Survey of Industrial and Service Firms in 2024

Statistics

Main results

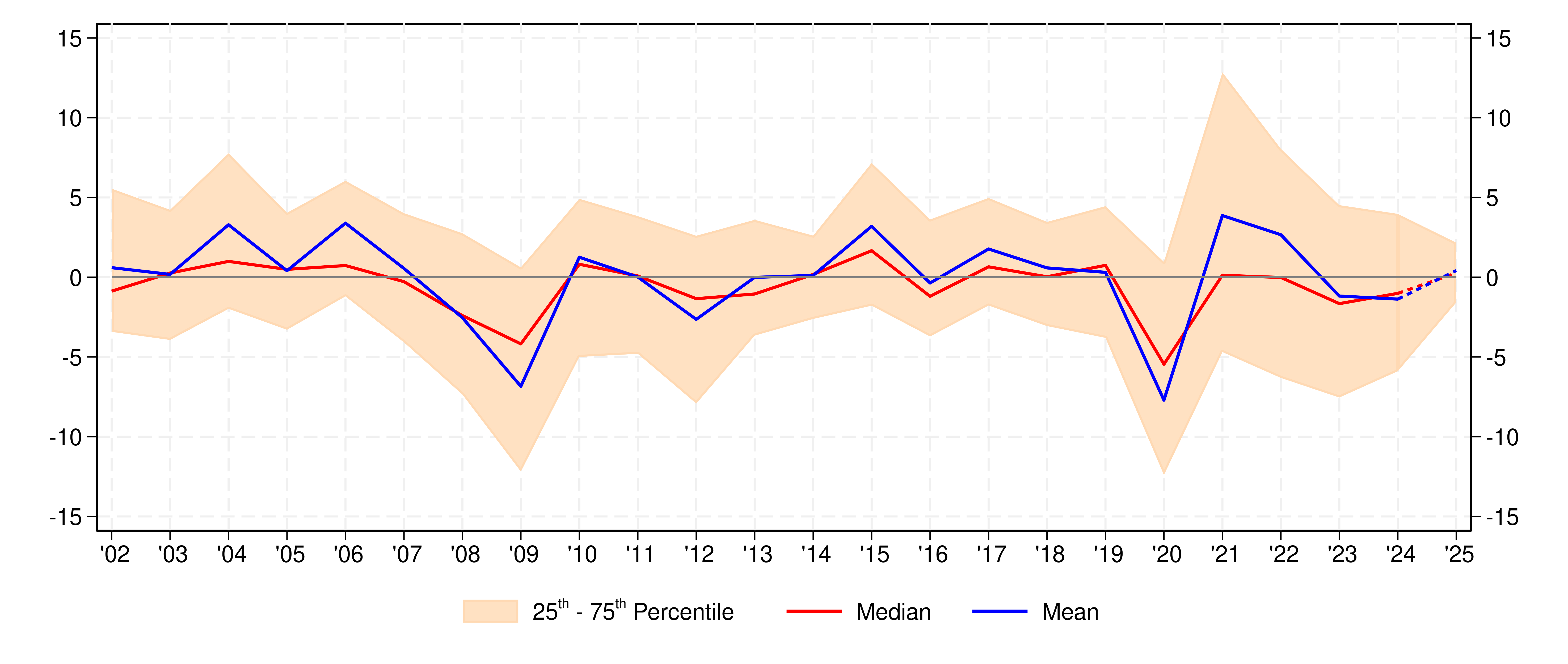

In 2024, sales for firms with 20 or more employees fell in manufacturing and remained stable in private non-financial services. Headcount employment rose again in both sectors, though at a lower rate than in the previous year. Selling prices continued to ease, and the share of firms that raised prices by more than 2 per cent fell further. The demand for funding remained subdued, albeit recovering slightly. Firms' assessments of credit access conditions improved and the share of respondents reporting a reduction in interest rates increased. Investment spending went up in services and energy, while it fell sharply in manufacturing.

Firms expect a slight recovery in sales in 2025, despite weak demand and uncertainty over international trade policies. Selling price growth is expected to hold stable. Employment is forecast to continue to expand across all sectors, while investment spending is expected to increase only in manufacturing.

Following three years of strong growth, construction output remained stable in 2024. Meanwhile, the number of persons employed continued to rise.

Turnover of Italian industrial firms excluding construction and of non-financial private service firms

(percentage changes on previous year)

Notes: Values at constant prices calculated based on the average deflators obtained from the survey. Data weighted by population weights and turnover. The dotted lines indicate firms’ expectations for 2025.

Full text

-

01 July 2025

-

01 July 2025TablesZIP 172 KB

-

03 July 2017

-

01 July 2025

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin