La ricchezza dei settori istituzionali in Italia: 2005-2023

Principali risultati

Le stime sulla ricchezza elaborate dall'Istat e dalla Banca d'Italia che qui si rendono disponibili consentono una lettura integrata delle attività patrimoniali detenute dai settori istituzionali e della loro evoluzione nel tempo, anche nel confronto con altre economie avanzate.

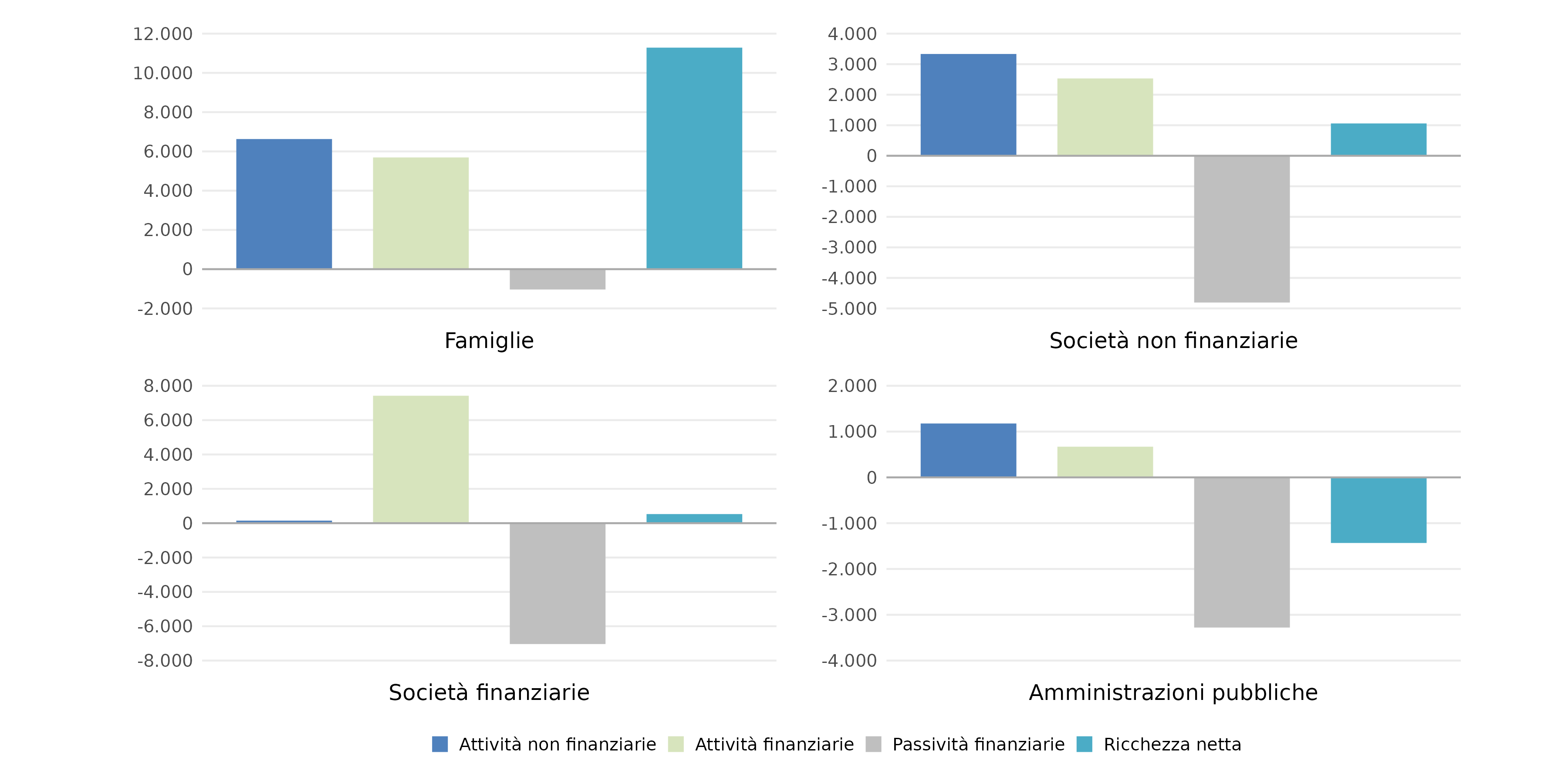

Alla fine del 2023 la ricchezza netta delle famiglie italiane è stata pari a 11.286 miliardi di euro. Rispetto al 2022 è aumentata del 4,5% a prezzi correnti, collocandosi sui livelli più elevati dal 2005, primo anno a partire dal quale sono disponibili i dati. Tuttavia, valutata a prezzi costanti, la ricchezza netta è ancora inferiore a quella del 2021 di oltre sette punti percentuali a causa della forte inflazione osservata nel 2022. L'aumento delle attività non finanziarie nel 2023 rispetto all'anno precedente (+1,6% a prezzi correnti) è stato trainato dalla componente delle abitazioni, che è cresciuta in misura significativa per il secondo anno consecutivo. Il valore delle attività finanziarie è aumentato del 7,1%, principalmente per effetto dell'andamento positivo dei prezzi di azioni, quote di fondi comuni e riserve assicurative, più che compensando le perdite in conto capitale osservate nel 2022. Sono inoltre aumentate le detenzioni di titoli, soprattutto pubblici, in cui le famiglie hanno investito ampiamente nel corso del 2023, mentre i depositi hanno registrato la diminuzione più marcata dal 2005 (‑3,2%). Le passività finanziarie sono rimaste stabili, con una modesta riduzione dei prestiti bilanciata dall'aumento degli altri conti passivi. Nel confronto internazionale, il rapporto tra la ricchezza netta e il reddito lordo disponibile delle famiglie è rimasto stabile nel 2023 in Italia, Canada e Germania, mentre è fortemente diminuito per il secondo anno consecutivo in Francia e Regno Unito.

Tra le attività reali delle società non finanziarie, che costituiscono il 56,8% della loro ricchezza lorda, nel 2023 ha continuato a crescere il valore degli impianti e macchinari. Dal lato finanziario, è sensibilmente aumentato il valore di mercato delle azioni in portafoglio mentre, per la prima volta dal 2012, i depositi si sono ridotti. La ricchezza netta è rimasta pressoché stabile rispetto al 2022 poiché alla complessiva crescita delle attività, reali e finanziarie, è corrisposta quella, di simile importo, delle passività, principalmente per effetto dell'aumento del valore delle azioni che ha più che compensato il calo dei prestiti. Il livello di indebitamento è calato, come è avvenuto anche per le imprese tedesche, mentre è salito per quelle francesi.

La contrazione dei bilanci delle società finanziarie, in atto dal 2022, è proseguita anche nel 2023, con una riduzione pari a circa il 3% sia della ricchezza lorda sia delle passività. La diminuzione delle consistenze all'attivo ha interessato principalmente i depositi e i prestiti, mentre, al passivo, la significativa contrazione della raccolta di depositi è stata parzialmente controbilanciata dalla crescita del valore delle azioni, sospinta dall'andamento dei prezzi.

Alla fine del 2023 la ricchezza netta delle amministrazioni pubbliche è risultata negativa per 1.432 miliardi di euro, in peggioramento rispetto al 2022 soprattutto per effetto di una forte crescita delle passività (+8,8%) che ha più che controbilanciato quella, lieve, delle attività (+0,9%). Nel confronto internazionale, la dinamica del rapporto tra la ricchezza netta delle amministrazioni pubbliche e il Pil in Italia è stata simile negli ultimi anni a quella nel Regno Unito, seppure con un calo più accentuato nel 2023, anno in cui si è osservata una forte riduzione del rapporto anche in Francia.

Ricchezza dei settori istituzionali in Italia (a)

(miliardi di euro; 2023)

(a) Le passività finanziarie sono riportate con il segno negativo.

Fonte: Istat e Banca d'Italia.

Testo del report

-

28 gennaio 2025

-

28 gennaio 2025Dati Ricchezza 2005-2023XLSX 184 KB

YouTube

YouTube  X - Banca d’Italia

X - Banca d’Italia  Linkedin

Linkedin