Rapporto Ambientale - 2024

Per questa edizione del Rapporto ambientale sono state scelte immagini di ghiacciai in omaggio al ruolo decisivo che la criosfera riveste nel sistema climatico: i ghiacci riflettono la luce solare riducendo l'assorbimento di energia da parte della superficie terrestre. Lo scioglimento dei ghiacciai, indotto dal cambiamento climatico, può causare un aumento del livello del mare, con conseguenti rischi di inondazioni costiere e danni agli ecosistemi.

Premessa

Gli obiettivi ambientali dell'Agenda 2030 dell'ONU, l'Accordo di Parigi sul clima, le strategie europee e nazionali in materia di ambiente richiedono l'impegno concreto di tutte le componenti della società, a partire dalle Istituzioni.

La Banca d'Italia è impegnata a dare il proprio contributo, sia tenendo conto di questi obiettivi nello svolgimento delle proprie funzioni istituzionali, sia riducendo progressivamente la propria impronta ambientale e carbonica. Uno degli obiettivi del Piano strategico della Banca è dedicato ad accrescere l'impegno per l'ambiente nel triennio 2023-25; tra le varie attività in corso in questo ambito figurano quelle miranti a definire un preciso percorso, oltre il triennio, per il conseguimento di un obiettivo di lungo periodo di emissioni nette della Banca pari a zero (net zero).

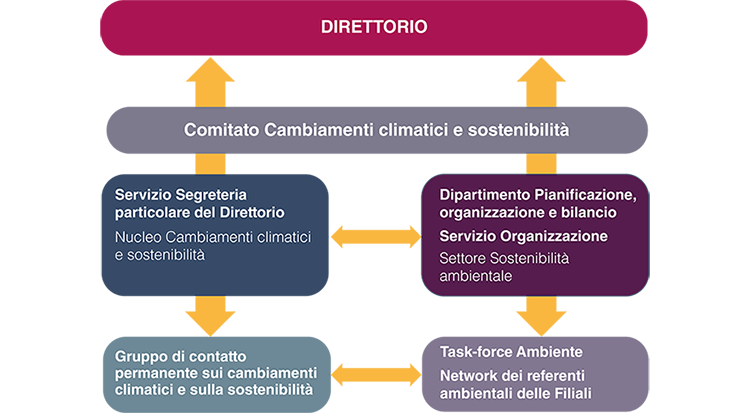

Il Direttorio della Banca d'Italia, costituito dal Governatore, dal Direttore generale e da tre Vice Direttori generali, definisce la strategia in materia di ambiente e sostenibilità. Il Comitato Cambiamenti climatici e sostenibilità, creato nel 2022 e presieduto da un membro del Direttorio, svolge funzioni di indirizzo strategico e di coordinamento dei diversi fronti di attività. Il Nucleo Cambiamenti climatici e sostenibilità assicura il coordinamento operativo delle attività sul versante istituzionale, anche attraverso un Gruppo di contatto permanente di esperti delle Funzioni di ricerca economica, stabilità finanziaria, mercati e investimenti finanziari, vigilanza ed educazione finanziaria. Il coordinamento operativo delle iniziative per ridurre l'impronta ambientale delle operazioni interne è svolto dal Settore Sostenibilità ambientale del Servizio Organizzazione. Il Settore si avvale della collaborazione di una Task force composta da esponenti delle strutture che si occupano di gestione immobiliare, logistica, informatica, banconote, appalti, risorse umane e comunicazione e del Network dei referenti ambientali in ciascuna Filiale sul territorio.

Con il Rapporto ambientale, pubblicato per la prima volta nel 2010, la Banca dà conto dell'impatto delle proprie attività sull'ambiente, nonché delle azioni realizzate e programmate per ridurlo. Il Rapporto contiene anche: sintetiche informazioni sulle emissioni di gas serra degli investimenti finanziari - che sono fuori dal perimetro di calcolo dell'impronta carbonica della Banca - e sulle attività istituzionali di ricerca economica, vigilanza e tutela dei clienti; tavole statistiche con indicatori quantitativi e note metodologiche, che forniscono informazioni sul calcolo degli indicatori ambientali. Le scelte metodologiche adottate si basano sulle migliori prassi e sulle basi dati al momento disponibili; sono pertanto sottoposte a un continuo vaglio critico e potranno evolvere in funzione dei progressi su questi temi.

In prospettiva la Banca intende potenziare la propria rendicontazione in materia di sostenibilità, con la definizione di un framework integrato dei profili ambientali, sociali e di buon governo (environmental, social and governance, ESG) e lo sviluppo di indicatori di performance ispirati agli standard europei.

Sintesi

L'impronta ambientale complessiva della Banca è migliorata sia rispetto all'anno precedente, sia nel confronto con il 2019, ultimo anno pre-pandemico.

L'impronta carbonica

La Banca calcola le proprie emissioni di gas serra dal 2010. Tra il 2010 e il 2019 è stato registrato un calo delle emissioni del 61 per cento, ottenuto principalmente per effetto dell'acquisto dal 2013 di energia elettrica proveniente esclusivamente da fonti rinnovabili (fig. 1). A partire dal Rapporto ambientale pubblicato nel 2022 il perimetro di calcolo dell'impronta carbonica della Banca è stato ulteriormente ampliato: le emissioni di gas serra sono state quindi ricalcolate con la nuova metodologia dal 2019, che è stato scelto come anno base di riferimento.

Figura 1 - Impronta carbonica

Emissioni di anidride carbonica equivalente 2010-2023 (1) (numeri indice, 2019=100)

(1) La serie delle emissioni di anidride carbonica equivalente della Banca presenta una discontinuità in corrispondenza dell'anno 2019; il grafico riporta i valori delle due serie per gli anni 2010-2019 e 2019-2023 espressi in numeri indice, con 2019=100 per ciascuna serie. I dati dal 2010 al 2019 si riferiscono a un perimetro di rendicontazione costituito dalle emissioni dirette provenienti dall'uso di combustibili fossili (Scope 1), da quelle indirette da: uso di energia elettrica e teleriscaldamento (Scope 2), acquisto di carta e viaggi di lavoro (Scope 3). I dati dal 2019 in avanti considerano anche le emissioni da: perdite di gas fluorurati (Scope 1), riscaldamento condominiale (Scope 2), acquisto di beni, prodotti e servizi, spostamenti casa-lavoro di dipendenti ed esterni, lavoro da remoto, ciclo di vita delle banconote (Scope 3). Per maggiori informazioni cfr., nelle Note metodologiche, la voce: Emissioni di gas serra.

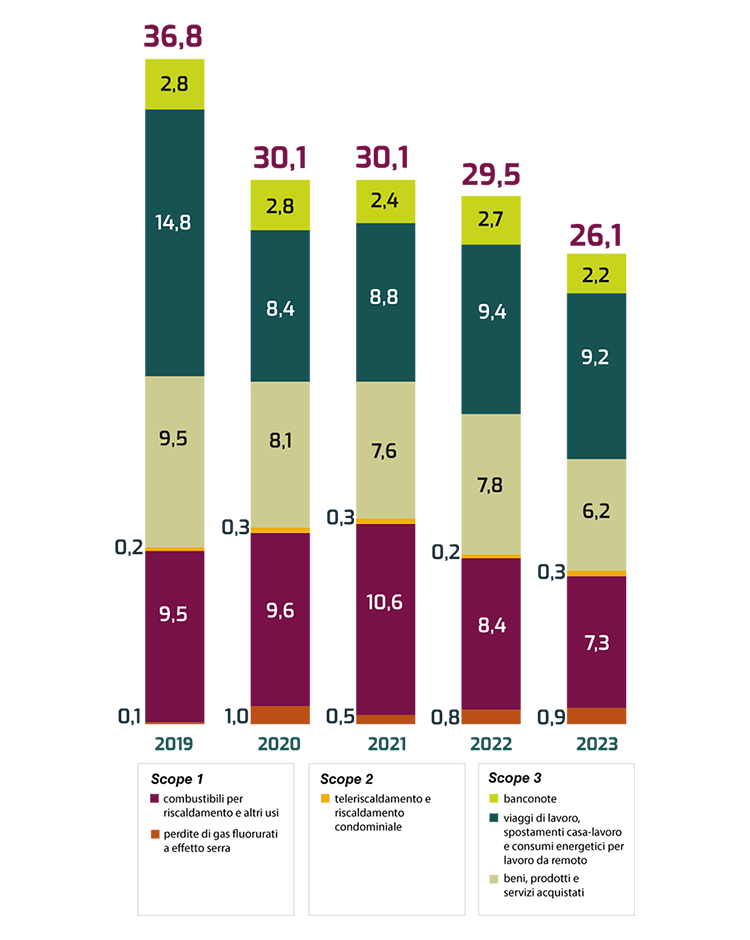

Nel 2023 le emissioni totali di gas serra si sono ridotte dell'11 per cento rispetto all'anno precedente, confermandosi su livelli inferiori di circa il 29 per cento rispetto al 2019, ultimo anno pre-pandemico (fig. 2; tav. a2). Il risultato è stato conseguito nonostante il 2023 abbia registrato un aumento sia del numero dei dipendenti (alla fine del 2023 la compagine era composta da 6.968 persone, 128 in più rispetto all'anno precedente; tav. a1), sia del lavoro in presenza (circa 63 per cento delle prestazioni a fronte del 58 per cento del 2022).

Rispetto al 2022 si è registrata, in particolare, una riduzione del consumo di combustibili per riscaldamento e delle connesse emissioni, in parte dovuta alle misure di risparmio energetico introdotte da norme esterne e poi adottate dalla Banca, su base volontaria, anche oltre il periodo di obbligatorietà previsto. Con l'obiettivo di ridurre i consumi di energia, l'Istituto ha infatti stabilito, per il 2024, di mantenere negli ambienti di lavoro di tutti gli edifici istituzionali temperature diverse rispetto ai valori previsti per gli edifici pubblici e, nello specifico, più alte di 1°C nella stagione estiva 2023 e più basse di 1°C nella stagione invernale (cfr. la sezione: Energia). Anche nel 2023 si sono registrate perdite non prevedibili di gas fluorurati dagli impianti di raffrescamento (310 kg; cfr. tav. a3), che contribuiscono all'impronta carbonica della Banca per via dell'alto potere climalterante di questi gas.

Sono diminuite le emissioni connesse con l'acquisto di prodotti, beni e servizi (tav. a2). Le emissioni riferibili ai viaggi di lavoro sono aumentate di poco meno del 15 per cento rispetto all'anno precedente, rimanendo però su livelli molto più bassi rispetto al periodo pre-pandemico (-58 per cento nel confronto con il 2019).

Nonostante l'aumento del lavoro in presenza rispetto al 2022, l'utilizzo di mezzi di trasporto a minore impatto ambientale ha consentito una diminuzione nelle emissioni connesse con gli spostamenti casa-lavoro dei dipendenti. Il computo della voce è stato arricchito, a partire da questa edizione del Rapporto ambientale (con ricostruzione a partire dal 2019), dalla stima delle emissioni connesse con il consumo di energia per il riscaldamento e raffrescamento degli ambienti utilizzati per il lavoro da remoto, in lieve calo rispetto all'anno precedente (cfr. la sezione: Mobilità sostenibile).

Una riduzione è stata registrata per le emissioni connesse con il ciclo di vita delle banconote - nonostante l'incremento del numero di pezzi prodotti (925 milioni di banconote a fronte di 807 milioni nel 2022) - anche grazie all'utilizzo di scorte di materie prime già acquistate e contabilizzate negli anni precedenti ai fini del calcolo delle emissioni. Dal 2023 tutti i rifiuti costituiti da banconote logore triturate, prodotti a valle del processo di selezione del contante, sono inviati a impianti di termovalorizzazione, in linea con le decisioni assunte nell'ambito dell'Eurosistema (cfr. la sezione: Banconote).

Figura 2 - Impronta carbonica

Emissioni di anidride carbonica equivalente 2019-2023(1)(2)(3) (migliaia di tonnellate di CO2 equivalente)

(1) Per effetto di alcuni aggiornamenti metodologici, i dati dal 2019 al 2022 sono stati parzialmente ricalcolati in modo da renderli confrontabili con il dato relativo al 2023; per le definizioni di Scope 1, Scope 2 e Scope 3, cfr., nelle Note metodologiche, la voce: Emissioni di gas serra. - (2) Le emissioni connesse con il consumo di energia elettrica sono state considerate pari a zero in quanto l'energia elettrica acquistata proviene unicamente da fonti rinnovabili (cosiddetto approccio market-based; cfr., nelle Note metodologiche, la voce: Emissioni di gas serra, sottovoce: Emissioni indirette di gas serra da energia importata). - (3) Le eventuali mancate quadrature sono dovute all'arrotondamento delle cifre decimali.

La figura 3 mostra le emissioni di gas serra del 2023 aggregate per le diverse sezioni tematiche del Rapporto ambientale.

Figura 3 - Impronta carbonica

Emissioni di gas serra del 2023 aggregate per sezione del Rapporto ambientale (percentuale)

Il perimetro di calcolo delle emissioni di gas serra indirette, ampliato a partire dal Rapporto ambientale pubblicato nel 2022 (con ricostruzione dei dati a partire dal 2019), non è ancora esaustivo di tutti gli acquisti di beni e servizi effettuati dalla Banca. In proposito si sta procedendo a stimare i valori mancanti moltiplicando i dati di costo relativi a beni e servizi acquisiti (al netto di IVA e inflazione) per opportuni fattori di emissione monetari (cosiddetti spend-based) selezionati da basi dati internazionali. Tali fattori sono espressi in chilogrammi di anidride carbonica equivalente per euro speso e consentono di ottenere rapidamente una stima, ancorché approssimata, delle grandezze mancanti. Questo calcolo, tuttora in corso per gli anni dal 2019 in poi, verrà meglio dettagliato nei prossimi documenti di rendicontazione ambientale della Banca: il nuovo perimetro di calcolo delle emissioni di gas serra sarà inoltre considerato nella definizione del futuro percorso di decarbonizzazione verso net zero, previsto dal Piano strategico 2023-25 (cfr. il riquadro: Il Piano strategico 2023-25).

In parallelo all'impegno per la riduzione della propria impronta ambientale, nel 2023 la Banca ha cofinanziato alcuni progetti di forestazione e di produzione di energia rinnovabile, acquistando, per la prima volta e in via sperimentale, crediti di carbonio certificati pari a 23.557 tonnellate di anidride carbonica equivalente (il 90 per cento circa delle proprie emissioni correnti). I progetti finanziati con l'acquisto di crediti di carbonio hanno riguardato la realizzazione di: piantagioni forestali in Uruguay; un piccolo impianto idroelettrico ad acqua fluente in Colombia; due parchi eolici in Nicaragua e in Uruguay. Il cofinanziamento di questi progetti contribuisce allo sviluppo sociale ed economico delle comunità locali dove vengono realizzati, in linea con gli obiettivi di sviluppo sostenibile dell'Agenda 2030.

L'Istituto ha realizzato, insieme al Comando Unità forestali, ambientali e agroalimentari dell'Arma dei Carabinieri, un intervento di forestazione in quattro aree del territorio italiano, per contribuire alla rimozione dell'anidride carbonica, migliorare la qualità dell'ambiente urbano e dell'aria, creare aree potenzialmente fruibili per i cittadini e tutelare la biodiversità territoriale: nello specifico sono stati messi a dimora 4.500 alberi in un'area complessiva di 4,5 ettari (cfr. la sezione: Biodiversità e forestazione).

Nell'ultimo anno la Banca ha compiuto ulteriori progressi in materia di investimenti sostenibili - in particolare per quanto riguarda l'intensità carbonica dei portafogli (cfr. la sezione: Investimenti sostenibili) - e ha rafforzato l'impegno sui temi della finanza sostenibile (cfr. la sezione: Cultura ambientale).

Il Piano Strategico 2023-25

Il Piano Strategico della Banca per il triennio 2023-25 contiene un programma di lavoro orientato all'innovazione e articolato in numerosi progetti. Uno dei cinque obiettivi del Piano è dedicato ad accrescere l'impegno per l'ambiente attraverso due piani di azione. Il primo piano di azione è finalizzato a rafforzare le iniziative in tema di finanza sostenibile e di contrasto ai cambiamenti climatici con linee di azione dedicate a: a) approfondire la ricerca sui temi inerenti la transizione ecologica; b) migliorare la sostenibilità degli investimenti; c) promuovere l'incorporazione della valutazione dei rischi climatici e ambientali nella gestione dei rischi degli intermediari; d) realizzare percorsi di educazione finanziaria in tema di transizione climatica; e) assumere un ruolo propulsivo nelle relazioni con gli organismi esterni.

Con il secondo piano di azione "Verso l'obiettivo net zero", la Banca intende ridurre ulteriormente la propria impronta ambientale e carbonica, realizzando iniziative per: (a) diminuire i consumi di combustibili fossili; (b) promuovere l'autoproduzione di energia da fonti rinnovabili; (c) migliorare le prestazioni energetiche di edifici e impianti; (d) incentivare la mobilità elettrica; (e) ridurre l'impatto sull'ambiente dei viaggi di lavoro; (f) compensare le emissioni di gas serra; (g) agire sulla formazione e sulla sensibilizzazione del personale; (h) aumentare il partenariato con altre istituzioni pubbliche sui temi ambientali. Al tempo stesso è stata avviata la definizione di un Piano di transizione a più lungo termine, che descriva gli obiettivi di dettaglio, le azioni da realizzare e le riduzioni di gas serra ottenibili, nonché le eventuali iniziative di compensazione per raggiungere l'obiettivo di emissioni nette pari a zero per le operazioni interne.

Energia

Il 40 per cento delle emissioni di gas serra della Banca è dovuto al consumo di energia.

Siamo impegnati a: ridurre progressivamente i consumi energetici e l'uso di combustibili fossili; conseguire una maggiore efficienza, attraverso interventi sugli edifici e sugli impianti tecnologici e tramite l'adozione di misure gestionali; aumentare progressivamente la quota di energia autoprodotta da impianti fotovoltaici. L'energia elettrica acquistata proviene unicamente da fonti rinnovabili.

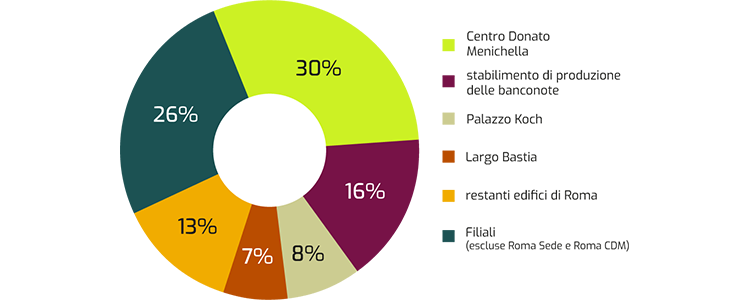

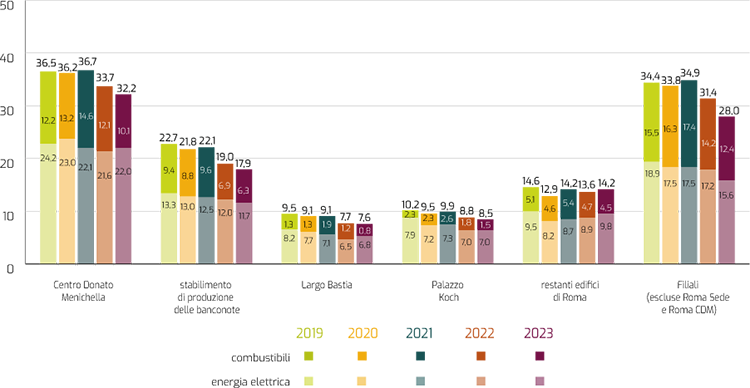

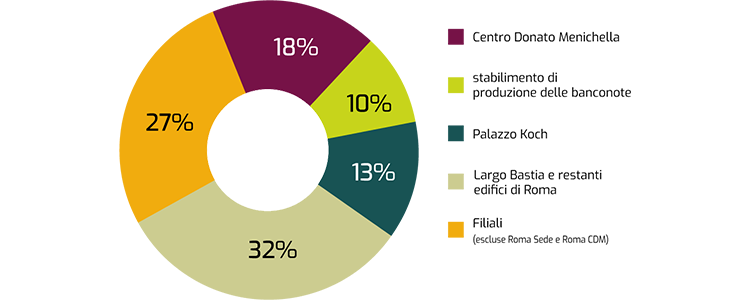

La Banca opera in circa 60 edifici su tutto il territorio nazionale. I quattro siti produttivi principali (il Centro Donato Menichella di Frascati; Palazzo Koch, sede legale della Banca, lo stabilimento di produzione delle banconote e l'edificio di Largo Bastia a Roma) consumano il 60 per cento del fabbisogno complessivo di energia elettrica e termica (fig. 4; tav. a7).

Figura 4 - Energia

Consumi energetici (percentuale)

Uso di fonti rinnovabili

L'Istituto acquista dal 2013 esclusivamente energia elettrica proveniente da fonti rinnovabili certificate. Oltre il 90 per cento dell'energia rinnovabile acquistata nel 2023 ha origine idroelettrica, mentre la restante quota ha origine solare (tav. a5).

Gli impianti fotovoltaici della Banca, installati presso lo stabilimento di produzione delle banconote e sugli edifici che ospitano le Filiali di Catania e di Catanzaro, hanno prodotto circa 59.000 chilowattora di energia elettrica (pari a poco meno dello 0,1 per cento del consumo annuo complessivo), registrando - a parità di numero di pannelli installati - una flessione produttiva dell'11 per cento rispetto al 2022 (tav. a4).

Sono in via di completamento i lavori per l'installazione di due impianti fotovoltaici presso la Filiale di Sassari e sulle coperture dei parcheggi del Centro Donato Menichella, di potenza rispettivamente pari a 150 e 316 chilowatt di picco, che consentiranno la produzione di oltre 550.000 chilowattora all'anno (circa lo 0,8 per cento dei consumi di energia elettrica della Banca); entro la fine del 2024 è previsto l'ampliamento di quello di Catanzaro, la cui potenza installata passerà da 12 a 20 chilowatt di picco (mentre i chilowattora misurano la quantità di energia reale generata da un impianto, i chilowatt di picco esprimono la potenza elettrica massima che l'impianto fotovoltaico è in grado di produrre nelle condizioni standard di temperatura e radiazione solare incidente). È stata completata la progettazione di tre impianti fotovoltaici, per una potenza complessiva di circa 130 chilowatt di picco, presso le Filiali di Milano e Reggio Calabria - con l'ottenimento dei relativi nulla osta all'esecuzione da parte delle locali Soprintendenze - e presso la Filiale di Forlì. Sono stati inoltre completati gli studi di fattibilità per l'installazione di impianti fotovoltaici su alcuni edifici del Centro Donato Menichella e sulla maggior parte degli stabili del centro storico di Roma: questi impianti - a condizione di ottenere le necessarie autorizzazioni da parte delle autorità competenti - potrebbero consentire di disporre di una potenza massima complessiva di oltre 600 chilowatt di picco. Ulteriori impianti saranno progettati nel corso del biennio 2024-25 per altre dieci Filiali.

Interventi di efficientamento energetico

In tutti gli edifici è in corso la progressiva sostituzione dei corpi illuminanti con luci a led, a minore consumo e maggiore durata.

Il Centro Donato Menichella, complesso immobiliare certificato secondo la norma ISO 50001, è il sito con il maggiore consumo energetico (anche per la presenza di un centro elaborazione dati; cfr. tav. a7). Sono state messe in esercizio le quattro nuove torri evaporative installate (sistemi per smaltire il calore prodotto dagli impianti di climatizzazione), che consentiranno una riduzione dei consumi annui di energia elettrica di 400.000 chilowattora (pari allo 0,5 per cento del totale dei consumi della Banca) e di acqua non potabile di 15.000 metri cubi (8 per cento dei consumi totali). È in corso la sostituzione, con sistemi a led, dell'illuminazione esterna e di quella dei corridoi di collegamento degli edifici del Centro: i risparmi di energia sono stimabili in oltre 500.000 chilowattora all'anno. Inoltre in uno degli edifici del Centro sono in corso lavori di riqualificazione che prevedono l'installazione, in via sperimentale, di sensori che disattivano automaticamente la climatizzazione e l'illuminazione negli ambienti di lavoro non occupati dal personale e regolano il livello di illuminazione in funzione della luce naturale; a seguito di un periodo di osservazione si valuterà la progressiva installazione di questi apparati negli altri edifici del complesso immobiliare.

Presso lo stabilimento di produzione delle banconote, dopo aver terminato l'installazione di luci a led negli uffici, nei corridoi e nella mensa, è in corso la sostituzione degli apparati di illuminazione del salone stamperia con sistemi di ultima generazione, che modulano l'intensità dell'illuminazione in funzione della luce esterna.

Nel complesso immobiliare di Palazzo Koch sono in corso i lavori di installazione di nuove torri evaporative ad alta efficienza: le unità saranno affiancate da una pompa di calore in grado di produrre acqua calda utilizzando una quota parte del calore di condensazione dei gruppi frigoriferi, con vantaggi in termini di efficienza energetica e consumi di acqua. Per gli impianti elettrici è stata installata una nuova stazione di continuità UPS a elevata efficienza, in sostituzione di quella precedente, ed è stato installato un sistema di monitoraggio per consentire l'ottimizzazione dei consumi.

Per gli edifici ubicati nel centro storico di Roma è stato definito un piano pluriennale di interventi sulla base dell'analisi delle diagnosi energetiche di terzo livello acquisite. Nei restanti edifici di Roma e delle Filiali sono in corso diversi interventi di efficientamento tra i quali: il rinnovo degli impianti di climatizzazione e delle centrali termiche; la sostituzione degli infissi e, laddove possibile, l'inserimento di coibentazioni in copertura; l'implementazione di sistemi di monitoraggio puntuale per individuare azioni mirate di riduzione dei consumi; l'adozione di sistemi smart di termoregolazione degli ambienti di lavoro integrabili con sensori di presenza. In prospettiva, nella progettazione dei nuovi impianti si adotteranno soluzioni per disattivare il riscaldamento e il raffrescamento negli spazi non occupati dal personale.

Elettrificazione dei sistemi di riscaldamento

L'uso di pompe di calore elettriche per il riscaldamento in sostituzione dei tradizionali impianti a gas metano o gasolio consente di ridurre le emissioni dirette di anidride carbonica.

Nel corso del 2023 tre impianti di riscaldamento a gasolio (a servizio rispettivamente della Scuola di formazione a Roma e delle Filiali di Foggia e Sassari) sono stati sostituiti da sistemi a pompa di calore. L'ultimo impianto a gasolio della Banca, installato presso la Filiale di Catania, sarà sostituito da un sistema a pompa di calore nel corso del 2025. È inoltre in corso di progettazione l'elettrificazione dell'impianto di climatizzazione invernale della Filiale di Bari che prevede la sostituzione della centrale termica a gas metano. Presso le Filiali di Forlì e Potenza è prevista l'installazione di sistemi di climatizzazione invernale di tipo ibrido, nei quali la caldaia a gas metano è integrata da un impianto a pompa di calore.

Nell'anno è stato concluso uno studio di fattibilità per l'installazione presso lo stabile di Largo Bastia di un sistema a pompa di calore integrato con un impianto solare termico, che consentirà la produzione di acqua calda per uso sanitario e, in parte, per la climatizzazione degli ambienti: questa soluzione, ora in fase di progettazione, consentirà di ricorrere all'utilizzo del gas metano solo nei mesi più freddi dell'anno.

Adesione alla Convenzione CONSIP

La Banca ha portato da 7 a 15 il numero delle Filiali aderenti alla convenzione Consip SIE4 (Servizio integrato energia e servizi connessi, edizione 4); l'adesione alla convenzione prevede la gestione e manutenzione degli impianti, la fornitura di energia elettrica rinnovabile e di combustibili per riscaldamento, il progressivo efficientamento degli impianti tecnologici e di illuminazione, nonché il raggiungimento di specifici obiettivi di risparmio energetico e, laddove possibile, l'installazione di impianti fotovoltaici.

Soluzioni gestionali

L'adozione in Banca del modello di lavoro ibrido - in cui la prestazione lavorativa da remoto si integra con quella svolta in presenza - ha consentito di sperimentare in alcuni edifici nuove soluzioni gestionali, tra le quali la condivisione della postazione di lavoro tra più addetti (desk sharing). Il minore fabbisogno di postazioni di lavoro ha consentito di dismettere un'intera area di un edificio a Roma e di disattivarne gli impianti, con conseguenti minori consumi stimabili, su base annua, in circa 220.000 chilowattora di energia elettrica e 12.000 metri cubi di gas metano (le emissioni di gas serra evitate sono circa 240 tonnellate di anidride carbonica equivalente). Inoltre, in via sperimentale, durante il periodo natalizio sono stati chiusi per alcuni giorni tre edifici non aperti al pubblico.

Sempre con l'obiettivo di ridurre i consumi energetici, la Banca ha stabilito - su base volontaria - di mantenere negli ambienti di lavoro di tutti gli edifici istituzionali temperature diverse rispetto ai valori previsti per gli edifici pubblici e, nello specifico, più alte di 1°C nella stagione estiva 2023 e più basse di 1°C nella stagione invernale 2023-24.

La recente approvazione di linee guida per la progettazione e l'utilizzo degli uffici in chiave smart consentirà di raggiungere, in prospettiva, importanti risultati in termini di maggior efficienza nell'utilizzo degli spazi e di miglioramento del benessere organizzativo, con conseguente riduzione del fabbisogno di immobili, dei costi di gestione, dei consumi e dell'impronta carbonica dell'Istituto.

Cantieri e nuovi progetti

Nello stabile di via Milano 60 a Roma, dopo aver completato il rifacimento delle facciate, è in corso il riordino edile e impiantistico degli interni, che consentirà una riduzione di circa due terzi del fabbisogno di energia (la classe energetica dell'edificio passerà dall'attuale classe E alla A2).

Sono iniziati i lavori di ristrutturazione integrale dell'edificio di via Mazzarino a Roma: gli interventi previsti sull'involucro edilizio e il contestuale rinnovo di tutti gli impianti tecnologici consentiranno il raggiungimento di elevati livelli di efficienza energetica (la classe energetica passerà dalla E alla A3).

È stato inoltre aggiornato lo studio di fattibilità per la realizzazione del nuovo centro di elaborazione dei dati della Banca (cfr. il riquadro: Il progetto del nuovo centro elaborazione dati della Banca).

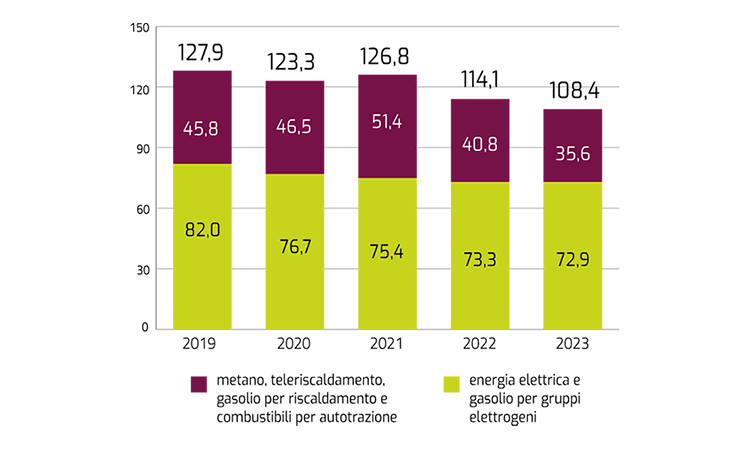

Figura 5 - Energia

Consumo di energia (megawattora) (1)

(1) Le eventuali mancate quadrature sono dovute all'arrotondamento delle cifre decimali.

Il Progetto del nuovo centro elaborazione dati della Banca

Il nuovo centro di elaborazione dati (CED) della Banca verrà costruito nell'area di Castel Romano a Roma e verrà progettato secondo i più avanzati criteri di sostenibilità ambientale.

Al momento lo studio di fattibilità del nuovo CED prevede: a) la ricerca della massima efficienza energetica attraverso la coibentazione dell'edificio, il riutilizzo del calore prodotto dagli elaboratori, l'installazione degli impianti più avanzati in termini di prestazioni energetiche e l'innalzamento delle temperature dell'acqua di raffreddamento (da 10-12°C attuali a 15-20°C, compatibilmente con le esigenze di smaltimento del calore prodotto dagli elaboratori); b) la drastica riduzione delle emissioni di gas serra attraverso l'uso esclusivo di sistemi a pompa di calore - anziché caldaie a gas - per il riscaldamento e la produzione di acqua calda, nonché con l'utilizzo di gruppi frigoriferi che impiegano gas refrigeranti a basso impatto climatico; c) la produzione di energia rinnovabile tramite impianti fotovoltaici con una potenza installata di circa 1 megawatt e, laddove possibile, geotermici o microeolici; d) la presenza di sistemi avanzati di gestione e monitoraggio dei consumi; e) l'impiego di soluzioni che consentano di limitare, per quanto possibile, il consumo di suolo; f) la creazione di numerose aree verdi e la piantumazione di alberi e arbusti autoctoni; g) la gestione attenta delle acque attraverso il recupero dell'acqua piovana e il riuso delle acque grigie tramite sistemi di fitodepurazione; h) l'utilizzo di materiali da costruzione ecosostenibili; i) l'uso di specifici protocolli di qualità ambientale delle nuove costruzioni (quali ad es. il protocollo LEED).

Green IT

Entro il 2024 sarà concluso il progetto di sostituzione delle stampanti da scrivania con un numero molto inferiore di apparecchiature multifunzione a uso condiviso. Questa soluzione, una volta a regime, consentirà di evitare circa 210 tonnellate di anidride carbonica equivalente all'anno, pari al 50 per cento delle emissioni connesse con l'attuale soluzione di stampa.

Consumi

Nel 2023 i consumi complessivi di energia termica ed elettrica hanno risentito di fattori strutturali e congiunturali quali: a) la rimodulazione del perimetro immobiliare, con la piena attivazione di alcuni edifici, tra cui quello di via delle Quattro fontane a Roma; b) gli interventi di efficientamento energetico; c) le condizioni meteorologiche (un inverno mite con benefici sul consumo di gas e un'estate afosa con maggior consumo di elettricità); d) le misure emergenziali sulla gestione degli impianti di condizionamento stabilite da norme nazionali (DM 383/22) o da ordinanze locali dei Sindaci e adottate su base volontaria dalla Banca; e) per la sola componente elettrica, un aumento dovuto sia all'elettrificazione dei sistemi di riscaldamento sia a un maggiore fabbisogno di energia dei due centri di elaborazione dati dell'Istituto (ospitati al Centro Donato Menichella a Frascati e nell'edificio di Largo Bastia a Roma).

A causa di questi fattori, i consumi complessivi di energia termica (gas metano, teleriscaldamento e, in misura residuale, gasolio per riscaldamento) sono diminuiti del 13 per cento rispetto all'anno precedente (22 per cento in meno rispetto al 2019); i consumi complessivi di energia elettrica sono rimasti sostanzialmente stabili (11 per cento in meno rispetto al 2019; fig. 5; tav. a4).

Figura 6 - Energia

Consumo di energia (1) (megawattora)

(1) Le eventuali mancate quadrature sono dovute all'arrotondamento delle cifre decimali.

Acqua

Meno dell'1 per cento delle emissioni di gas serra della Banca è dovuto al consumo di acqua.

Siamo impegnati a ridurre progressivamente il consumo di acqua potabile. Laddove disponibile si utilizza acqua non potabile per l'irrigazione delle aree verdi o per gli usi industriali (produzione delle banconote e torri evaporative per la produzione di acqua refrigerata).

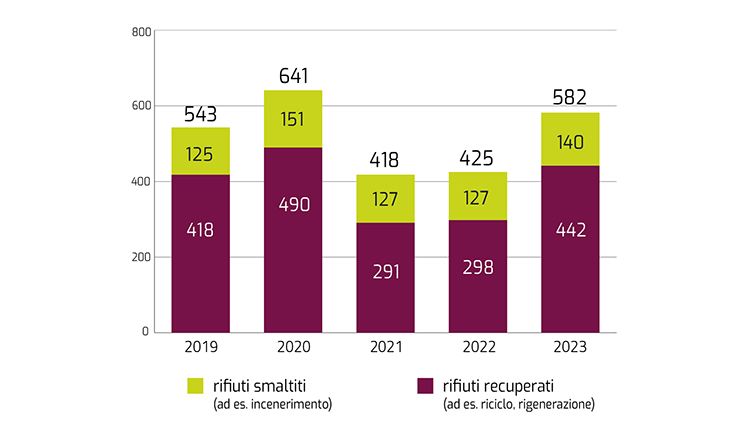

I tre edifici con il maggior numero di persone (Centro Donato Menichella, Palazzo Koch e stabilimento di produzione delle banconote) consumano circa la metà del fabbisogno complessivo di acqua potabile (fig. 7; tav. a9).

Figura 7 - Acqua

Consumo di acqua potabile (percentuale)

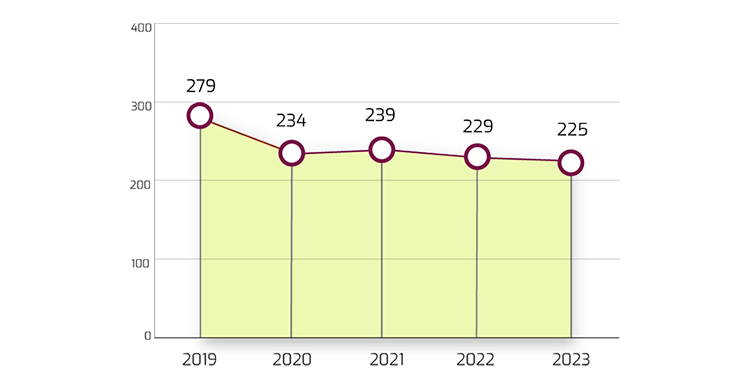

Nel 2023 il consumo complessivo di acqua potabile (225.000 metri cubi) è risultato in lieve flessione rispetto all'anno precedente; nel confronto con il 2019, ultimo anno pre-pandemico, la riduzione è stata del 19 per cento (fig. 8; tav. a8).

Il consumo di acqua non potabile (195.000 metri cubi) è risultato del 5 per cento più alto rispetto all'anno precedente: l'aumento è dovuto a un maggiore utilizzo presso lo stabilimento di produzione delle banconote.

Sono in corso diverse iniziative per ottimizzare i consumi idrici, sia con interventi nei servizi igienici (ad es. con la progressiva sostituzione delle cassette di scarico o con l'installazione di erogatori temporizzati), sia attraverso l'installazione di sistemi puntuali di monitoraggio per intercettare eventuali consumi anomali o perdite.

Figura 8 - Acqua

Consumo di acqua potabile (migliaia di metri cubi)

Carta

Meno dell'1 per cento delle emissioni di gas serra della Banca è dovuto al consumo complessivo di carta.

Siamo impegnati a ridurre l'utilizzo della carta attraverso lo snellimento e la digitalizzazione dei processi e la dematerializzazione dei documenti e delle pubblicazioni.

Carta per ufficio

I cittadini inoltrano segnalazioni e accedono ai servizi informativi dell'Istituto utilizzando sempre più la piattaforma Servizi online per il cittadino, attiva dal 2019. Nel 2023 oltre l'86 per cento delle comunicazioni della Banca con soggetti esterni è avvenuto in forma esclusivamente digitale (98 per cento in termini di numero di pagine inviate).

I processi di lavoro interni sono stati completamente digitalizzati e prevedono la stampa di documenti in casi residuali: fanno eccezione alcune procedure di tesoreria statale che saranno completamente digitalizzate entro il 2024 e quelle per la gestione operativa e contabile delle Filiali, per le quali è fase di conclusione il rilascio in esercizio di una nuova applicazione che consentirà, entro la fine del 2024, la quasi completa eliminazione della modulistica ora stampata su carta. Un ulteriore progetto, relativo a un nuovo portale interno dei servizi, permetterà di conseguire benefici aggiuntivi in termini di dematerializzazione documentale, riducendo al minimo le comunicazioni cartacee inviate ai pensionati.

Figura 9 - Carta

Acquisto di carta in risme A3 e A4 per ufficio (migliaia di chilogrammi)

La Banca è stata inoltre autorizzata dalla Direzione generale Archivi del Ministero della Cultura a distruggere tutti i documenti originali cartacei più recenti di cui esista copia digitale conforme. Nel corso del 2023 sono state riciclate 33 tonnellate di carta (circa 1.500 metri lineari di archivi).

In Banca si utilizza sia carta bianca sia carta riciclata: laddove possibile si acquista carta con marchio di qualità ecologica Ecolabel UE, che attesta il rispetto di elevati standard ambientali in tutto il processo di produzione.

Nel 2023 gli acquisti complessivi di carta per ufficio sono aumentati del 18 per cento nel confronto con l'anno precedente, risultando comunque circa un terzo di quelli del periodo pre-pandemico (fig. 9; tav. a10): l'aumento è dovuto alla creazione di scorte. La quota di carta riciclata acquistata è stabile al 42 per cento (fig. 10; tav. a10).

Figura 10 - Carta

Carta riciclata per ufficio (percentuale)

Pubblicazioni

Le pubblicazioni della Banca d'Italia sono disponibili in formato digitale sul sito internet dell'Istituto. Alcune hanno una diffusione esclusivamente online: in questa categoria rientrano il Rapporto ambientale (dal 2021), il Rapporto annuale sugli investimenti sostenibili e sui rischi climatici, i fascicoli della collana Statistiche, le collane Questioni di economia e finanza e Temi di discussione, le Note di stabilità finanziaria e vigilanza e L'economia italiana in breve.

Le pubblicazioni per cui è prevista la versione cartacea sono stampate solo su richiesta oppure per particolari esigenze, come nel caso di quelle distribuite in occasione della lettura delle Considerazioni finali del Governatore alla fine di maggio. La tiratura di queste ultime pubblicazioni è stata nettamente ridotta nel tempo: nel caso della Relazione annuale, ad esempio, la quantità di copie stampate nel 2024 è stata pari a 1.500 (1.895 nel 2023, 2.700 nel 2019).

La Banca provvede anche alla stampa delle pubblicazioni per l'educazione finanziaria, diffuse in prevalenza nelle scuole.

Con l'obiettivo di ridurre l'impatto sull'ambiente connesso con le attività di stampa, nel 2023 è stata utilizzata in gran parte carta provvista del marchio ecologico FSC; inoltre per le pubblicazioni distribuite in occasione delle Considerazioni finali del Governatore e per altri prodotti editoriali è stata usata carta con marchio Ecolabel UE (25 per cento in peso).

Prosegue l'analisi e la sperimentazione di formati editoriali alternativi alla stampa (quali ad es. il linguaggio HTML, utilizzato dal 2021 per il Rapporto ambientale), che consentono anche di migliorare i profili di accessibilità e fruibilità delle informazioni.

Lo scorso anno i consumi complessivi di carta per la stampa di pubblicazioni e di altri prodotti editoriali (ad es. materiali per convegni) sono diminuiti del 32 per cento rispetto all'anno precedente, nel confronto con il 2019 si è registrata una flessione del 47 per cento. Nel 2023 una parte delle lavorazioni di stampa delle pubblicazioni è stata esternalizzata (fig. 11; tav. a11).

Figura 11 - Carta

Consumo di carta per le pubblicazioni (migliaia di chilogrammi)

Rifiuti e donazioni solidali

Meno dell'1 per cento delle emissioni di gas serra della Banca è dovuto alla produzione di rifiuti.

Gli obiettivi prioritari sono ridurre all'origine la quantità dei rifiuti prodotti e privilegiare, rispetto allo smaltimento in discarica, il riutilizzo e il riciclo, in un'ottica di economia circolare.

Rifiuti

Tutti i rifiuti prodotti dalle attività d'ufficio, dalle mense interne, dagli scarti d'archivio, dalla stampa delle pubblicazioni dell'Istituto, nonché quelli informatici sono raccolti in maniera separata e avviati a riciclo (tav. a13). I rifiuti originati dal processo di produzione delle banconote sono inviati a impianti di riciclo o di recupero energetico (cfr. la sezione: Banconote).

In Banca l'utilizzo della plastica è molto limitato: nelle mense interne e negli uffici delle Filiali di Ancona, Arezzo, Firenze, Forlì, Perugia e Venezia sono presenti erogatori di acqua collegati alla rete idrica locale (questa misura ha consentito di ridurre drasticamente l'utilizzo di acqua confezionata in bottiglie di plastica); i dipendenti dispongono di borracce termiche in acciaio; stoviglie e bicchieri monouso sono usati solo se strettamente necessari e sono di carta riciclabile o materiale compostabile. Negli eventi in cui è strettamente necessario usare acqua confezionata si fa ampio ricorso a bottiglie di acqua con vetro a rendere.

Donazioni a fini solidali

La donazione di alimenti o di beni, quali ad esempio arredi e computer, effettuata in primo luogo a fini sociali, contribuisce anche a ridurre la produzione di rifiuti in un'ottica di economia circolare.

Il servizio di ristorazione aziendale è effettuato minimizzando la quantità dei pasti allestiti, ma non erogati. Nel 2023 nelle mense di Roma e Frascati è ripresa la donazione a fini solidali di questi pasti, che era stata interrotta negli anni precedenti a causa delle difficoltà nell'individuare organizzazioni di volontariato attrezzate per il trasporto di alimenti con i necessari presidi igienico-sanitari.

Inoltre circa 1.000 arredi e 415 personal computer non più reimpiegabili in Banca sono stati donati a scuole, enti e associazioni senza finalità di lucro che ne avevano fatto richiesta.

Nelle sedi di Roma e Frascati sono stati raccolti oltre 240 occhiali e 140 cellulari usati, che sono stati donati ad associazioni che operano nel sociale.

Banconote

L'8 per cento delle emissioni di gas serra della Banca è dovuto alla produzione, distribuzione, ricircolo e smaltimento delle banconote in euro.

La Banca contribuisce insieme alla BCE e alle altre banche centrali dell'Eurosistema a ridurre l'impatto ambientale connesso con il ciclo di vita del contante.

Le iniziative dell'Eurosistema

La Banca ha partecipato, insieme alle altre BCN, a uno studio promosso dalla BCE per valutare l'impronta ecologica delle banconote in euro come mezzo di pagamento. Lo studio, condotto secondo la metodologia standardizzata di calcolo dell'impronta ambientale di prodotto (product environment footprint, PEF), ha richiesto l'analisi dell'intero ciclo di vita delle banconote, coinvolgendo quindi anche i fornitori di materie prime e i gestori del contante. I risultati di questa valutazione sono stati presentati dalla BCE nel mese di dicembre 2023: l'impronta ambientale dei pagamenti medi annui con banconote per cittadino dell'area dell'euro è risultata pari a 101 micropunti, equivalente all'impatto ambientale di 8 chilometri percorsi in auto, ossia allo 0,01 per cento dell'impatto ambientale totale delle attività di consumo annuali da parte di un cittadino europeo.

Le principali attività che contribuiscono all'impronta ambientale delle banconote in euro sono l'alimentazione elettrica degli ATM (37 per cento), il trasporto (35 per cento), le attività di trattamento nella fase di distribuzione (10 per cento), la fabbricazione della carta (9 per cento), il controllo dell'autenticità delle banconote presso i POS nella fase di utilizzo (5 per cento) e la produzione delle banconote (3 per cento).

La produzione delle banconote

Lo stabilimento di produzione delle banconote è dotato, sin dal 2004, della certificazione ambientale ai sensi della norma ISO 14001.

Nel corso degli anni sono state attuate numerose iniziative volte a contenere gli impatti ambientali del processo produttivo, tra le quali: (a) l'ottimizzazione energetica degli impianti tecnologici dello stabilimento; (b) la riqualificazione dell'impianto di depurazione dei reflui industriali; (c) una gestione sempre più efficace dei rifiuti industriali, improntata a preferire le operazioni di riutilizzo e recupero (ad es. riciclo, rigenerazione, termovalorizzazione) rispetto a quelle di smaltimento (incenerimento, conferimento in discarica; cfr. fig. 12 e tav. a14). A questo riguardo, con la collaborazione delle cartiere fornitrici, gli imballaggi in legno utilizzati per la fornitura della carta filigranata sono ora restituiti alle stesse cartiere per il riutilizzo. Sono inoltre in corso incontri specifici con uno dei fornitori di inchiostri per razionalizzare le consegne e per studiare soluzioni di confezionamento degli inchiostri più ecosostenibili.

In ambito produttivo, prosegue la sperimentazione del sistema di incisione laser diretta di lastre calcografiche che si prevede abbia un impatto ambientale ridotto rispetto al tradizionale processo di elettroformatura galvanica: si è conclusa la fase di test preliminari con la realizzazione di lastre di piccolo formato ed è stato avviato lo studio di fattibilità per sperimentare l'impiego di lastre di formato standard da impiegare nella produzione corrente. Oltre a una minore produzione di rifiuti pericolosi, l'adozione di questo sistema consentirebbe la riduzione dei rischi di salute e sicurezza dei lavoratori.

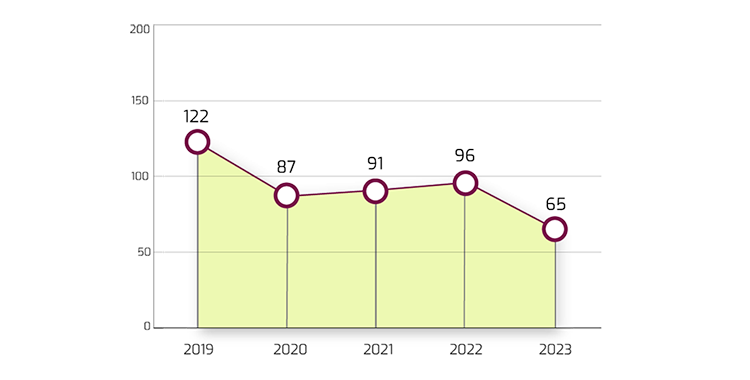

Figura 12 - Rifiuti (stabilimento di produzione delle banconote)

Rifiuti speciali generati nel processo di stampa delle banconote (migliaia di chilogrammi)

Per gli addetti dello stabilimento sono stati acquistati dispositivi di protezione individuale a bassa impronta carbonica, prodotti con materiali riciclati e processi che assicurano emissioni nette di gas serra pari a zero.

Il trasporto delle banconote

Per ridurre l'impatto ambientale connesso con la distribuzione delle banconote dallo stabilimento di produzione verso le Filiali della Banca, è in corso la progressiva sostituzione del parco automezzi blindati con modelli omologati secondo le recenti direttive europee in materia di emissioni; i primi sette nuovi mezzi saranno consegnati nel corso del 2024.

Nell'aprile 2024 la Banca ha pubblicato una procedura per l'affidamento del trasporto aereo delle banconote verso le altre banche centrali dell'Eurosistema: con l'obiettivo di ridurre l'impatto sull'ambiente connesso con questi trasporti, l'Istituto potrà richiedere ai fornitori di utilizzare biocarburante aereo sostenibile (sustainable aviation fuel, SAF) in una percentuale superiore rispetto alla soglia del 2 per cento stabilita dal Regolamento UE 2023/2405 (ReFuelEU Aviation), che entrerà in vigore a partire dal 2025.

La gestione dei rifiuti costituiti dalle banconote logore

La Banca d'Italia cura presso il Servizio Gestione circolazione monetaria e 34 Filiali la selezione periodica delle banconote in circolazione, con l'obiettivo di garantire gli standard di qualità del contante: le banconote che in fase di selezione sono giudicate non più idonee alla circolazione, in quanto logore o usurate, sono ridotte in frammenti.

Nel 2023 la produzione di rifiuti costituiti da banconote logore triturate è aumentata del 10 per cento rispetto all'anno precedente (fig. 13; tav. a14). In linea con le decisioni assunte nell'ambito dell'Eurosistema, i rifiuti costituiti da scarti di produzione e banconote logore triturate sono conferiti a impianti per la produzione del combustibile solido secondario (CSS) o per il recupero energetico (termovalorizzazione), che rappresentano le modalità di trattamento più idonee dal punto di vista ambientale. Grazie a questa iniziativa è stato possibile evitare l'emissione di 4 tonnellate di anidride carbonica equivalente (tav. a2).

Figura 13 - Rifiuti

Banconote logore ritirate dalla circolazione e ridotte in frammenti (migliaia di chilogrammi)

La Banca ha affidato un incarico alla Facoltà di Ingegneria dell'Università degli Studi di Napoli Federico II per valutare la fattibilità industriale relativa al riuso in edilizia dei frammenti di banconote logore.

Mobilità sostenibile

Il 35 per cento delle emissioni di gas serra della Banca è dovuto ai viaggi di lavoro, agli spostamenti casa-lavoro e ai consumi di energia del lavoro da remoto.

Siamo impegnati a ridurre gli spostamenti per motivi di lavoro e a promuovere l'utilizzo di mezzi di trasporto ecosostenibili e la mobilità elettrica.

Lavoro da remoto e spostamenti casa-lavoro e tra sedi

Da un punto di vista ambientale il lavoro da remoto comporta: (a) la riduzione dei consumi energetici e idrici nei luoghi di lavoro, dovuta a una minore presenza di persone; (b) la riduzione degli spostamenti casa-lavoro e delle connesse emissioni in atmosfera; (c) l'aumento dei consumi domestici. Nel 2023 le prestazioni svolte a distanza sono state in media circa il 37 per cento del totale: il dato è inferiore rispetto al 42 per cento del 2022 ma significativamente più alto rispetto al 4 per cento registrato nel 2019, ultimo anno pre-pandemico.

Nel corso del 2023 è stato diffuso tra tutti i dipendenti un questionario messo a punto insieme all'ENEA (Agenzia nazionale per le nuove tecnologie, l'energia e lo sviluppo economico sostenibile) per: (a) acquisire informazioni sulle abitudini di spostamento casa-lavoro e calcolare le relative emissioni in atmosfera; (b) stimare gli extra-consumi domestici di energia elettrica e termica quando si lavora da remoto (cfr. il riquadro: L'aggiornamento dei dati sugli spostamenti casa-lavoro e sul lavoro da remoto).

L'aggiornamento dei dati sugli spostamenti casa-lavoro e sul lavoro da remoto

Il questionario messo a punto insieme all'ENEA ha consentito di aggiornare le informazioni raccolte nel 2020 in merito agli spostamenti casa-lavoro dei dipendenti, nonché di approfondire i consumi di energia connessi con il lavoro da remoto.

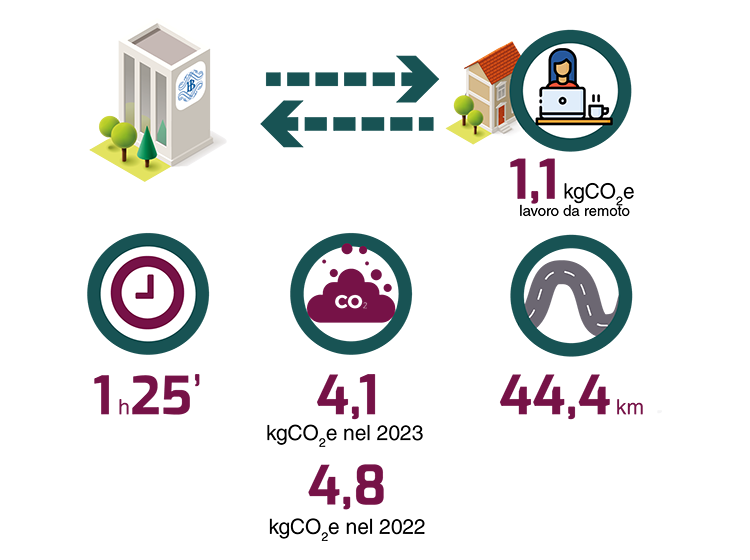

Dal questionario è emerso che il tragitto di andata casa-lavoro dei dipendenti è pari in media a 22,2 km (meno di 20 chilometri per gli addetti alle sedi di Roma e Frascati e oltre 30 km per gli addetti alla rete periferica delle Filiali) e il tempo necessario per percorrerlo è di 42,5 minuti (nella rilevazione precedente la distanza percorsa era 21 km e il tempo impiegato pari a 37,5 minuti). I mezzi più utilizzati sono il treno e l'auto privata (usati rispettivamente per il 39 e il 38 per cento dei chilometri percorsi). L'analisi dei dati raccolti ha consentito di stimare le emissioni medie pro-capite giornaliere per gli spostamenti casa-lavoro dei dipendenti in 4,1 chilogrammi di anidride carbonica equivalente: la flessione rispetto al dato calcolato nel 2020, pari a 4,8 chilogrammi di anidride carbonica equivalente, è dovuta a un maggiore utilizzo dei mezzi pubblici e all'utilizzo di autovetture private meno inquinanti rispetto alla rilevazione precedente.

Il progetto di ricerca con l'ENEA ha consentito inoltre di stimare le emissioni giornaliere connesse con una giornata di lavoro da remoto in 1,1 chilogrammi di anidride carbonica equivalente: il dato, che comprende gli extra-consumi domestici per il riscaldamento e il raffrescamento dei luoghi in cui i dipendenti effettuano la prestazione lavorativa a distanza nonché i consumi di energia legati all'illuminazione e all'utilizzo del pc, è quindi circa un quarto del corrispondente costo ambientale dello spostamento casa-lavoro connesso con l'effettuazione della giornata di lavoro in presenza (per approfondimenti cfr., nelle Note metodologiche, la voce: Emissioni indirette di gas serra dal trasporto). Nel corso della pandemia, a causa del maggiore utilizzo di mezzi di trasporto privati dovuto ai diffusi timori di contagio, il differenziale tra i due valori era più ampio.

A livello complessivo le emissioni di gas serra totali dovute agli spostamenti casa-lavoro dei dipendenti sono state circa 3.500 tonnellate di anidride carbonica equivalente, in flessione del 5 per cento rispetto all'anno precedente: il maggior numero di spostamenti casa-lavoro effettuati nel 2023 è stato infatti più che compensato dall'utilizzo di mezzi di trasporto meno inquinanti (tav. a2). Nell'anno le emissioni complessive dovute agli extra consumi domestici di energia sono state 532 tonnellate di anidride carbonica equivalente (602 tonnellate nel 2022): la loro flessione è proporzionale al minor numero complessivo di giornate lavorate da remoto.

I dati raccolti tramite il questionario sviluppato con l'ENEA sono stati utilizzati anche per aggiornare il Piano degli spostamenti casa-lavoro (PSCL) relativo al personale che lavora nelle sedi di Roma e Frascati e per elaborare i PSCL delle Filiali di Bari, Bologna, Milano, Napoli, Palermo e Torino. L'obiettivo del PSCL è individuare e realizzare misure mirate di mobilità sostenibile che determinino una riduzione dell'utilizzo del mezzo proprio negli spostamenti casa-lavoro.

Per ridurre l'utilizzo di combustibili fossili nel tragitto casa-lavoro, presso i principali edifici di Roma e Frascati sono disponibili torrette per la ricarica di auto, moto e bici elettriche. Nel corso del 2023, nelle aree di parcheggio aziendali, sono state installate 23 torrette per la ricarica rapida delle vetture elettriche di proprietà dei dipendenti a costi agevolati (ciascuna torretta consente la ricarica di due autovetture): per 20 di queste si è in attesa dell'allaccio da parte del gestore della rete elettrica locale.

Alcune stazioni di ricarica per mezzi elettrici sono in corso di realizzazione presso le Filiali di Bolzano e Cagliari: per quest'ultima le postazioni di ricarica dedicate a biciclette e monopattini sono in parte alimentate dalla pensilina fotovoltaica di copertura.

Con l'obiettivo di incentivare la mobilità dolce e l'utilizzo delle biciclette per raggiungere il posto di lavoro, in due edifici a Roma sono stati allestiti in via sperimentale spogliatoi attrezzati con docce a disposizione dei dipendenti. Sono state inoltre installate nuove rastrelliere per biciclette.

Il sistema di navette aziendali, che prevede 67 corse giornaliere su 7 tratte nel territorio di Roma e Frascati, è strutturato per gestire sia gli spostamenti casa-lavoro, sia gli spostamenti infra-giornalieri tra le sedi della Banca. Il servizio è svolto con una flotta in parte costituita da autobus a metano, meno inquinanti rispetto a quelli tradizionali a gasolio: il numero dei mezzi a metano sarà portato da 9 a 12 entro la fine dell'anno.

La flotta delle auto di servizio a noleggio con conducente (NCC) è stata integrata con 17 auto ibride o elettriche.

Per contribuire a ridurre l'impatto ambientale degli spostamenti di servizio all'interno dell'area romana sono stati stipulati contratti di noleggio a lungo termine per 15 auto elettriche ed è in via di ridefinizione il servizio di bike sharing. Una bicicletta elettrica verrà acquisita a noleggio, in via sperimentale, dalla Filiale di Cagliari.

Viaggi di lavoro

La Banca ha fissato per gli anni 2023, 2024 e 2025 un obiettivo quantitativo di riduzione delle emissioni connesse con i viaggi di lavoro pari rispettivamente al 25, 30 e 35 per cento in meno rispetto a quelle del 2019.

Per facilitare il raggiungimento di questo obiettivo, a partire dal 2023, al consueto budget finanziario assegnato alle diverse Unità della Banca è stato associato, in via sperimentale, anche un budget in termini di gas serra. In corso d'anno questo budget viene progressivamente ridotto di una quota corrispondente alle emissioni connesse con ciascun viaggio effettuato. L'attivazione di questo strumento, al momento non vincolante, consente anche di aumentare la consapevolezza dei responsabili e del personale riguardo agli impatti sull'ambiente associati ai viaggi di lavoro.

Inoltre dallo scorso anno i dipendenti, in occasione di un viaggio per motivi di lavoro, ricevono dall'agenzia, oltre alla lista degli alberghi proposti, anche la rispettiva valutazione di ecosostenibilità: questa valutazione è assegnata sulla base delle risposte delle strutture alberghiere a un questionario predisposto dalla Banca ed aggiornato annualmente.

Un'ulteriore iniziativa realizzata ha riguardato l'acquisto del biocarburante SAF (sustainable aviation fuel) nei viaggi aerei: grazie agli accordi contrattuali in vigore con le principali compagnie aeree, la Banca ha convertito i crediti maturati a fronte dei biglietti emessi in SAF per il successivo impiego nei voli effettuati dai vettori.

Sul fronte internazionale, su iniziativa della Banca, nel 2024 è stato costituito un gruppo di lavoro con l'obiettivo di elaborare linee guida condivise finalizzate a ridurre i viaggi di lavoro tra le sedi delle banche centrali dell'Eurosistema.

L'infrastruttura per le comunicazioni a distanza (136 apparati di videoconferenza, 4 monitor multifunzione e 10 apparati tecnologici per migliorare l'interazione e la collaborazione nelle riunioni ibride) non ha subito variazioni nel corso del 2023: nell'anno sono state effettuate oltre 2,6 milioni di chiamate e circa 410.000 riunioni online, in lieve flessione rispetto all'anno precedente.

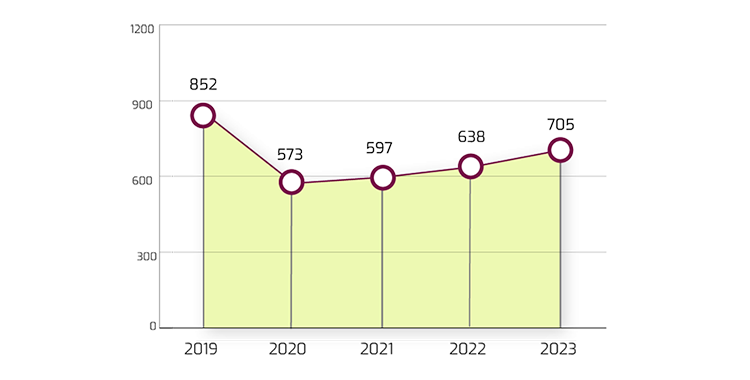

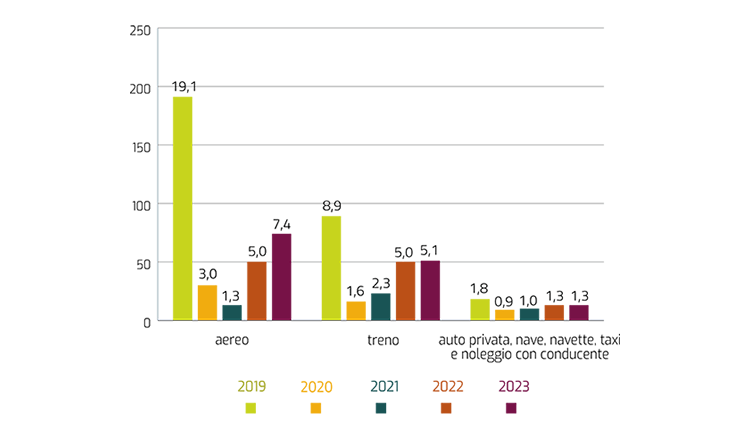

Nel 2023 i chilometri complessivamente percorsi per viaggi di lavoro con i diversi mezzi di trasporto sono aumentati del 22 per cento rispetto all'anno precedente (-54 per cento rispetto al 2019): l'aumento di quelli percorsi in aereo è stato del 48 per cento mentre non ci sono state variazioni nei chilometri percorsi in treno (fig. 14; tav. a15). Il numero di pernottamenti per motivi di lavoro è diminuito dell'8 per cento rispetto al 2022 (-46 per cento rispetto al 2019): l'87 per cento di essi è avvenuto presso strutture alberghiere ubicate in Italia.

Nel complesso, nel 2023 si è registrato un aumento delle emissioni di gas serra del 15 per cento rispetto all'anno precedente. Nel confronto con il 2019, ultimo anno pre-pandemico, si è osservata una diminuzione sia del numero di missioni effettuate sia dei chilometri percorsi: in termini di gas serra la flessione osservata è stata del 58 per cento, ben al di sopra dell'obiettivo di riduzione del 25 per cento, fissato per il 2023.

Figura 14 - Viaggi di lavoro

Distanze percorse per mezzo di trasporto (milioni di chilometri)

Acquisti verdi

Il 15 per cento delle emissioni di gas serra della Banca è dovuto agli acquisti dei beni e dei servizi inclusi nel perimetro di calcolo dell'impronta carbonica (servizi di mensa, arredi e apparecchiature informatiche).

Attraverso una politica di acquisti verdi cerchiamo di contribuire a orientare il mercato verso lo sviluppo di beni, servizi e lavori più ecosostenibili.

Nelle procedure di appalto sono utilizzati i criteri ambientali minimi (CAM) emanati dal Ministero dell'Ambiente e della sicurezza energetica. Sono inoltre previsti, laddove applicabili: (a) il possesso di certificazioni ambientali (ISO 14001 o EMAS) o in materia di gestione dell'energia (ISO 50001); (b) clausole ecologiche di esecuzione dei servizi; (c) marchi di qualità ecologica per i beni oggetto dell'appalto; (d) punteggi premianti per le aziende che utilizzano prodotti, strumenti e procedure a più basso impatto ambientale (nelle gare con criterio di aggiudicazione del miglior rapporto qualità/prezzo).

La Banca promuove anche l'adozione da parte dei fornitori delle migliori pratiche sotto il profilo sociale e di buon governo richiedendo il possesso di specifiche certificazioni in materia di: salute e sicurezza sul lavoro (ISO 45001); tutela dei diritti dei lavoratori (SA 8000); parità di genere (UNI/PdR 125); prevenzione della corruzione (ISO 37001).

Le procedure interne prevedono, sin dalla fase di progettazione dell'iniziativa di spesa, un obbligo per le Strutture committenti di inserire criteri ecologici e sociali ovvero di motivare il mancato ricorso a tali criteri.

Nel 2023 sono state avviate complessivamente 64 procedure di appalto (escludendo le procedure negoziate con unico fornitore, gli affidamenti diretti e le adesioni a contratti stipulati a livello di Eurosistema). In 28 procedure sono stati inseriti criteri ambientali o sociali. Le restanti procedure hanno riguardato servizi per i quali non è possibile, vista la loro natura, applicare criteri verdi (come ad es. l'acquisto di beni immateriali quali software e banche dati).

Nella quasi totalità delle procedure (92 per cento) in cui sono stati previsti criteri premiali di natura ambientale, sociale o di buon governo societario (ESG), le imprese risultate aggiudicatarie hanno presentato offerte - e quindi assunto corrispettivi obblighi contrattuali - in linea con la valutazione di tali criteri.

Nelle gare per i servizi di ristorazione per le mense interne dell'Amministrazione centrale e della Rete territoriale, oltre al possesso delle certificazioni ISO 14001/EMAS, SA 8000, ISO 22000 (sicurezza alimentare) e ISO 22005 (rintracciabilità della filiera alimentare), sono stati inseriti come elementi premianti: a) l'utilizzo di divise per il personale e di detergenti con etichetta Ecolabel UE o di altre etichette ambientali equivalenti; b) la raccolta dei pasti non consumati e la successiva distribuzione a fini solidali; c) l'utilizzo di prodotti biologici e provenienti da aziende del territorio (filiera corta). Per la procedura relativa alle mense di Roma e Frascati sono stati inoltre previsti punteggi aggiuntivi per: a) il possesso della certificazione ISO 45001; b) l'acquisto di crediti di carbonio certificati Gold Standard a compensazione delle emissioni dovute all'esecuzione del servizio; c) il trasporto degli alimenti con veicoli a basso impatto ambientale.

Per il servizio di indagini statistiche sul trasporto internazionale di merci, oltre alla richiesta delle certificazioni ISO 14001/EMAS e SA8000, è stata valutata come elemento premiante la compensazione delle emissioni di gas serra connesse con l'esecuzione del servizio, attraverso l'acquisto di crediti di carbonio sul mercato volontario.

Per l'affidamento dei lavori di manutenzione straordinaria per la riqualificazione dello stabile di via Mazzarino a Roma, oltre al rispetto dei CAM e al possesso di certificazioni (ISO 14001/EMAS, SA 8000, ISO 45001, ISO 37001), sono stati valutati come fattori premianti: a) la progettazione e l'installazione di un sistema a pompa di calore integrato con le caldaie a condensazione a gas metano; b) la progettazione e realizzazione di un impianto di recupero dell'acqua piovana; c) l'utilizzo di una percentuale di materiali riciclati più elevata di quella richiesta dai CAM; d) la formazione del personale in tema di riduzione dell'impatto ambientale di cantiere; e) la fornitura e la posa in opera di pannelli informativi sulla qualità delle condizioni microclimatiche ambientali.

Negli affidamenti per la conduzione e manutenzione impiantistica degli edifici dell'Amministrazione centrale e delle Filiali, oltre al rispetto dei CAM, sono stati previsti punteggi migliorativi per: a) la certificazione dell'azienda secondo la ISO 50001 o UNI 11352 (società che forniscono servizi energetici, ESCO); b) la certificazione ambientale ISO 14001 o EMAS; c) le certificazioni SA 8000 e ISO 45001 e il reimpiego dei dipendenti non coperti da clausola di riassorbimento; d) l'utilizzo di autoveicoli a basso impatto ambientale (a trazione ibrida o elettrica, con standard emissivo di riferimento non inferiore a Euro 6).

Negli affidamenti relativi alla fornitura di carta filigranata per la produzione delle banconote è stato richiesto che le fibre di cotone impiegate per la fabbricazione della carta provengano esclusivamente da agricoltura biologica o equosolidale oppure da produzione integrata. Per la movimentazione vengono inoltre impiegati pallet e materiale di confezionamento già utilizzato e riutilizzabile per altri trasporti. La certificazione ISO 14001 è stata richiesta nelle gare per la fornitura dei macchinari per la triturazione delle banconote logore e delle fascette di carta per il confezionamento delle banconote.

Nell'ambito dell'appalto per l'acquisizione di servizi professionali per la digitalizzazione dell'archivio storico, oltre a prevedere punteggi premiali per il possesso delle certificazioni SA 8000 e ISO 45001, è stato anche introdotto un requisito migliorativo di tipo qualitativo in relazione al complessivo trattamento riconosciuto ai dipendenti del fornitore (retribuzione, benefit, stabilità del rapporto di lavoro); quest'ultimo requisito è stato anche previsto nell'appalto relativo all'acquisizione di servizi di movimentazione e installazione di postazioni di lavoro.

Negli affidamenti per il rinnovo dei servizi informatici erogati, anche parzialmente, attraverso infrastrutture esterne (ad es. public cloud), i punteggi premianti hanno riguardato: la maggiore efficienza dei data center (power usage effectiveness, PUE); l'alimentazione degli stessi esclusivamente con energia elettrica da fonti rinnovabili; il possesso di certificazioni ISO 50001 e 14001.

L'impegno della Banca d'Italia in materia di appalti verdi è stato riconosciuto dall'Ufficio di coordinamento degli acquisti dell'Eurosistema (Eurosystem Procurement Coordination Office, EPCO), che promuove la cooperazione tra le banche centrali europee nel settore degli appalti: nel febbraio 2024 l'EPCO ha assegnato all'Istituto il premio 2023 Most Sustainable Procurement per i risultati raggiunti in questo ambito e per le procedure di appalto svolte a beneficio delle altre banche centrali.

Biodiversità e forestazione

Siamo impegnati a realizzare iniziative di forestazione urbana e di tutela del nostro patrimonio verde e della biodiversità.

Forestazione urbana

Alberi e boschi in aree urbane e periurbane apportano molti benefici a livello ambientale, climatico e sociale: contribuiscono a contrastare i cambiamenti climatici assorbendo anidride carbonica; aiutano a migliorare la qualità dell'aria e il microclima delle zone interessate, contrastando la formazione di isole di calore nella stagione estiva; migliorano la componente paesaggistica ed estetica, creando spazi verdi a disposizione della comunità.

Per questi motivi, nell'autunno 2023-24 la Banca ha partecipato al progetto Foresta Italia, patrocinato dai Ministeri dell'Ambiente e della sicurezza energetica e dell'Agricoltura, della sovranità alimentare e delle foreste, finanziando quattro interventi di forestazione urbana in Italia.

In particolare, in collaborazione con il Comando Unità Forestali, Ambientali e Agroalimentari (CUFAA) dell'Arma dei Carabinieri e con il supporto operativo di un ente non profit, sono stati piantumati 4.500 alberi autoctoni, distribuiti su un'area complessiva di circa 4,5 ettari nei territori di Roma Capitale, Benevento, Spilamberto (Modena) e Statte (Taranto). La messa a dimora delle piante e la successiva cura sono state affidate ad aziende florovivaistiche del territorio.

Tutela del patrimonio verde

La Banca pone particolare attenzione, da un lato, a ridurre l'utilizzo di suolo, dall'altro, alla cura del proprio patrimonio verde, ricco di biodiversità, distribuito prevalentemente nelle aree circostanti lo stabilimento di produzione delle banconote a Roma (polo tuscolano), il Centro Donato Menichella a Frascati, la Sadiba a Perugia e le Filiali di Agrigento, Arezzo, Bergamo e Piacenza e Sassari (tav. a16).

L'area del polo tuscolano si estende per circa 25 ettari e ospita più di 500 alberi mentre nei 37 ettari dell'area del Centro Donato Menichella trovano spazio, tra le varie essenze, circa 1.000 esemplari di ulivo. A Perugia, nel parco di 7 ettari della Sadiba sono presenti oltre 2.660 alberi, numerosi arbusti e piante aromatiche. In tutte queste aree trovano ospitalità anche diversi animali quali scoiattoli e uccelli di varie specie.

L'attività di gestione e manutenzione è mirata, da un lato, alla salvaguardia delle alberature esistenti attraverso piani di monitoraggio in continuo aggiornamento e, dall'altro, al miglioramento costante del patrimonio verde con nuove piantumazioni in armonia con il paesaggio circostante e nel rispetto degli ecosistemi, anche in ambito urbano o peri-urbano.

Entro il 2024 si procederà a realizzare tre interventi: a) al CDM, una zona attrezzata, arricchita di aiuole con arbusti mediterranei e piante officinali; b) presso il polo tuscolano, un percorso didattico denominato hortus romanus, che prevede l'allestimento di orti coltivati secondo le tecniche agricole utilizzate nella Roma antica e la valorizzazione degli elementi storici dell'area tra i quali un tratto di acquedotto romano; c) presso la Sadiba, l'installazione di due arnie nell'area del frutteto.

Inoltre, per contribuire a sviluppare una maggiore consapevolezza sui temi dell'ambiente e della biodiversità, presso le aree verdi degli edifici di Roma e Frascati e presso la Sadiba sono organizzati corsi di formazione, seminari e visite guidate.

Investimenti sostenibili

Contribuiamo alla tutela dell'ambiente e allo sviluppo dell'economia e della società anche mediante una politica di investimenti sostenibili.

Dal 2019 la Banca integra criteri finanziari e di sostenibilità ambientale, sociale e di governo societario (environmental, social and governance, ESG) nella gestione dei propri investimenti non di politica monetaria. La Carta degli investimenti sostenibili, pubblicata nel 2021, è il documento di riferimento che enuncia i principi guida. L'integrazione dei criteri di sostenibilità nella strategia di investimento ha una duplice finalità: migliorare il profilo di rischio e rendimento degli investimenti e contribuire alla tutela dell'ambiente e alla sostenibilità. Sul fronte del contrasto ai cambiamenti climatici l'Istituto intende gestire le proprie attività di investimento in coerenza con gli obiettivi dell'Accordo di Parigi e con quelli dell'Unione europea che mirano a conseguire la neutralità climatica entro il 2050.

In concreto, la gestione degli investimenti in azioni e obbligazioni societarie è finalizzata a migliorare, rispetto agli indici di mercato presi come riferimento, sia il punteggio sui profili ESG sia gli indicatori climatici dei portafogli. Tra gli indicatori climatici la Banca utilizza i dati sulle emissioni carboniche delle imprese e, a partire dal 2022, anche le informazioni sui loro impegni di decarbonizzazione.

I risultati di sostenibilità dell'attività di investimento sono pubblicati nel Rapporto annuale sugli investimenti sostenibili e sui rischi climatici, che descrive anche il modo in cui i profili di sostenibilità sono integrati nel processo decisionale, nelle strategie e nella gestione dei rischi relativi agli investimenti, nonché le metodologie per la misurazione di tali profili.

Figura 15 - Investimenti sostenibili

Intensità carbonica media ponderata del portafoglio azionario in euro 2019-2023 (1) (tonnellate di CO2e per milione di euro di fatturato)

(1) Il criterio di aggiornamento dei dati concordato nell'Eurosistema rende i valori dell'intensità carbonica media ponderata riportati non del tutto confrontabili con quelli indicati nel Rapporto ambientale 2023 (Per maggiori informazioni sul criterio di aggiornamento dei dati, cfr. la Nota Metodologica del Rapporto annuale sugli investimenti sostenibili e sui rischi climatici sul 2023).

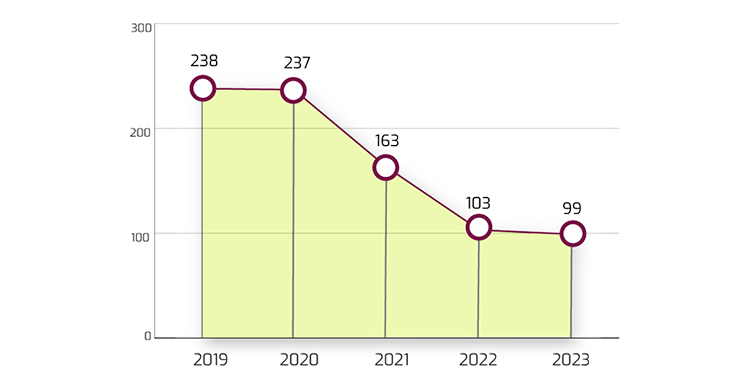

Nel confronto con il 2019 l'intensità carbonica del portafoglio azionario in euro gestito internamente (del valore di 17,3 miliardi di euro e corrispondente a poco meno dell'80 per cento degli investimenti dell'Istituto in titoli privati) si è ridotta del 58 per cento, portandosi a 99 tonnellate di anidride carbonica equivalente per milione di euro di fatturato (fig. 15; tav. a17). Rispetto all'indice di mercato preso come riferimento, l'intensità carbonica del portafoglio è inferiore del 38 per cento. Risultati migliori rispetto all'indice si osservano anche per quanto riguarda l'utilizzo di energia elettrica (-18 per cento), di acqua (-26 per cento) e la produzione di rifiuti (-19 per cento).

Per il portafoglio di obbligazioni societarie in euro (circa il 4 per cento degli investimenti dell'Istituto in titoli privati) l'intensità carbonica si è ridotta del 54 per cento rispetto al 2019, portandosi a 68 tonnellate di anidride carbonica equivalente per milione di euro di fatturato (tav. a17), un valore inferiore del 32 per cento rispetto a quello osservato per l'indice.

Il perimetro dell'attività di investimento sostenibile include anche le azioni e le obbligazioni societarie in valuta (rispettivamente circa il 15 e il 2 per cento degli investimenti dell'Istituto in titoli privati) e i titoli emessi da Stati, organismi sovranazionali e agenzie di emanazione pubblica.

Per i titoli pubblici, la strategia di sostenibilità ritenuta più adatta è l'investimento tematico mediante obbligazioni finalizzate a finanziare progetti con caratteristiche di sostenibilità ambientale (green bond); l'ammontare complessivo di investimenti in green bond è di 5,4 miliardi di euro.

Cultura ambientale

La Banca collabora con altre istituzioni sui temi della finanza sostenibile; dà il proprio contributo ai lavori internazionali e nazionali in materia; contribuisce in qualità di autorità di vigilanza ad assicurare una sana e prudente gestione dei rischi legati ai profili ambientali, sociali e di governo societario degli intermediari finanziari; condivide i risultati delle proprie attività di ricerca e analisi sulle relazioni tra economia, finanza, energia, clima e ambiente; collabora alle iniziative per promuovere la formazione e la consapevolezza di imprese e cittadini sui temi ambientali.

Collaborazioni internazionali ed europee

La Banca partecipa attivamente al Network for Greening the Financial System (NGFS), la rete globale composta da 138 tra banche centrali e autorità di supervisione, che elabora studi e promuove lo scambio di esperienze sulla gestione del rischio ambientale e climatico nel settore finanziario. Dal 2022 l'Istituto coordina, insieme alla banca centrale della Nuova Zelanda, il gruppo di lavoro Net Zero for Central Banks, dedicato a sostenere gli sforzi delle banche centrali verso: la riduzione delle proprie emissioni di gas serra, la promozione degli investimenti sostenibili, la divulgazione di informazioni sui rischi climatici; dal 2024 un nuovo filone di approfondimento del gruppo di lavoro è dedicato ai piani di transizione climatica.

In ambito G20 la Banca fa parte del gruppo di lavoro permanente sulla finanza sostenibile (Sustainable Finance Working Group, SFWG), che ha elaborato un programma di lavoro pluriennale (G20 Sustainable Finance Roadmap) per individuare gli ostacoli e le soluzioni per lo sviluppo di un sistema finanziario sostenibile. Nel 2024 l'Istituto coordina insieme al Ministero dell'Economia e delle finanze i lavori del Climate change mitigation working group durante la Presidenza italiana del G7. In tale ambito la Banca ha promosso un programma di attività per studiare gli impatti macro-economici della transizione e delle politiche di mitigazione, approfondire il contributo della tecnologia nello sviluppo dei piani di transizione e analizzare i rischi macro-finanziari legati alla natura.

L'Istituto partecipa inoltre: al Consiglio per la stabilità finanziaria (Financial Stability Board, FSB), il cui programma per il 2024, pubblicato nel mese di gennaio, include tra le priorità i rischi finanziari connessi con i cambiamenti climatici; al gruppo di lavoro congiunto tra Banca centrale europea e Comitato europeo per il rischio sistemico (European Systemic Risk Board, ESRB), che ha promosso un approccio metodologico comune per l'analisi dei rischi per la stabilità finanziaria dovuti ai cambiamenti climatici e alla fine del 2023 ha pubblicato un rapporto che indaga anche i rischi finanziari legati alla natura.

Nell'ambito dell'Eurosistema, la Banca fa inoltre parte del Forum sul cambiamento climatico (Eurosystem Climate Change Forum, ECCF), volto a favorire la discussione su temi di interesse comune e lo sviluppo di iniziative congiunte, e della rete ambientale delle banche centrali (Environmental Network of Central Banks, ENCB), che promuove la condivisione di buone prassi nella gestione degli aspetti ambientali interni.

A settembre del 2023 la Banca ha ospitato una riunione del comitato di indirizzo dell'NGFS, una riunione dell'ECCF, un workshop sulle frontiere degli investimenti sostenibili organizzato dal gruppo sugli investimenti sostenibili dell'NGFS.

Le iniziative in ambito di supervisione

A livello internazionale, la Banca partecipa ai lavori del Comitato di Basilea per la vigilanza bancaria che sta conducendo analisi per l'inclusione dei rischi climatici negli standard prudenziali: nel novembre 2023 ha avviato una consultazione pubblica sull'inclusione dei rischi climatici nell'informativa ai clienti predisposta dalle banche. Sul fronte europeo, anche in vista dell'approvazione del nuovo pacchetto regolamentare che prevede l'introduzione di presidi per i rischi ESG, l'Autorità bancaria europea (European Banking Authority, EBA) ha avviato la consultazione pubblica su un documento di discussione relativo alla gestione di questi rischi da parte delle banche. In linea con il Meccanismo di vigilanza unico europeo, la Banca ha inserito i rischi climatici e ambientali tra le proprie priorità di vigilanza e nel 2023 ha progressivamente rafforzato il dialogo con gli intermediari e le associazioni di categoria tramite indagini, incontri e workshop dedicati.

Nel mese di settembre si sono svolte presso l'Istituto due tavole rotonde, rispettivamente con le banche e gli altri intermediari finanziari vigilati, per mantenere il dialogo e favorire lo scambio di esperienze e la definizione di buone prassi. È proseguito, inoltre, il monitoraggio dei piani di azione presentati dagli intermediari vigilati sull'integrazione dei rischi climatici e ambientali nei processi aziendali, in linea con le aspettative di supervisione pubblicate nel 2022. Le principali risultanze dell'analisi, unitamente a un aggiornamento delle buone prassi osservate, sono state pubblicate a dicembre 2023.

L'educazione alla finanza sostenibile

La Banca partecipa ai gruppi di lavoro internazionali dell'EBA e della Rete internazionale sull'educazione finanziaria (International Network on Financial Education, INFE) dell'OCSE volti a promuovere la conoscenza della finanza sostenibile tra i cittadini.

In ambito nazionale, sono stati realizzati percorsi strutturati di educazione finanziaria sulla transizione climatica e sulla finanza sostenibile, anche in collaborazione con altre autorità e soggetti pubblici attivi nel mondo della scuola e dell'Università.

Una sezione del sito di educazione finanziaria della Banca, l'Economia per tutti, è dedicata alla finanza sostenibile e spiega in modo semplice quali sono le caratteristiche degli investimenti sostenibili e come ridurne e gestirne i rischi.

Partecipazione a gruppi di lavoro nazionali

L'Istituto partecipa assieme al Ministero dell'Ambiente e della sicurezza energetica (MASE), Consob, Covip e Ivass al Tavolo per la finanza sostenibile, istituito dal Ministero dell'Economia e delle finanze, che ha lo scopo di stimolare la diffusione di informazioni di sostenibilità e di metodologie di valutazione dei rischi che favoriscano la mobilizzazione delle risorse private, attraverso il mercato dei capitali, a supporto della transizione ecologica in Italia. Nell'aprile 2024, il Tavolo ha pubblicato la propria relazione annuale sulle attività svolte nel 2023 e sui gruppi di lavoro avviati su tre tematiche ritenute prioritarie: l'individuazione e la disponibilità dei dati sui rischi climatici e naturali; l'informativa di sostenibilità delle piccole e medie imprese non quotate; la protezione assicurativa contro i rischi ambientali e climatici. La Banca collabora con propri esperti alla redazione del rapporto La situazione energetica nazionale, predisposto dal MASE; prende parte alle attività del Comitato per il capitale naturale, coordinato dallo stesso Ministero, che produce periodicamente un Rapporto sullo stato del capitale naturale in Italia; contribuisce ai lavori dell'Osservatorio Italiano sulla povertà energetica (OIPE).

In sede ABI Lab, il centro di ricerca e innovazione promosso dall'ABI (Associazione bancaria italiana), l'Istituto partecipa all'Osservatorio sui Mercati di energia elettrica e gas, che conduce approfondimenti sulle dinamiche dei prezzi dell'energia e sulle evoluzioni della normativa di settore, e all'Osservatorio Green Banking, che elabora studi sulla gestione degli impatti ambientali nelle operazioni interne ed elabora linee guida sulla rendicontazione ambientale.

Convegni e attività di ricerca e analisi

Nel periodo tra luglio 2023 e luglio 2024 il Governatore e gli altri membri del Direttorio sono intervenuti a diversi eventi e convegni sui temi della finanza sostenibile: i principali sono riportati nella figura 15. Nel marzo 2024 il Vice Direttore Generale Paolo Angelini ha pubblicato un lavoro di ricerca dal titolo Strategie di decarbonizzazione dei portafogli: domande e suggerimenti (Banca d'Italia, Questioni di economia e finanza, 840, 2024).

I temi della finanza sostenibile e dell'impatto dei cambiamenti climatici sulla stabilità del sistema economico e finanziario sono inseriti stabilmente nell'agenda di ricerca della Banca. Nell'anno sono state svolte analisi e ricerche sugli effetti della transizione sul mercato del lavoro e sulle dinamiche d'impresa. I 17 studi pubblicati nel 2023 dai ricercatori dell'Istituto su questi argomenti sono consultabili in una pagina dedicata del sito internet.

La Banca ha inoltre ospitato e organizzato diversi convegni, eventi e incontri sui temi ambientali e climatici, tra i quali due seminari giuridici a novembre 2023 e febbraio 2024, rispettivamente sulla tutela costituzionale dell'ambiente, della biodiversità e degli ecosistemi e sul contenzioso climatico. Nel marzo del 2023 l'Istituto ha organizzato insieme alla Florence School of Banking & Finance un convegno su ESG e cambiamento climatico: sfide per la regolamentazione e vigilanza del settore bancario. In aprile, in collaborazione con l'Associazione italiana economisti dell'energia, si è tenuto un workshop sulla finanza sostenibile e sulla transizione. In ottobre si è svolta a Roma la quarta conferenza congiunta su Flussi internazionali di capitale e politiche finanziarie, organizzata dalla Banca d'Italia in collaborazione con la Bank of England, la Banque de France, il Fondo monetario internazionale e l'OCSE.

Un seminario dedicato ai temi della finanza sostenibile è stato organizzato nell'ambito delle attività di cooperazione tecnica internazionale con le banche centrali dei paesi inclusi nella politica di vicinato europea e di altre economie emergenti.

Altre iniziative

L'Istituto ha collaborato con la Scuola nazionale dell'Amministrazione (SNA) nella progettazione e realizzazione di un corso dal titolo Sostenibilità della PA: strategie, gestione e rendicontazione, rivolto a dirigenti e funzionari pubblici.