The wealth of Italy's institutional sectors: 2005-2022

Main findings

The wealth estimates compiled by Istat and the Bank of Italy, released today, provide a comprehensive overview of the assets held by Italy's institutional sectors and of how they have changed over time, also compared with other advanced economies.

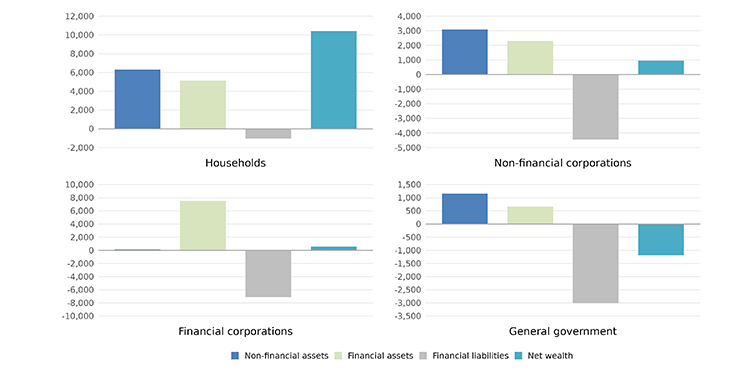

At the end of 2022, the net wealth of Italian households stood at €10,421 billion. Compared with 2021, it decreased by 1.7 per cent at nominal values, after three years of growth; the decline in real terms, computed by using the index of consumer prices as a deflator, was more marked (-12.5 per cent). The ratio of net wealth to gross disposable income dropped from 8.7 to 8.1, returning to 2005 levels. The increase in non-financial assets in 2022 (+2.1 per cent) was primarily reflected by the rise in the value of dwellings, which recorded its highest growth rate since 2009; the share of this component in total gross wealth reached 46.3 per cent. Financial assets shrank by 5.2 per cent, largely due to the reduction in the value of shares and of asset management products. Breaking a downward trend underway since nearly a decade, debt securities owned by households returned to positive growth, mostly those issued by general government. On the contrary, the increase in deposits was moderate, after the strong accumulation of the previous three years. The rise in financial liabilities (+2.8 per cent) was mainly driven by loans.

Among real assets of non-financial corporations, accounting for 57.2 per cent of their gross wealth, the value of machinery and equipment continued to grow in 2022. On the financial side, the stock of debt securities and shares increased markedly, whereas the growth of deposits, which had been strong during the pandemic crisis, became weaker. Overall, firms' gross wealth grew by 2.4 per cent. Liabilities decreased by 2.6 per cent thanks to a reduction in the market value of shares and debt securities. The level of indebtedness declined slightly, in line with the other countries.

Financial corporations' gross wealth declined by 7.0 per cent. The contraction of the balance sheets was mainly driven by deposits and debt securities on the asset side. Liabilities dropped as well, by 5.7 per cent, due to a fall in deposits, insurance reserves, and shares.

General government net wealth was negative by €1,188 billion at the end of 2022, an improvement compared with the previous year thanks to the rise in assets (+4.7 per cent) and the reduction in liabilities (-6.9 per cent). Among real assets, the value of the other structures and of non-residential buildings increased; on the financial side, the value of debt securities grew. The strong decline in liabilities was driven by the fall in the market prices of government debt securities. At international level, the ratio of general government net wealth to GDP rose over the last two years, after the drop recorded in 2020 during the pandemic crisis. In Italy, this ratio returned to the level preceding the pandemic, which has been greatly exceeded in the other countries.

Wealth of Italy's institutional sectors (a)

(billions of euros; 2022)

(a) Financial liabilities are shown with a negative sign.

Sources: Istat and Bank of Italy.

Report text

-

29 January 2024Wealth Data 2005-2022XLSX 205 KB

-

29 January 2024

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin