Sondaggio congiunturale sulle imprese industriali e dei servizi - 2025

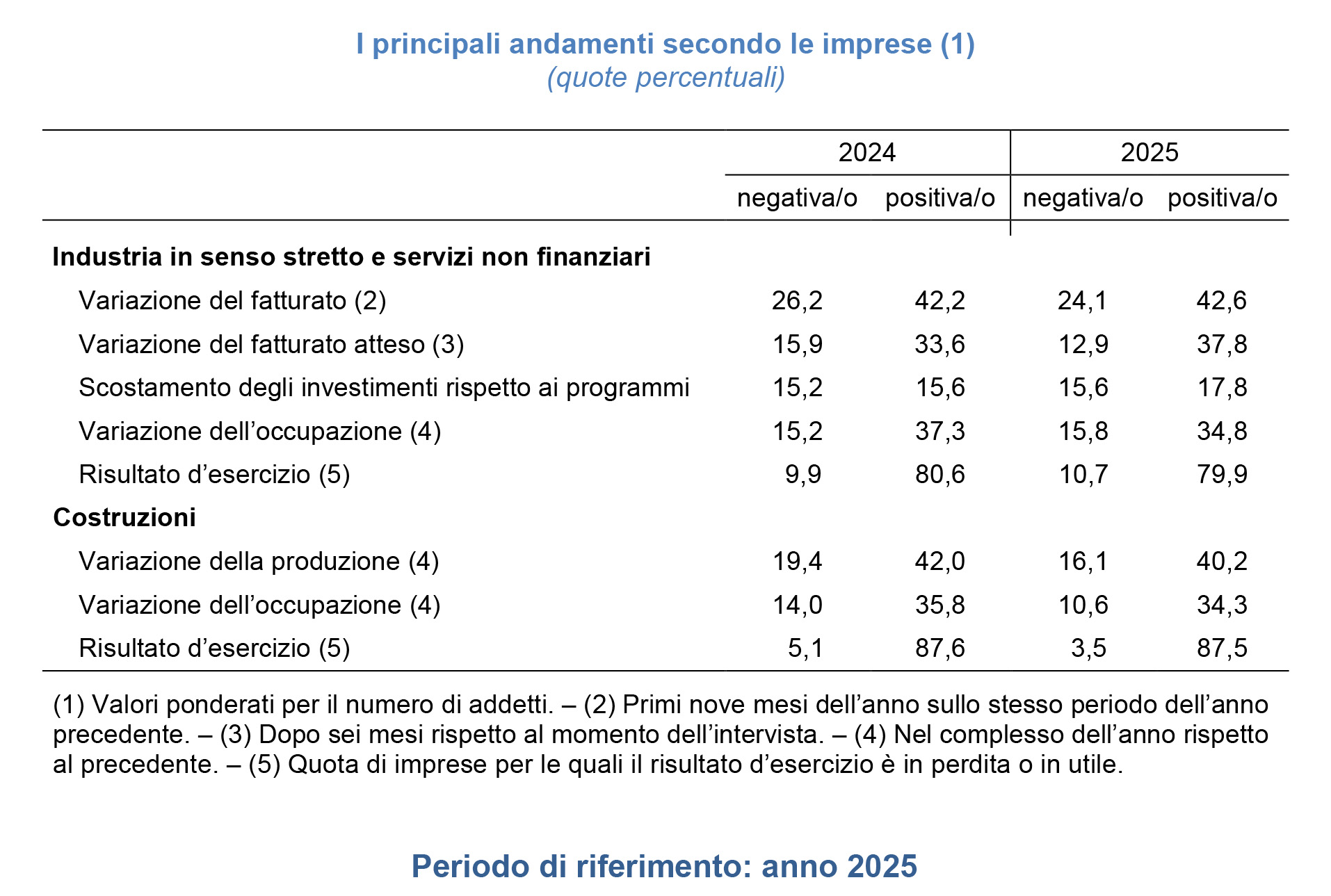

Nei primi nove mesi del 2025 i giudizi delle imprese con almeno 20 addetti segnalano un'ulteriore crescita delle vendite nei servizi privati non finanziari e un nuovo calo nella manifattura, seppur attenuato rispetto alla rilevazione precedente. Le prospettive sul fatturato nel prossimo semestre sono complessivamente positive, sia sul mercato interno sia su quello estero. I giudizi circa l'impatto sulle vendite dei dazi introdotti dall'amministrazione degli Stati Uniti indicano un effetto negativo ma nel complesso moderato per i primi nove mesi dell'anno, con un lieve peggioramento per il quarto trimestre.

Il saldo tra la quota di aziende che hanno indicato un aumento delle ore lavorate e quella delle imprese che hanno segnalato una riduzione è rimasto positivo, ma in flessione rispetto alla rilevazione precedente. Le prospettive dell'occupazione nel complesso del 2025 restano positive.

Le valutazioni delle imprese indicano, per l'anno in corso, un aumento della domanda di prestiti bancari e un nuovo miglioramento delle condizioni di accesso al credito.

Due terzi delle imprese hanno realizzato nel 2025 i piani di investimento previsti, che nel complesso delineavano una crescita. Per chi ha rivisto i piani, la decisione è stata guidata soprattutto da fattori organizzativi interni; le revisioni al rialzo sono state anche legate all'adozione di innovazioni di prodotto o di processo, quelle al ribasso alla domanda debole e all'incertezza. Le attese sul 2026 prefigurano un'ulteriore espansione degli investimenti.

Nel 2025 l'attività del settore edile è aumentata, sostenuta dalle opere pubbliche; i giudizi per il 2026 delineano una nuova espansione.

Testo del report

-

06 novembre 2025

-

06 novembre 2025TavoleZIP 332 KB

-

09 novembre 2017

-

06 novembre 2025Sondaggio 2025: QuestionariZIP 317 KB

YouTube

YouTube  X - Banca d’Italia

X - Banca d’Italia  Linkedin

Linkedin