Monetary policy and macroeconomic forecasts: the last fifty years

I would like to thank the Prometeia association for inviting me to take part in this conference, marking the fiftieth anniversary of its founding.

Since 1974, Prometeia has contributed to the Italian economic debate with economic analyses and forecasts, in line with its original mission as the "Association for Econometric Forecasts". Over time, it has come to play a prominent role by developing its own modelling tools capable of generating reliable forecasts and evaluating the impact of economic policies.1

Over the past fifty years, the macroeconomic landscape has changed profoundly. Changes in shocks, progress in economic theory, and the experience gained have transformed the role of central banks, redefining how they safeguard the purchasing power of money and financial stability.

The tools available to central bankers have also evolved. The growing availability of data, together with advances in economic and statistical analysis, has enabled the development of more sophisticated forecasting models, better suited to grasp the complexity of today's economy.

In my remarks, I will focus on three interconnected areas: the conduct of monetary policy, macroeconomic modelling, and the use of forecasts in central banks' decision-making processes. Their proper interaction is a fundamental element for more informed, timely, and effective monetary action - especially in a constantly evolving environment.

1. Central bank independence, price stability, and forecasts

In the early 1970s - when, even in Italy, monetary policy was not yet separate from other public policies - forecasts, including those on inflation, were not considered essential. Central banks pursued intermediate objectives, such as the defence of the exchange rate or the growth of monetary aggregates, often using administrative tools.2 Price stability was not yet their primary goal.

Since then, profound changes in the macroeconomic and institutional context, along with significant innovations in economic theory, have increased the importance of forecasts in monetary policymaking. As I will explain later, this evolution was not linear: phases of affirmation and consolidation alternated with periods of refining models and rethinking their role in guiding monetary policy.

A turning point came with the inflationary wave between the late 1970s and early 1980s. In response to that shock, many central banks gained independence and adopted medium-term price stability as their stated primary objective.3

Macroeconomic forecasts - especially those concerning inflation - thus became a structural and essential component of the monetary policy toolkit.

Independence, however, required greater transparency and accountability. Central banks were expected to explain and justify their decisions: the publication of forecasts, along with information on the models used, became an essential factor for transparency and accountability.

Today, almost all central banks regularly publish their forecasts.4 This practice reflects the awareness of the crucial role of expectations in inflation dynamics and in the transmission of monetary policy. Publishing forecasts not only promotes transparency; it also helps guide investors' expectations, thereby strengthening the effectiveness of monetary policy.

This approach has radically transformed central bank communication. Fifty years ago, the prevailing view held that the effectiveness of monetary policy depended on its ability to surprise markets. Today, by contrast, most central banks explain their "reaction function"5 in order to guide market expectations. Some have gone even further, adopting forms of forward guidance6 and, at times, publishing the expected path of official rates they deem consistent with achieving the inflation target.7

2. Economic instability, monetary policy, and forecasts in the 2000s

Over the past twenty years, the main macroeconomic and financial variables have experienced wide fluctuations and increased sensitivity to shocks, marking a clear break from the Great Moderation period, characterized by stable growth and the rapid absorption of shocks.8

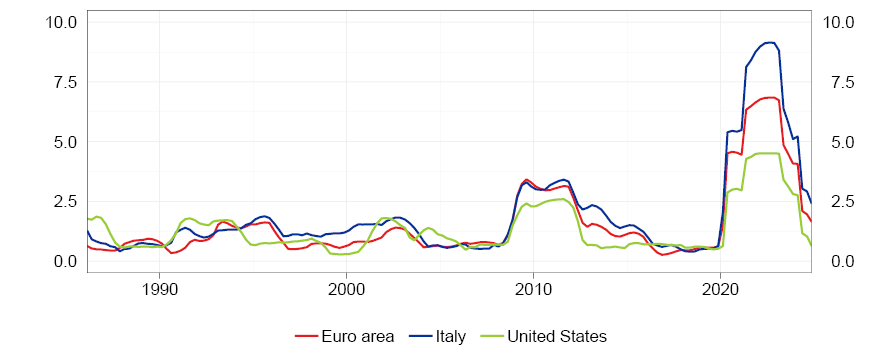

The phase of instability began with the global financial crisis of 2008-09, followed by the sovereign debt crisis in Europe, the post-pandemic recession, and the inflation spike triggered by the energy crisis (Figure 1).

Figure 1

GDP volatility during the Great Moderation and in the first decades of the 2000s

(percentage points)

Source: OECD.

(1) Standard deviation of year-on-year GDP growth rates calculated over a 12-quarter period.

The increased volatility has led to two important changes in the nature and role of the forecasts produced by central banks.

The first one concerns the growing awareness of the need to consider not only the central scenario of forecasts, but also the distribution of surrounding risks - an approach known as risk management. In a highly uncertain environment, it is essential for central banks to adopt a robust policy strategy, capable of responding in a balanced way to a wide range of possible developments, rather than relying solely on the optimal policy for the most likely scenario.

This orientation has profoundly transformed the practice of forecasting, establishing the development of alternative scenarios9 and the systematic assessment of uncertainty around the central projection as standard components of the process.10

In effect, the succession of extraordinary shocks - and the occasionally substantial forecast errors they produced - have enhanced the informational content of forecasts, making them more comprehensive and context-aware tools.

The second change concerns the role of macroeconomic projections in the decision-making process of central banks, which at times has been partially reduced due to the sequence of major shocks mentioned earlier and the associated forecast errors. For example, the inflation surge of 2021-23 - the most intense in the last forty years - was not anticipated, mainly due to the sharp rise in energy prices linked to the war in Ukraine.

In response to these developments, central banks have started to use forecasts more cautiously, integrating them with alternative analyses and indicators - particularly those relating to core inflation - and paying increasing attention to actual data. In the euro area, this approach - known as data-dependence - has led to favouring decisions taken on a meeting-by-meeting basis.

Today, monetary policy in the euro area is once again being conducted under conditions of heightened uncertainty.

The Eurosystem projections for the coming months indicate that inflation is likely to remain below the 2 per cent target for an extended period, alongside persistently weak economic activity. Nevertheless, the macroeconomic outlook remains subject to substantial and difficult-to-quantify risks. These arise, on the one hand, from conflicting signals in US trade policy and, on the other, from the recent escalation of the conflict between Israel and Iran.

Against this backdrop, the ECB's Governing Council, at its most recent meeting, reaffirmed a flexible approach, keeping its options open. It will continue to take decisions on a meeting-by-meeting basis, without pre-committing to a defined course for monetary policy.

3. Forecasting Errors and Learning by Doing

As mentioned, econometric models have made significant forecasting errors in recent years, for example during the pandemic and the high inflation phase of 2022-23, reigniting debate about their reliability.

This is a crucial issue: major errors can compromise the timeliness and effectiveness of central bank actions, with tangible effects on price stability, growth, and employment.

In reality, most of these errors - particularly those relating to inflation - can be traced to the unpredictability of the exogenous shocks that occurred during that period, linked to geopolitical or environmental events rather than economic ones.

For example, the surge in energy prices between 2021 and 2022 was largely driven by Russia's manipulation of oil supply and its invasion of Ukraine.11 Clearly, the ability to anticipate such events has little to do with the features of forecasting models.

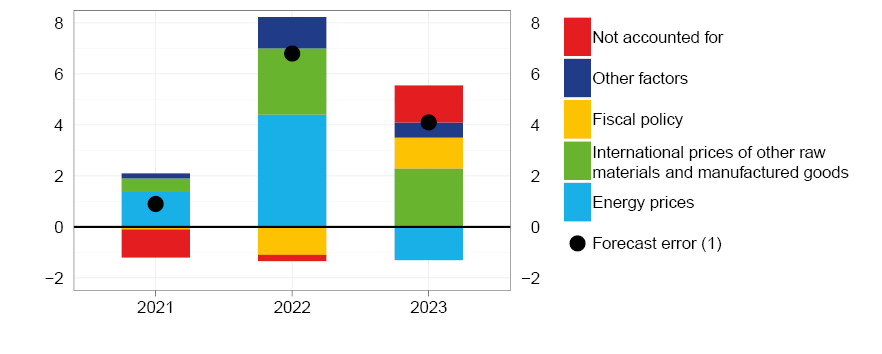

A reassuring element, emerging from ex-post analyses, is that more than two-thirds of the forecasting error made by Banca d'Italia on 2022 inflation is attributable to the energy component; the figure rises to 80 per cent when food products are included (Figure 2).12

Figure 2

Contributions to inflation forecast errors in Italy

(percentage points)

Sources: Istat and based on Banca d'Italia's calculations.

(1) Forecast errors for the household consumption deflator growth rate.

The lesson from the pandemic and energy crises concerns the need to refine the techniques for anticipating the behaviour of key exogenous variables, starting with energy prices themselves, which are notoriously volatile and particularly relevant for inflation.

It should be noted that the process of revising forecasting tools - initiated by Banca d'Italia and other central banks to account for exceptional events - is nothing new. The global financial crisis, for example, led to the introduction of mechanisms to simulate the effects of a potential credit crunch,13 while the sovereign debt crisis spurred the development of tools to analyse "unconventional" monetary policies.

In addition to the challenges posed by extraordinary shocks, there are well-known limitations relating to the nature of the data used in economic forecasts, which are often estimates and subject to subsequent revisions. Economic forecasters - unlike meteorologists - lack certainty even about current data.14

Nevertheless, there are encouraging signs. Research by Banca d'Italia shows that, compared with the 2008 financial crisis, forecasts were adjusted promptly during the sovereign debt crisis and even more so during the pandemic.15 The initial errors were still substantial, but the ability to correct them improved significantly.

Forecasting errors are, to a large extent, inevitable; the ability to learn from them is what makes the difference.

4. Which Models?

Today, semi-structural econometric models remain a central tool for both private forecasters - such as Prometeia - and central banks.16 In the Eurosystem, national forecasts for the euro area often rely on models of this type.

Their resilience can be explained by their ability to reconcile two often conflicting needs: on the one hand, adherence to data; on the other, consistency with economic theory. Purely statistical models, although sometimes more accurate in the short term, do not clarify the underlying economic mechanisms or ensure internal consistency between variables. In other words, they do not provide monetary authorities with the economic narrative that is indispensable for the analysis and communication of policy decisions.17

At the other extreme, more theoretically sophisticated models may fail to use empirical information efficiently. Semi-structural models, though involving inevitable compromises, manage to integrate a wide range of data while maintaining a recognizable theoretical framework.18

For this reason, most central banks continue to use them, alongside a range of alternative tools within a "model suite". Banca d'Italia also follows this approach, using more statistical models for short-term forecasts and more theoretical ones for medium- and long-term projections.

New Frontiers: Integrated Models and Computing Power

Recent advances in computing capabilities are opening up new possibilities for economic analysis, enabling the integration of macroeconomic models with microeconomic analysis tools. This combined approach has made it possible to address issues that macroeconometric models alone could not tackle effectively.

For example, analyses by Banca d'Italia show that the quantitative easing policies adopted in the pre-pandemic period, contrary to some expectations, did not exacerbate inequalities but rather produced moderately positive redistributive effects.19

The combination of micro and macro levels has also proven useful in other areas, allowing for the estimation of potential output while avoiding the "aggregation bias",20 and providing more accurate measures of the effects of credit rationing during the sovereign debt crisis.21

5. Conclusions: The Future of Forecasts (and of Errors)

This discussion has highlighted several promising ways to enhance the reliability of macroeconomic forecasts - including the systematic analysis of error sources, the integration of macroeconomic and microeconomic models, and the use of alternative scenarios to account for uncertainty.

Future challenges will require even more advanced tools. It will be crucial to understand the impact of long-term trends - such as the green transition - and to harness the potential offered by recent advances in data processing.

Artificial intelligence opens up interesting perspectives for modelling complex and non-linear dynamics, as has already happened in the field of meteorology.22 However, in the realm of monetary policy, the ability to provide an economic narrative remains essential: for this reason, even the most advanced models must be accompanied by interpretable and theoretically grounded tools.

Ultimately, forecasting the economy will never be an exact science. Economic agents, unlike physical particles, react to policies23, form expectations, and interact strategically.For this reason, error will always be part of the process, and precisely for this reason, models will always be a work in progress.

As a well-known quote has it, "It's tough to make predictions, especially about the future".24

Endnotes

- * I would like to thank Stefano Siviero for his help in writing this speech.

- 1 Prometeia and Banca d'Italia were among the pioneers in the development of econometric models in Italy. In the 1960s, the Bank's econometric efforts drew the attention of Beniamino Andreatta, who later became one of Prometeia's main advocates. In 1969, he wrote: "The path forward is the one already pursued by our central bank for years: to refine its interpretative frameworks and develop an increasingly sophisticated system for gathering the necessary statistical data."(B. Andreatta, "Il disegno della politica della Banca centrale e l'uso di modelli econometrici di flussi monetari", Bancaria, 1, 1969, p. 18).

- 2 The administrative tools used at that time included credit ceilings, portfolio constraints, and foreign exchange controls.

- 3 The adoption of price stability as the direct goal of monetary policy is mainly associated with the work of Svensson, who introduced the concepts of inflation targeting and inflation forecast targeting. See: Lars E.O. Svensson, "Inflation Targeting", in B.M. Friedman and M. Woodford (eds.), Handbook of Monetary Economics, vol. 3, Amsterdam, New Holland, 2011, pp. 1237-1302.

- 4 Banca d'Italia has done this since 2007, in line with Eurosystem decisions. Before the early 2000s, central banks rarely released public forecasts. Banca d'Italia only published some simulations in May 1992 using its quarterly model, to analyze public finance adjustment paths; these were essentially forecasts conditional on different fiscal scenarios.

- 5 The "reaction function" describes how the central bank adjusts its policy tools in response to changes in the economic environment, in order to maintain price stability.

- 6 Forward guidance refers to explicit indications about the future stance of monetary policy. The ECB adopted formal forward guidance between 2013 and 2021, when inflation was below the 2 percent target and official interest rates were at their lower bound.

- 7 This approach has been adopted by the central banks of Sweden, Norway, and New Zealand. Its benefits and risks are discussed by Ben Bernanke in his review of the Bank of England's forecasting tools: B. Bernanke, "Forecasting for monetary policy making and communication at the Bank of England: a review", Bank of England, 12 April, 2024.

- 8 The term "Great Moderation" refers to the final decades of the last century, when major economies appeared to follow a stable trajectory, marked by small and temporary shocks that were quickly absorbed.

- 9 In June 2025, for instance, the Eurosystem presented two alternative scenarios, alongside its economic projections for the euro area, in order to assess the impact of different US trade policies compared with the forecasting scenario deemed likelier.

- 10 This trend began with the Bank of England's inflation fan charts. See: E. Britton, P. Fisher, and J. Whitley, The inflation report projections: understanding the fan chart, Bank of England, Quarterly Bulletin, March 1998, pp. 30-37. For the approach developed by Banca d'Italia, see: C. Miani and S. Siviero, "A non-parametric model-based approach to uncertainty and risk analysis of macroeconomic forecasts", Banca d'Italia, Temi di discussione (Working Papers), 758, 2010.

- 11 F. Panetta, "Monetary policy after a perfect storm: festina lente", speech at the 3rd International Monetary Policy Conference organized by the Bank of Finland "Monetary policy in low and high inflation environments", Helsinki, 26 June, 2024.

- 12 D. Delle Monache and C. Pacella, "The drivers of inflation dynamics in Italy over the period 2021-2023", Banca d'Italia, Questioni di economia e finanza (Occasional Papers), 873, 2024. Similar assessments apply to the euro area. See: M. Chahad, A.-C. Hofmann-Drahonsky, A. Page and M. Tirpák, "An updated assessment of short-term inflation projections by Eurosystem and ECB staff", ECB, Economic Bulletin, 1, 2023, pp. 61-55.

- 13 L. Rodano, S. Siviero and I. Visco, "Business cycle reversals and macroeconomic forecasts: tale of two recessions", in R. Bardozzi (ed.), Economic multisectoral modelling between past and future: a tribute to Maurizio Grassini and a selection of his writings, Florence, Firenze University Press, 2013, pp. 229-247.

- 14 F. Busetti, "Preliminary data and econometric forecasting: an application with the Bank of Italy quarterly model", Journal of Forecasting, 25, 2006, pp. 1-23.

- 15 L. Rodano, S. Siviero and I. Visco, 2013, op. cit.

- 16 The construction of the semi-structural econometric model of Banca d'Italia began in 1963 by a working group coordinated by Antonio Fazio and Guido Maria Rey, under the direction of then-Governor Guido Carli. Over time, several generations of the model have followed, with major contributions from Franco Modigliani (in the initial phase) and Albert Ando (from 1982 to 2002). These generations were regularly documented in Bank publications, including: "Un modello econometrico dell'economia italiana (M1BI)", Banca d'Italia, 1970; A. Fazio and B. Sitzia, "The quarterly econometric model of the Bank of Italy. Structure and policy applications", Banca d'Italia, 1979; I. Visco et al., "Modello trimestrale dell'economia italiana", Banca d'Italia, Temi di discussione del Servizio Studi, 80, 1986; G. Galli, D. Terlizzese and I. Visco, "Un modello trimestrale per la previsione e la politica economica: le proprietà di breve e di lungo periodo del modello della Banca d'Italia", Politica Economica, 5, 1, 1989, pp. 3-52.

- 17 Policymakers need an "economic narrative" to judge the reliability of a forecast scenario; data alone are not enough.

- 18 S. Siviero and D. Terlizzese, "Macroeconomic forecasting: debunking a few old wives" tales', Journal of Business Cycle Measurement and Analysis, 3, 2007, pp. 287-316; M. Caivano and S. Siviero, "Strumenti matematici a supporto delle decisioni di politica monetaria. Il caso della Banca d'Italia", in G. Boffi (ed.), I modelli matematici di fronte alla crisi economica e finanziaria, Università Bocconi, Pristem/Storia, 31, 2013, pp. 49-78.

- 19 M. Casiraghi, E. Gaiotti, M.L. Rodano and A. Secchi, "A 'reverse Robin Hood'? The distributional implications of non-standard monetary policy for Italian households", Journal of International Money and Finance, 85, 2018, pp. 215-235.

- 20 D. Fantino, "Potential output and microeconomic heterogeneity", Banca d'Italia, Temi di discussione (Working Papers), 1194, 2018; D. Fantino, S. Formai and A. Mistretta, Firm characteristics and potential output: a growth accounting approach, Banca d'Italia, Questioni di economia e finanza (Occasional Papers), 616, 2021.

- 21 L. Burlon, D. Fantino, A. Nobili and G. Sene, "The quantity of corporate credit rationing with matched bank-firm data", Banca d'Italia, Temi di discussione (Working Papers), 1058, 2016.

- 22 C. Cookson, "Weather forecasting takes big step forward with Europe's new AI system", Financial Times, 25 February, 2025.

- 23 This feature was highlighted by R.E. Lucas, "Econometric policy evaluation: a critique", in K. Brunner and A.H. Meltzer (eds.), The Phillips curve and labor markets, Amsterdam, North-Holland, 1976, pp. 19-46.

- 24 The quote has been variously attributed to Niels Bohr, Winston Churchill, and even Yogi Berra.

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin