by 6 per cent in 2024 compared with the previous year, mainly owing to the increase in emissions connected with the purchase of goods and services and with the transport of banknotes to and from other central banks and, to a lesser extent, with employees' business travel and home - work commuting. They were still 26 per cent lower than in 2019, and compared with 2023, total energy consumption fell by 3 per cent. Specifically, demand for electricity went down by just over 1 per cent, despite the growth in consumption at data processing centres (4 per cent); that for methane gas declined by about 5 per cent.

Alongside its commitment to reduce its greenhouse gas emissions, the Bank co-financed a number of forestation and renewable energy production projects in Central and South America in 2024, purchasing certified carbon credits on the voluntary market for 23,557 tonnes of CO2 equivalent. At the beginning of 2025, along with the Comando Unità forestali, ambientali e agroalimentari (Command of the Forest, Environmental and Agri-food units - CUFA), a special unit of the Carabinieri police force, 1,700 trees were planted in urban and peri-urban areas of Italy, adding to the 4,500 already planted during the first forestation operation. According to international research carried out by an independent body, Banca d'Italia, together with the Bundesbank, was the second greenest G20 central bank (behind Banque de France).

Banca d'Italia and the environment in 2024

Social commitment

Society. - The Bank influences people's lives by protecting price stability and savings and ensuring access to credit and the proper functioning of payment infrastructures, systems and services. In carrying out its functions, the Bank achieves economic results that benefit the public, as profits are distributed to the State (in addition to the payment of taxes); in 2024, €644 million were transferred to the State.

Maximizing the development of human resources. - Banca d'Italia looks after its staff, which is its most valuable asset. There is an increasing focus on promoting a working environment that is inclusive, efficient and able to innovate. Dedicated listening channels are available to staff, also for reporting any instances of harassment or discrimination; these channels are flanked by other tools for engagement, such as focus groups and questionnaires, as well as the participation via trade unions in decisions that affect employment contracts. Management policies are based on principles of impartiality and non-discrimination. In 2024, Banca d'Italia obtained certification from the EDGE Certified Foundation on gender equality and on policies for disabilities, for people who are part of the LGBTIQ+ world, and for different age groups (EDGEPlus).

As regards health and safety protection and staff well-being, the risk assessment methodology was fine-tuned and surveys were carried out on the use of new machines for producing banknotes. Lastly, the Bank's constant commitment to protecting health and well-being was demonstrated in numerous communication and training initiatives for employees.

There is a particular focus on staff development, including through targeted career paths, both professional and managerial, and dedicated consultancy staff. Overall, 90 per cent of employees did training courses, with an average of 49 hours of training per participant (3 per cent of total hours worked); 61 per cent of the courses were provided online.

Information services and accessibility. - The Bank provides information services intended directly for the public; many of them are on its website, especially on the Online Services for the Public platform. Citizens also have access to two archives, the Central Credit Register (CR) and the Interbank Register of Bad Cheques and Payment Cards (CAI), where they can check their position and ask banks or financial firms to correct or delete data in the event of incorrect or non-required reporting. Some services are available via a toll-free number. The Bank also provides specific services free of charge at dedicated points in its branches.

Cultural and solidarity initiatives. - The Bank's social commitment also consists in promoting culture, organizing initiatives to support environmental and social bodies and associations, as well as in directly providing the public with information services. Loans of artworks and guided tours of the Bank's historical buildings continued in 2024. As part of the training for young people, in addition to the work experience programmes (PCTOs) for high school students (242 in the school year 2023-24), 190 training internships were provided for recent graduates with bachelor's and master's degrees, in collaboration with many universities. A total of €4.9 million was given to support 147 projects of public interest. The disbursements are made - based on an allocation decided every year by the the Board of Directors- according to the criteria and procedures found on the website, where a list of recipients of contributions of more than €1,000 is also published every year.

Banca d'Italia and social commitment in 2024

Governance

Ethics, prevention of corruption, and transparency. - The Bank is committed to promoting integrity and transparency when conducting its activities. It is therefore responsible for overseeing the behaviour of personnel, the efficient and transparent management of relationships with suppliers, and the integrity, availability and reliability of information systems. Specific policies aim to prevent conflicts of interest during people's working life and after the termination of their working relationship with the Bank. The transposing of the guidelines adopted by the ECB continued in 2024, in order to be better at: containing the risks of misuse of confidential information, managing conflicts of interest and ensuring equal treatment and transparency in relations with external parties. There was a special focus on staff training to increase their sensitivity on ethics and integrity issues and to encourage a law-abiding culture.

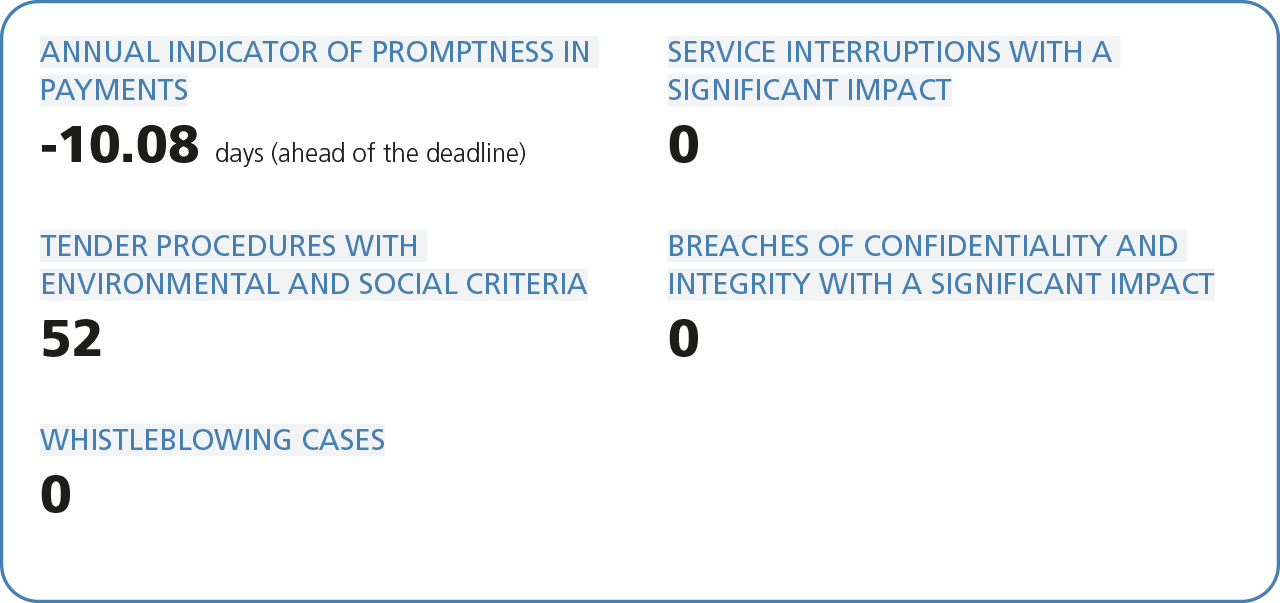

Relations with suppliers. - Banca d'Italia is guided by principles of good faith, competition, impartiality and non-discrimination. Its priority objectives are compliance with legislation, the quality of supply and the inclusion in tenders of environmental and social criteria. To mitigate the risks of default, guidelines were introduced in 2024 that set out the main risk scenarios associated with possible economic difficulties for contractors.

Security, integrity and reliability of information systems. - With the Bank's digital transformation, the availability of reliable, efficient, secure and resilient information systems is now an essential prerequisite for the proper carrying out of its functions and for the stability of the financial system itself. The cloud services policy was thus revised in 2024 and activities to combat cyber risks were stepped up; in order to raise the level of awareness of such risks, specific initiatives were launched to increase Bank staff's understanding of the correct way to combat them.

Banca d'Italia and governance in 2024

The current strategic Plan

The Bank's strategic vision focuses on its commitment to provide Italy and Europe with high quality services in all its spheres of action. This vision steers the long-term development of functions and activities and is regularly translated into a strategic plan setting out priorities, objectives and action plans. The Bank's departments are widely involved in drawing up the document, which embodies the orientation of the Governing Board: it sets out the vision and strategic objectives, appoints the people in charge of action plans, and approves activity programmes. The results achieved are assessed on a regular basis.

The 2023-2025 Strategic Plan is divided into five strategic objectives, pursued through 17 action plans that cover the Bank's various areas of intervention and involve all the central administration's departments, as well as the branch network.

The Plan's five strategic objectives aim to: strengthen commitment to a stable and secure financial system; step up economic and financial innovation in Italy and Europe; increase protection for banking and financial service consumers and make dialogue with external stakeholders ever more direct and open; foster the energy transition and safeguard the environment; and make the Bank's organization increasingly inclusive, efficient and able to innovate.

The plan was updated in July 2024 and takes account of the results of the mid-term review carried out in light of the changes in the baseline scenario.

Specifically, risk safeguards continued to be strengthened in 2024 (including for cyber risks), as did the promotion of financial innovation, and the combating of economic and financial illegality including by international cooperation.

The Bank has further improved both its analytical and forecasting capacity in support of monetary policy and financial stability, and its role in providing European payment infrastructures and in the statistical function.

Work has continued on expanding and improving the instruments used to protect banking and financial customers, as well as on promoting more widespread and informed access to financial services, by upgrading listening channels to detect new protection needs. There have also been initiatives to communicate and spread knowledge about the Bank's activities.

The project - approved in early 2025 - for reviewing the structure of the branch network continued in order to optimize the Bank's local presence and to promote a more flexible use of resources that is integrated with the central administration.

The transition towards a green economy continues, helping the financial system to increase its resilience to climate risks and reducing the Bank's environmental footprint, including by drawing up a transition plan. Tools to support the acquisition and development of key skills for institutional functions are being consolidated, with a view to maximizing diversity and inclusion. Work is continuing on the digitalization of work processes and on making the use of artificial intelligence in the Bank more widespread.

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin