Are high levels of NPLs a problem?

A large stock of NPLs tends to have adverse effects on individual banks in the form of depressed earnings and impaired ability to raise funds on the market. If the problem spreads throughout the entire banking system, it could also cause credit allocation mechanisms to malfunction. However, a recent analysis conducted by the Bank of Italy highlights how the supply of bank credit to Italian firms between 2008 and 2015 was not affected by high NPL ratios (Questioni di Economia e Finanza (Occasional Papers), 374, 2016).

How large is the phenomenon in Italy?

Last December Italian banks’ NPLs amounted to €349 billion including write-downs already recorded in previous balance sheets. Of these, €215 billion were bad loans. Net of write-downs NPLs came to €173 billion, while net bad loans amounted to €81 billion (or 9.4 and 4.4 per cent of total loans respectively). Roughly 75 per cent of NPLs are attributable to non-financial firms, the remainder to households. The estimated value of real guarantees held by banks against bad loans is €92 billion.

And in Europe?

According to the EBA’s latest survey, last December the ratio of NPLs to total outstanding loans averaged 5.1 per cent for a large sample of leading European banks; for the Italian banks included in the sample, this ratio came to 15.3 per cent. The coverage ratio of NPLs (i.e. the ratio of the stock of value adjustments to the gross value of NPLs) was 44.6 per cent for European banks on average, and 48.9 per cent for Italian banks.

What are the causes of the large stock of NPLs in Italy?

Rapid growth in NPLs was driven first and foremost by the severe contraction of the Italian economy during the financial crisis, amounting to almost ten percentage points of GDP and around one fourth of industrial production (the comparable figures for the euro area were -5.7 per cent for GDP and -19 per cent for industrial production; see below). In some instances the increase in NPLs was also driven by inadequate or illegal lending policies, which were subsequently sanctioned and/or the subject of judicial inquiries. Another underlying cause is the lengthy credit recovery procedures, which in turn is mostly attributable to the slow pace of civil justice.

What has been done to improve the regulatory and supervisory frameworks?

In the regulatory sphere it is worth recalling the changes to the tax treatment of banks' loan losses (The use of tax law from a macroprudential perspective – Notes on Financial Stability and Supervision, 1, 2014); the reforms of the bankruptcy law and code of civil procedure approved in 2015 and 2016 to speed up judiciary procedures and make insolvency and enforcement proceedings more efficient (The changes of the Italian insolvency and foreclosure regulation adopted in 2015 – Notes on Financial Stability and Supervision, 2, 2015 and New measures for speeding up credit recovery: an initial analysis of Decree Law 59/2016 – Notes on Financial Stability and Supervision, 4, 2016); the state guarantee scheme set up under Decree Law 18/2016 to securitize banks' NPLs (GACS, Garanzia sulla cartolarizzazione delle sofferenze) published in the Official Gazette on 15 February 2016). The Bank of Italy routinely conducts analyses and inspections to verify that banks have appropriately valued NPLs and set aside the relative provisions. For instance, a large-scale ad hoc initiative to this effect was launched in 2012. Since 2016 the Bank of Italy has requested that banks prepare statistical reports with very detailed breakdowns of individual bad loan positions. The reports were designed to prompt banks to improve the quality of their data, which is vital for ensuring the effective management of bad loans. The Single Supervisory Mechanism (SSM) has published guidance to banks on NPL management, a draft version of which has been submitted to public consultation.

What more can be done?

The reform effort must continue, first of all to shorten the recovery times of NPLs and to increase the efficiency of Italy’s courts and civil justice system. On the banking front, recovery procedures must be improved, including by exploiting recent legislation.

Are NPLs still increasing in Italy? What is the outlook?

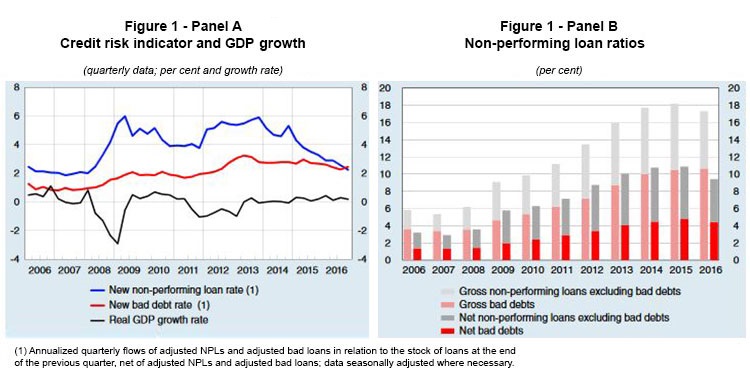

The stock of NPLs has ceased to grow in recent months, following the (still modest) economic recovery. In 2016, both gross and net NPLs declined as a share of total outstanding loans (by almost 1 percentage point and by 1.4 percentage points respectively; Figure 1, panel B). Moreover, in the fourth quarter of last year the annualized flow of new NPLs fell to 2.3 per cent of the total, the lowest level recorded since 2008 (Figure 1, panel A). The latest estimates indicate that the downward trend is set to continue.

How much are bad loans worth?

The value at which bad loans are recorded in banks’ balance sheets is typically higher than the price that market purchasers (normally hedge funds) are willing to offer. The gap is mostly attributable to the difference between the evaluation criteria used by banks for accounting purposes and the criteria used by investors to determine purchase prices. It is possible to show (What’s the value of NPLs? – Notes on Financial Stability and Supervision, No. 3, 2016) that these divergent assessment criteria can fully explain the difference between the book value of bad loans and the price offered by investors, and that this difference is proportional to the length of recovery times (for both in and out-of-court procedures).

Are NPLs valued correctly in banks’ balance sheets or do they conceal losses?

No precise response can be given until after an inspection has been conducted to examine individual bad loan positions. The answer may also depend on whether or not guarantees are present, the type and value of the guarantee associated with the underlying exposure, the time required for its recovery, etc. Every year the Bank of Italy conducts around one hundred inspections of less significant institutions (LSIs) for supervisory purposes (those for which it is directly responsible) and when necessary calls for prudential adjustments to NPL book values. To respond to the question at a systemic level, we can refer to NPL recovery rates – the portion of these assets that the banks succeed in recovering. The available evidence on bad loan positions (the category of lowest quality credit) indicates that recovery rates are largely in line with banks’ book values (see The management of non-performing loans: a survey among the main Italian banks – Questioni di Economia e Finanza (Occasional Papers), No. 311, 2016 and Bad loan recovery rates – Notes on Financial Stability and Supervision, No. 7, 2017).

Must the problem of having a large stock of NPLs be resolved in a hurry?

There is little agreement about whether the problem should be resolved rapidly. The only quick solution is to sell these assets but, as explained earlier, sales of this kind are typically made at below book values. While they may resolve one problem, rapid, ‘en bloc’ sales can produce adverse effects: they can transfer value from the banks to the purchasers of NPLs; above all, in the current macroeconomic context in which banks are experiencing some difficulties in accessing capital markets, blanket sales can erode their capital base and pose risks to financial stability. Moreover, it must be taken into account that most of these NPLs are held by banks in sound financial conditions. These banks are capable of pursuing in-house management and work-out strategies for NPLs and of obtaining recovery rates which, as we have seen, tend to be on average significantly higher than market prices.

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin