Banca d'Italia has identified the Intesa Sanpaolo, UniCredit, Banco BPM, ICCREA, and Banca Nazionale del Lavoro (BNL) banking groups as other systemically important institutions (O-SIIs) authorized to operate in Italy based on data as at 31 December 2024.

The procedure was initiated before the completion of two recent merger operations, the one between BPER Banca and Banca Popolare di Sondrio and the one between Monte dei Paschi di Siena and Mediobanca. Therefore, the effects of the two transactions were not factored into this decision. However, Banca d'Italia has already initiated procedures for the BPER Banca and Monte dei Paschi di Siena banking groups to account for their new configurations. The outcomes will be announced upon completion of the procedures (until the procedure is completed, the BPER Group, already identified as an O-SII for 2025, shall continue to hold a capital buffer of 0.25 per cent of its total risk-weighted exposure).

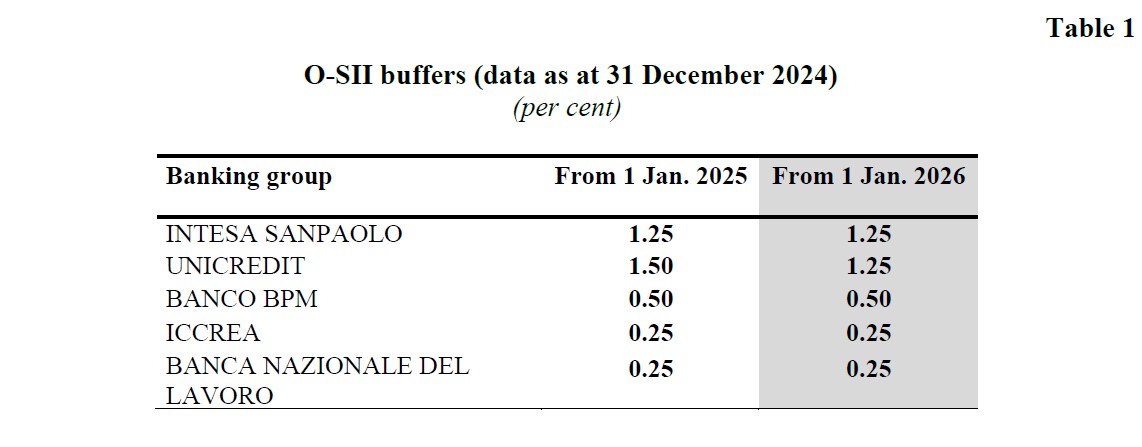

As of 1 January 2026, Intesa Sanpaolo, UniCredit, Banco BPM, ICCREA, and BNL will have to maintain an O-SII buffer of 1.25 per cent, 1.25 per cent, 0.50 per cent, 0.25 per cent, and 0.25 per cent, respectively, of their total risk-weighted exposure (see Table 1).

Banca d'Italia has decided to exercise its supervisory judgment to maintain BNL's O-SII buffer at 0.25 per cent also in 2026.

The decision was taken pursuant to Banca d'Italia's Circular No. 285/2013 (prudential regulations for banks), which implements Directive 2013/36/EU and specifies the criteria on which the methodology for identifying O-SIIs is based. The assessment was conducted in accordance with the European Banking Authority Guidelines (EBA/GL/2014/10), which set out the criteria and data required to identify O-SIIs in EU jurisdictions.

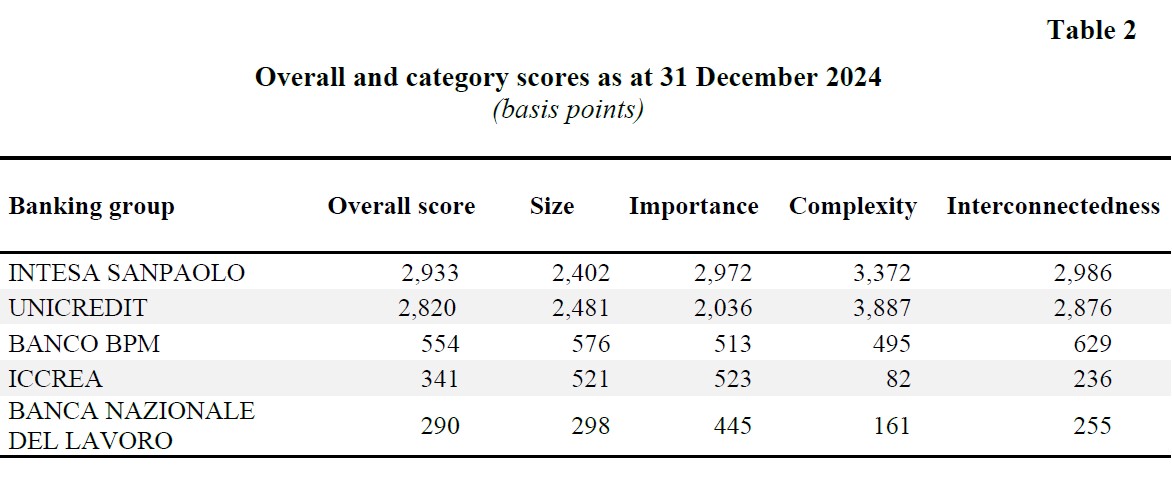

The assessment covered all banking groups and stand-alone banks operating in Italy at the end of 2024. The identification considered, for each bank/banking group, the four categories established by the EBA guidelines, i.e. size, importance for the Italian economy, complexity and interconnectedness with the financial system.

Considering the data as at 31 December 2024, the overall score that indicates the domestic systemic importance of UniCredit, Intesa Sanpaolo, Banco BPM, and ICCREA is above the threshold of 300 basis points that Banca d'Italia uses to identify O-SIIs, in compliance with the EBA Guidelines (see Table 2).

BNL's overall score, instead, fell below the threshold for automatic designation as O-SII. However, the drop in the score was concentrated in the second half of last year and was mainly driven by complexity and interconnectedness, which are the most volatile of the four components that make up the overall score. The decrease may therefore be temporary. Banca d'Italia has thus decided to exercise its supervisory judgment to maintain BNL's buffer at 0.25 per cent (the buffer assigned to BNL is defined in compliance with Article 131(8) of CRD 5 - as transposed by Circular No. 285/2013).

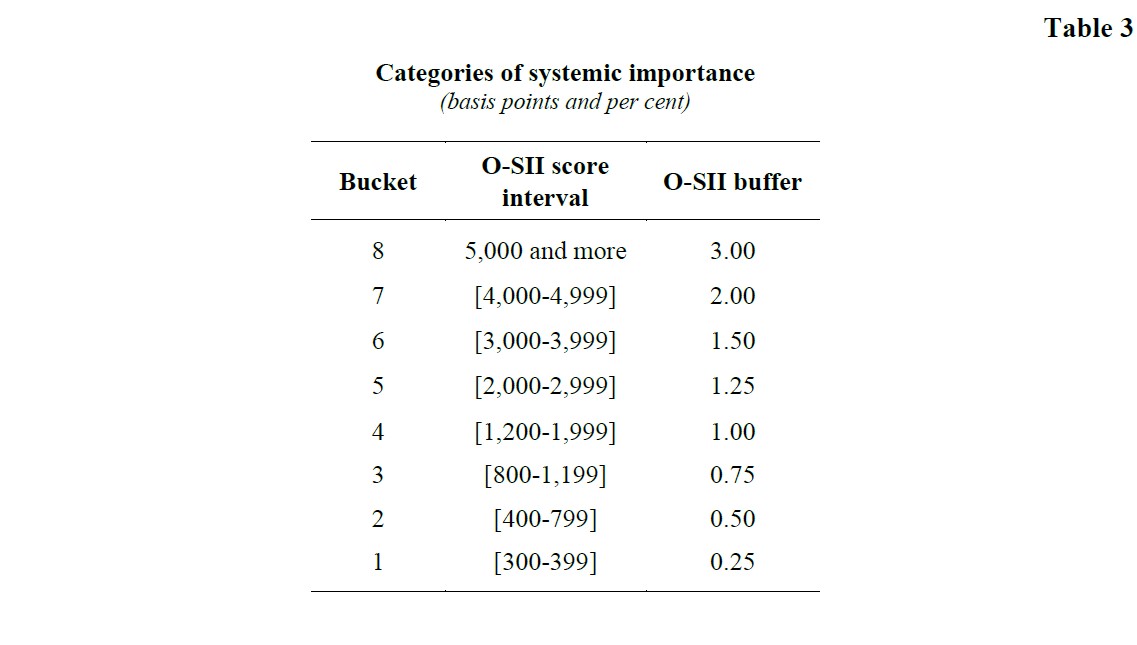

The scheme used to support the calibration of the O-SII buffer is the one defined last year, which consists of eight buckets of systemic importance; each bucket is associated with a higher buffer (see Table 3).

Pursuant to the regulations, the identification of O-SIIs and the level of the O-SII buffers will be reviewed at least once a year. As noted above, Banca d'Italia has initiated procedures for the BPER Banca and Monte dei Paschi di Siena banking groups to account for their systemic relevance following the recent merger operations.

Sezione di approfondimento

- Publish date::14 November 2025Identification of other systemically important institutions authorized to operate in Italypdf 195 KB

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin