Business scope

Asset-referenced tokens (ARTs) are crypto-assets, other than e-money tokens (EMTs), that aim to maintain a stable value by referencing another value or right, or a combination of the two, including one or more official currencies.

The activities of issuing, offering to the public and seeking admission to trading of ARTs are governed by Regulation (EU) 2023/1114 ('MiCA Regulation') and may be carried out by:

- licensed legal persons or undertakings established in the European Union;

- credit institutions, i.e. banks and class1 investment firms (SIMs);

- payment institutions (PIs), electronic money institutions (EMIs), SIMs and crypto-asset service providers.

For the purposes of offering to the public and seeking admission to trading, issuers of ARTs must publish on their website a crypto-asset white paper approved by the national competent authorities and containing information on the issuer, the characteristics of the token (including the rights and obligations attached thereto), the underlying technology and its risks, and investors' rights.

The issue and offer to the public of ARTs is governed, in addition to the MiCA Regulation, by the regulatory technical standards (RTS) and implementing technical standards (ITS) adopted by the European Commission on a proposal from the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA). These rules are supplemented by implementing provisions issued - to the extent permitted by the directly applicable European rules - by Banca d'Italia and CONSOB, in accordance with their respective competences (see the Legal framework - EU Legislation section). The EBA also publishes Q&As on its website to provide clarifications on the provisions on the issuance and offering of ARTs to the public.

As the rules introduced by the MiCA Regulation for issuing and offering ARTs to the public are harmonized, licensed entities may offer their tokens to the public or seek their admission to trading throughout the European Union (see FAQs on cross-border operations).

Licensing and notification process

Banca d'Italia and CONSOB are the competent authorities for the licensing and supervision of the issuers/offerors of ARTs. For an overview of the division of competences between Banca d'Italia and CONSOB, please see the Note of 29 October 2024.

Specifically, with regard to the start of operations:

- for credit institutions, Banca d'Italia receives the notification provided for in the MiCA Regulation and, in agreement with CONSOB, approves crypto-asset white papers;

- for entities other than credit institutions, Banca d'Italia in agreement with CONSOB authorizes the applicant to offer ARTs to the public and to seek admission to trading (the authorization includes the approval of crypto-asset white papers).

The exchange of information between the authorities during the licensing procedure is regulated by a memorandum of understanding (only in Italian).

There is no template for notifications, which shall contain the information required by Article 17 of the MICA Regulation; applications must be drawn up using the appropriate form (see the Downloads section). White papers are prepared in line with Article 19 of the MiCA Regulation and Implementing Regulation (EU) 2024/2984.

Notifications and applications must be submitted, together with their annexes, to Banca d'Italia by certified email (‘PEC’, see the Contacts section).

Before formally submitting a notification or an application, operators may contact Banca d'Italia or CONSOB (see the Contacts section) and request a meeting to illustrate their activities. These meetings, which are not compulsory, are intended to help operators and do not affect the deadlines of the licensing process.

Authorization to offer ARTs to the public and to seek admission to trading by entities other than credit institutions

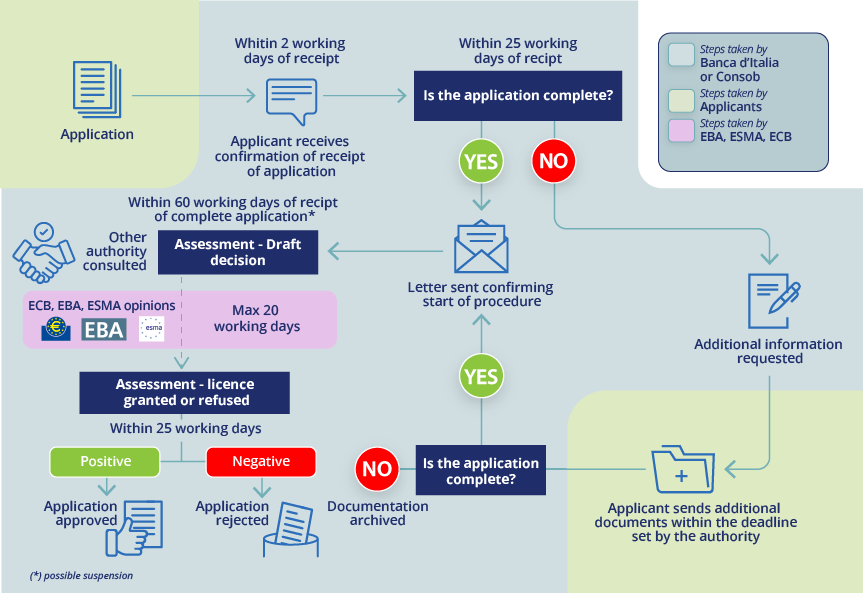

The procedure (see infographic) lasts no more than 105 working days from the date of receipt of the complete application.

Within 25 working days of receipt of the application, Banca d'Italia and CONSOB shall assess whether the application, including the white paper, contains all the required information: if it is incomplete, the authorities shall set a time limit for the applicant to provide the missing information; the evaluation period is suspended for the time between the request for information and the receipt of the information (this suspension does not exceed 20 working days).

Within 60 working days of receipt of the complete application, the competent authorities shall adopt a draft decision, which shall be transmitted, together with the application, to the EBA, ESMA and the ECB. If the applicant is established in a Member State whose official currency is not the euro, or if the ART references an official currency of a Member State other than the euro, the competent authorities shall transmit the draft decision and the application also to the central bank of that Member State. During these 60 working days, Banca d'Italia and CONSOB may request additional information; the evaluation period is suspended for the time between the request for information and the receipt of information (this suspension does not exceed 20 working days).

Within 20 working days of receipt of the draft decision and the documentation submitted by the applicant:

- the EBA and ESMA - upon request of the competent authorities - shall issue and transmit to the competent authorities an opinion as regards their evaluation of the legal opinion on the qualification of the token submitted by the applicant together with the licensing application;

- the ECB (and, where applicable, the relevant central bank) shall issue and transmit to the competent authorities an opinion on the risks that the issuance of the ART could pose to financial stability, the smooth operation of payment systems, the transmission of monetary policy and monetary sovereignty.

Within 25 working days of receiving the opinions - or of the expiry of the period for issuing them -Banca d'Italia, in agreement with CONSOB, shall adopt a reasoned decision granting or refusing authorization to the applicant issuer; if the issuer is authorized, the white paper shall be deemed approved. The final decision shall be notified to the applicant within 5 working days of its adoption.

Notification and approval of white papers for ARTs issued by credit institutions

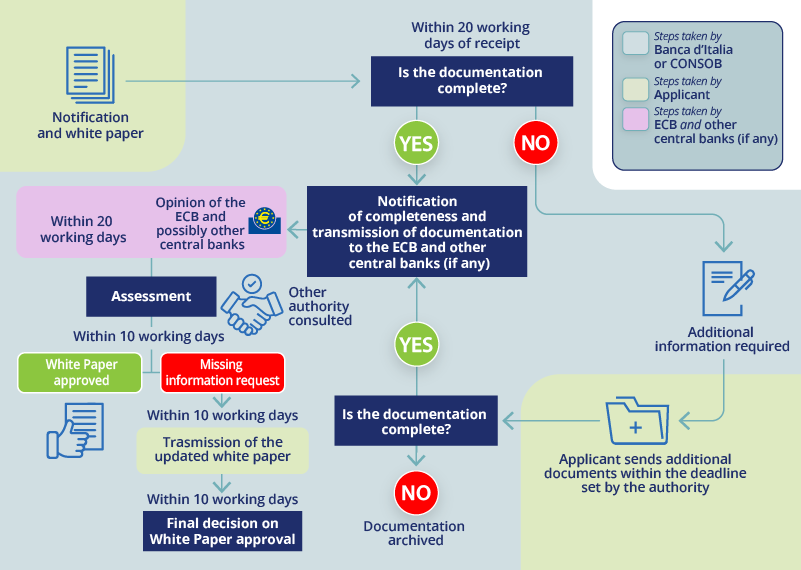

The procedure for approving a white paper (see infographic) may take up to 50 working days, starting from the date of receipt of the complete documentation.

Within 20 working days of receipt of the documentation (notification and white paper), the authorities shall assess whether it is complete: if it is incomplete, the authorities shall set a time limit for the credit institution to provide the missing information. Once the authorities consider that the documentation is complete, they shall notify the credit institution and specify the date on which the documentation is considered complete.

Within 2 working days of the notification of completeness, Banca d'Italia shall transmit the complete documentation to the ECB. If the credit institution is established in a Member State whose official currency is not the euro or if the ART references an official currency of a Member State other than the euro, the complete information is also transmitted to the central bank of that Member State.

Within 20 working days of receipt of the documentation, the ECB (and, where applicable, the central bank concerned) shall issue an opinion on the risks, if any, to the smooth operation of payment systems, monetary policy transmission or monetary sovereignty.

Within 10 working days of receipt of this opinion - or of the expiry of the deadline for issuing it - Banca d'Italia in agreement with CONSOB shall take (and notify the credit institution of) its final decision on the approval of the white paper or require amendments. In the latter case, the credit institution must transmit the updated white paper within the deadline - not exceeding 10 working days - specified by the authorities, which have an additional 10 working days to assess the updates, adopt the final decision and notify the credit institution.

The following instructions shall apply to licensing, notification and white paper approval procedures:

- Regulation (EU) 2023/1114;

- Legislative Decree 129/2024 (only in Italian);

- Delegated Regulation (EU) 2025/296 on the procedure for the approval of a crypto-asset white paper;

- Memorandum of Understanding between CONSOB and Banca d'Italia (only in Italian).

For further clarifications on the administrative procedure, please see the FAQ section.

Requirements

Without prejudice to the specific provisions applicable to supervised intermediaries intending to issue/offer asset-referenced tokens, the requirements for ART issuers are listed in Articles 18, 34, 35 and 36 of the MiCA Regulation and include, inter alia:

- the requirements laid down by law for shareholders with direct or indirect qualifying holdings;

- the legal requirements for directors;

- the own funds requirements for the forecast three-year period;

- the requirement to adopt governance and organizational structures that are appropriate for the business overall;

- the requirements on asset reserves.

All applications and notifications must be accompanied by specific documents, as indicated in the relevant legislation (see the Legal framework section) and in the available form (see the Downloads section).

The competent authorities shall reject a licensing application in the following cases:

- objective and demonstrable grounds to believe that sound and prudent management and business continuity are compromised or that serious AML/CFT risks arise;

- failure to meet the regulatory requirements for directors or owners of qualifying holdings and any requirements laid down in Title III of the MiCA Regulation;

- evidence that the applicant issuer's business model could pose a serious threat to market integrity, financial stability or the smooth operation of payment systems;

- negative opinion of the ECB or any relevant central bank based on the risk posed to the smooth operation of payment systems, monetary policy transmission or monetary sovereignty.

Contacts

Applications and notifications can be submitted via PEC only. For informal discussion or clarification, please contact Banca d'Italia or CONSOB at the following addresses:

- for Banca d'Italia,

- Supervisory Institutional Relations Directorate, New Banks and Financial Intermediaries Division:

email: Servizio.Riv.Costituzioni@bancaditalia.it

PEC: riv@pec.bancaditalia.it - for entities already supervised by Banca d'Italia, please contact the units normally responsible for supervision (SB1, SB2, SIF Directorates or the relevant Branch), using the contact details provided in the Operational Guidelines of 13 September 2024;

- Supervisory Institutional Relations Directorate, New Banks and Financial Intermediaries Division:

- for CONSOB, please use the contact details available on its website.

Please note: questions relating to matters already covered on Banca d'Italia's website will not be answered.

Post licensing requirements

Following licensing, ART issuers are entered in ESMA's register. Competent authorities shall provide ESMA with the necessary information.

Once licensed, ART issuers are required to start operations within 12 months and to comply with the reporting requirements set out in the applicable provisions.

For audits within the remit of Banca d'Italia, issuers are assigned to the unit responsible for supervision and are subject to the supervisory powers established by Legislative Decree 129/2024.

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin