Survey of Industrial and Service Firms in 2021

Statistics

Main results

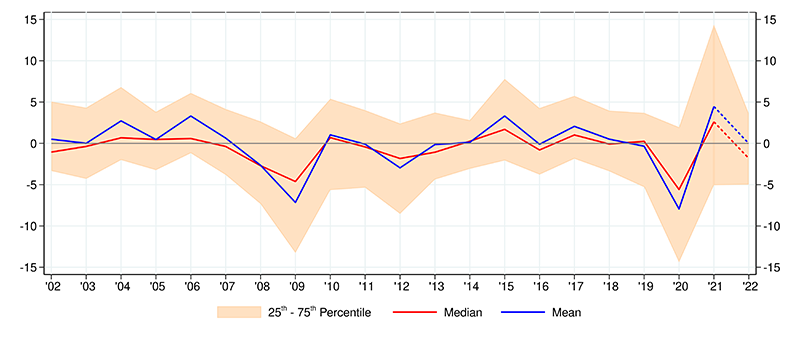

In 2021, turnover and investment returned to positive growth for Italian industrial and service firms with 20 or more employees, recouping in part the contraction observed in 2020 owing to the pandemic. The growth in sales was supported by the recovery in both domestic and foreign demand, and was associated with a rise in profitability and in the number of hours worked, while employment was largely stable. The increase in selling prices was widespread, though for almost one in five firms it was still accompanied by a reduction in profit margins.

In the second half of the year, firms' activity was impacted by rising commodity prices and growing difficulties in sourcing production inputs. These obstacles affected most firms and were associated with relatively stronger price growth.

The expectations for 2022 are affected by the war in Ukraine; most firms believe that the impact on their business will be negative, though limited overall. The main concerns arising from the conflict are linked to the potential reduction in demand, further rises in energy prices, and ongoing difficulties in sourcing production inputs. Prices are expected to continue to grow this year, while sales look set to hold largely stable and investment will likely slow, while still posting positive growth. Employment is expected to turn upwards again.

Production in the construction sector recorded strong growth in 2021, driven above all by the private sector construction segment. Economic activity will likely stabilize in 2022, while employment is expected to rise.

Turnover (1)

(percentage changes)

Note: (1) Does not include the construction sector. Data weighted by population weights and turnover. Values at constant prices calculated on the basis on the average deflators found in the survey. Dotted lines indicate firms' expectations for 2022.

Reference period: 2021

Full text

-

01 July 2022

-

01 July 2022TablesZIP 333 KB

-

03 July 2017

-

01 July 2022

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin