Introduction by Governor Fabio Panetta

The years ahead will be crucial in the fight against climate change. Recent international developments point to a weakening of climate commitments among some of the world's major countries. In Europe too, some key regulations in this area are currently under review, with the aim of ensuring that the climate transition is gradual and orderly, and takes greater account of its potential social and economic implications, especially for the most vulnerable groups of society. What remains firmly in place is the resolve to significantly reduce net greenhouse gas emissions over the coming decade, with the goal of reaching net zero by 2050. This is a responsibility we have towards future generations, and one that calls for the collective effort of all stakeholders - businesses, citizens and institutions.

At the same time, we must be aware that even if we succeed in reducing emissions, the effects of climate change will persist for decades. For this reason, decarbonization efforts must be accompanied by adaptation measures aimed at limiting the impacts of climate change, to which Banca d'Italia - like many other institutions and businesses in this country - is increasingly exposed.

For many years, Banca d'Italia has been working to reduce its environmental footprint and to strengthen its resilience to climate change. The Environment Report, first published in 2010, was incorporated in 2025 into the Activity and Sustainability Report, drawn up in line with the requirements of the Corporate Sustainability Reporting Directive.

The Transition Plan that we are presenting to the public today is a further step forward in the Bank's path towards climate change mitigation and adaptation. The gradual shift from gas to electricity as the primary energy source for heating systems forms the backbone of this strategy. Together with the rationalization of energy consumption, this measure will help to reduce both greenhouse gas emissions and the Bank's dependence on imported energy sources, which are particularly vulnerable to unexpected price fluctuations.

The Plan will be monitored and updated as part of the Bank's regular three-year strategic planning process, in order to reflect developments in the regulatory framework and to seize new economic and technological opportunities as they arise.

Overview

The Paris Agreement - signed in 2015 by 196 countries, including Italy - aims to limit the global average temperature increase to well below 2°C above pre-industrial levels, while striving to keep it within 1.5°C, and to address the impacts of climate change. In line with these commitments, the European Union (EU) has set ambitious targets for reducing greenhouse gas emissions1 and for adapting to climate change. Under the European Climate Law (Regulation (EU) 2021/1119), EU institutions and Member States are legally bound to achieve net-zero emissions by 2050. They must also ensure continuous progress in improving adaptation, strengthening resilience, and reducing vulnerability to climate change.

The European System of Central Banks (ESCB), of which Banca d'Italia is a member, without prejudice to its objective of price stability, supports the general economic policies of the EU and contributes to achieving its objectives,2 including sustainable development based on a high level of environmental protection and quality improvement. EU environmental policy3 identifies the objectives to be pursued, including the promotion of measures to combat climate change.

In Italy, the protection of the environment, biodiversity and ecosystems is enshrined in the Constitution (Articles 9 and 41).4 With regard to climate change mitigation, the Integrated National Energy and Climate Plan (PNIEC) sets national targets for reducing greenhouse gas emissions by 2030 and outlines the measures needed to achieve them. As regards climate adaptation, the National Plan for Adaptation to Climate Change (PNACC) provides a national framework for minimizing risks arising from climate change.

Achieving these goals requires the collective effort of society as a whole, including citizens, businesses and institutions.

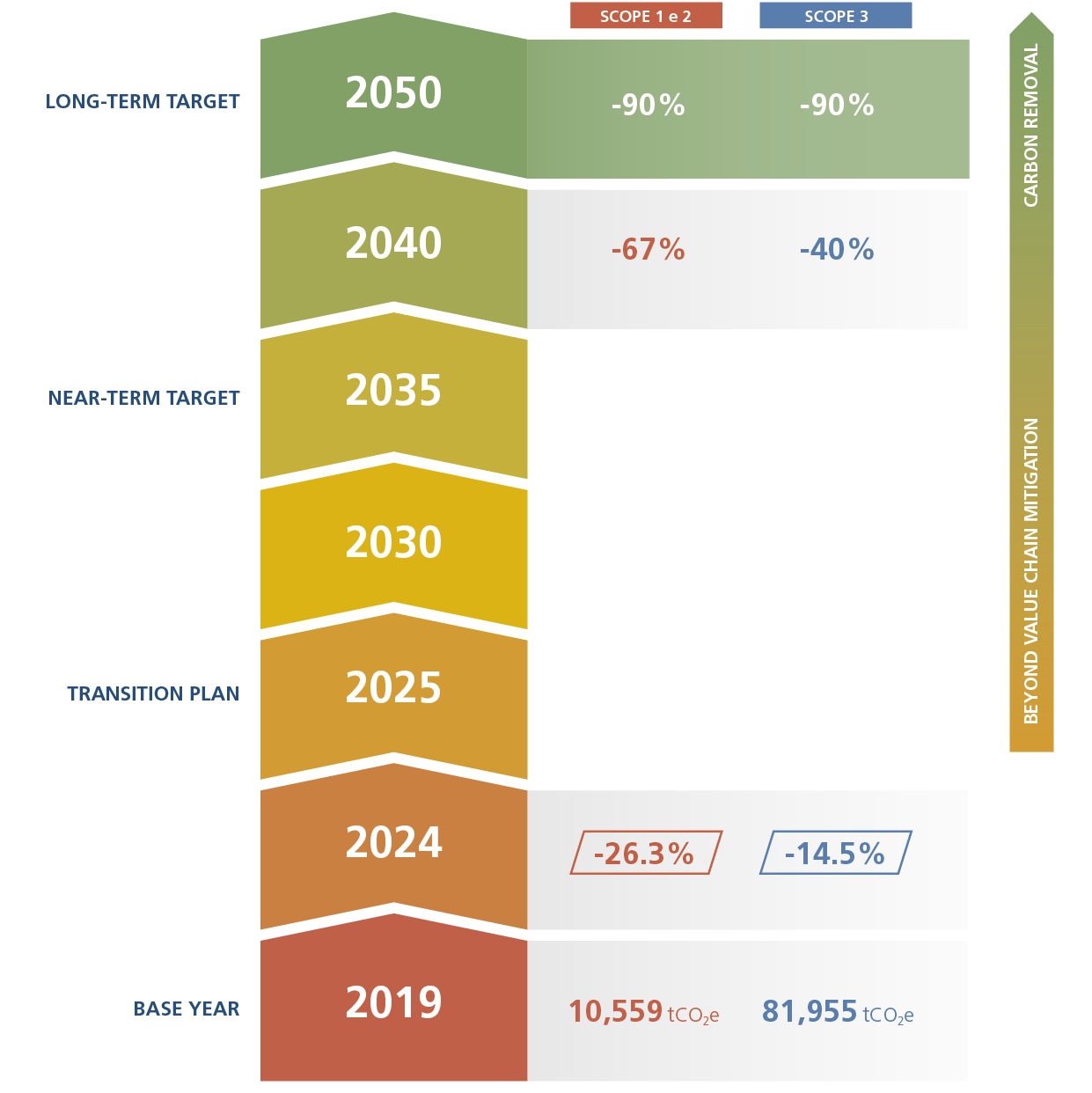

Within the scope and limits of its mandate, Banca d'Italia supports the transition to a low-carbon economy both through its institutional functions and by reducing its own environmental footprint. This Transition Plan for Climate Change Mitigation and Adaptation, developed in line with European and international frameworks and drawing on best practices adopted by other central banks, describes the path to progressively reduce the carbon footprint of the Bank's operations, to achieve net-zero greenhouse gas emissions by 2050;5 specifically, the goal is to cut greenhouse gas emissions by 90 per cent compared with 2019 levels (chosen as the base year) and to ensure the permanent removal of residual emissions through state-of-the-art technologies. The decarbonization path also includes an intermediate emission reduction target to be met by 2035, ten years after the publication of the Plan (Figure 1).

Figure 1. Overview of the Bank's decarbonization targets and carbon mitigation and removal measures, whose achievement depends on technological, economic and political factors largely beyond the control of Banca d'Italia.

The scope of greenhouse gas emissions includes direct and indirect emissions arising from the operation of buildings and data centres, the production and circulation of banknotes, and more broadly across the value chain.6

To pursue the goal of net-zero emissions, the Bank has developed a programme of short- and medium-term initiatives aimed at:

- reducing the use of fossil fuels and related emissions by accelerating the electrification and replacement of heating systems in institutional buildings,7 optimizing logistics, reducing the use of space, and improving energy efficiency;

- using electricity from renewable sources, both by increasing self-generation, especially through photovoltaic systems, and by entering into long-term Power Purchase Agreements (PPAs),8 including to support the expected rise in the Bank's electricity consumption resulting from the electrification of heating systems and the development of IT applications;

- optimizing the consumption of goods and services by leveraging technological and market developments and promoting the decarbonization of the Bank's supply chain;

- reducing the carbon and environmental footprint across the entire lifecycle of banknotes;

- consolidating efforts to reduce the environmental impact of employee commuting and work-related travel.

The measures to reduce greenhouse gas emissions outlined in the Plan will help improve the resilience of the Bank's infrastructure to the effects of climate change. The Plan also sets out specific adaptation initiatives aimed at further strengthening business continuity for all critical processes carried out by the Bank to ensure the functioning of the payment system and financial stability.

Mitigation and adaptation measures together form complementary components of an integrated climate transition strategy that combines environmental sustainability, managerial efficiency and organizational resilience.

Implementing the actions set out in the Plan will bring additional benefits, including: enhancing energy security by reducing dependence on fossil fuels; fostering technological development through the testing and use of innovative solutions; and building expertise in the practical application of external rules and standards, to be shared with Italian public institutions and other central banks in support of institutional functions.

The transition plan will be integrated into the Bank's strategic planning and into its regular financial and human resource planning cycles. It will therefore be updated every three years, taking account of the results achieved and any changes in the external context. Progress on the initiatives set out in the Plan will be monitored using specific metrics aligned with international standards. The Bank will report on the results achieved in the annual update of its Activity and Sustainability Report, published on its website.

The governance of the Bank's Transition Plan is based on a structured framework with clearly defined roles and responsibilities:

- the Governing Board sets the Bank's climate strategy and determines the allocation of the necessary human and financial resources;

- the Management Coordination Committee oversees the Bank's corporate activities, including the initiatives in this Plan, in synergy with the Climate Change and Sustainability Committee, which promotes and coordinates the Bank's institutional activities on climate-related matters;

- the Bank's Directorates are responsible for developing and implementing the planned actions within their respective areas of expertise; the Organization Directorate ensures operational coordination and monitors project progress, as well as quantitative indicators.

Effective implementation of the actions outlined in the Plan will require the active participation of the Bank's staff, who will be involved in professional training and awareness-raising activities.

The implementation of the Plan is highly dependent on developments in the external context, particularly: global warming levels in the short, medium and long term; changes in international and national strategies and in regulatory frameworks; the actual implementation of decarbonization measures in global, European, and national economies, especially in sectors relevant to the Bank's institutional activities and services; trends in energy resource availability and prices; technological progress; and the availability and quality of data from suppliers and other partners in the value chain.

The initiatives set out in this Transition Plan will be implemented without compromising the effectiveness of the Bank's institutional tasks or the efficient management of available resources.

The Bank will continue to work with other national, European and international institutions to share experiences and strategies for reducing greenhouse gas emissions and adapting to climate change, and to promote greater awareness.

The Transition Plan is divided into six chapters:

- Foundations - sets out the final and intermediate targets for reducing greenhouse gas emissions through 2050, as well as the regulatory framework, international reference guidelines and the assumptions underpinning the Plan;

- Climate change mitigation - describes the actions the Bank intends to implement across corporate operations, products and services to achieve decarbonization objectives, as well as the implications for financial planning and the cost-benefit assessment methodology for real estate and IT projects (including those not included in the Plan);

- Adaptation and resilience to climate change - reports on actions already taken and identifies those to be undertaken to increase the resilience of operational processes and buildings;

- Cooperation and partnership - outlines how the Bank plans to cooperate with suppliers, other central banks, the public sector, communities, and civil society to implement the Plan, as well as actions to be taken beyond the value chain;

- Monitoring and metrics - describes the data and metrics used to track progress toward milestones and objectives;

- Governance - illustrates the roles and responsibilities of the Bank's top management and organizational structures, and explains how the Transition Plan is integrated into decision-making processes.

Notes

-

1 By 2030, they are expected to decrease by 55 per cent compared with 1990 levels.

-

2 See Article 127 of the Treaty on the Functioning of the European Union.

-

3 See Article 191 of the Treaty on the Functioning of the European Union.

-

4 Under its Constitution, Italy protects the environment, biodiversity, and ecosystems, also in the interest of future generations. Furthermore, private economic activity must not cause environmental harm, and legislation provides for controls and programmes to ensure that public and private economic activity is directed and coordinated for environmental purposes.

-

5 Net-zero is the condition in which, after a drastic reduction in anthropogenic greenhouse gas emissions, the remaining emissions - which cannot be reduced due to various constraints - are offset by permanent removals (such as through afforestation or carbon capture and storage), over a specific period of time and within a defined boundary.

-

6 A value chain refers to the activities, resources and relationships a company uses and relies on to create its products or services, from conception to delivery, consumption, and end-of-life. The value chain includes both upstream and downstream stakeholders: the former (e.g. suppliers) provide inputs for a company's products or services; the latter (e.g. distributors and customers) receive and use them

-

7 Planned interventions on systems and building envelopes are particularly complex, as many of the Bank's real estate assets are historic buildings subject to specific regulatory protection measures, which limit the adoption of certain technological solutions.

-

8 A PPA is a medium-to-long-term contract between a renewable energy producer and a buyer that sets the price and terms for the supply of electricity. This instrument provides financial stability for generation plants, facilitating their financing, while allowing buyers to secure a supply of renewable energy at a predetermined price.

Full text

- Transition Plan for Climate Change Mitigation and Adaptation climatici

(Full text in pdf)

(Only in Italian) 29 January 2026

- Transition Plan for Climate Change Mitigation and Adaptation - Appendix

(Full text in pdf)

(Only in Italian) 29 January 2026

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin