The wealth of Italian households and non-financial corporations: 2005-2017

Main findings

The wealth estimates calculated by Istat and the Bank of Italy released as of today provide a comprehensive description of the assets held by households and non-financial corporations and of how they have changed over time. It is also possible to make a comparison with other advanced economies, bearing in mind that an international comparison remains imperfect.

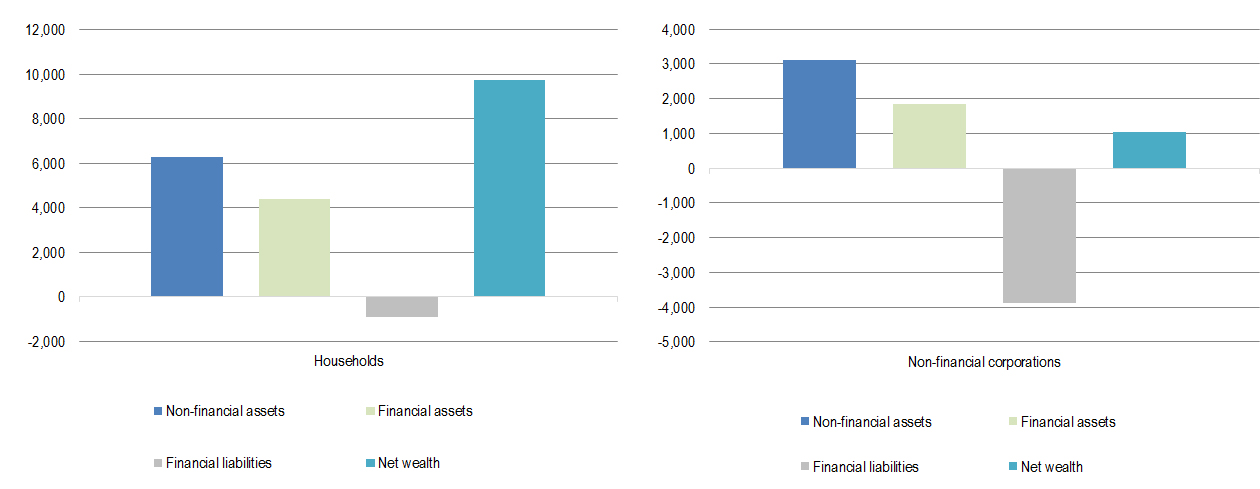

At the end of 2017, the net wealth of Italian households stood at €9,743 billion, eight times the size of their disposable income. Dwellings were the main form of investment for households: with a value of €5,246 billion, they accounted for half of gross wealth. Total household liabilities equalled €926 billion, a level which, in relation to income, was lower than in other countries. Financial assets reached €4,374 billion, up compared with the previous year; however, in proportion to net wealth they remained lower than the level recorded in other economies.

The net wealth of non-financial corporations amounted to €1,053 billion. Total assets equalled €4,943 billion, 63 per cent of which were non-financial assets. The financial component grew between 2013 and 2017, to stand at €1,840 billion. In contrast, there was a decline in the value of real assets, which largely consisted of non-residential real estate and machinery and equipment. Recourse to financing through securities and loans equalled €1,233 billion, a limited amount by international comparison.

Wealth of Italian households and non-financial corporations (a)

(bilions of euros; 2017)

(a) Financial liabilities are shown with a negative sign.

Sources: Istat and Bank of Italy.

Report text

-

09 May 2019

-

09 May 2019Wealth Data 2005-2017XLSX 85 KB

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin