Key messages

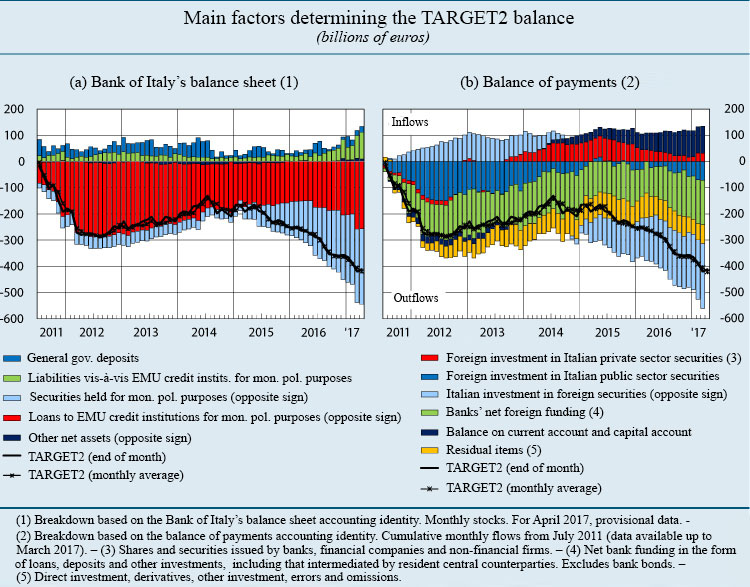

- Since the second quarter of 2015 the Bank of Italy’s TARGET2 deficit has widened by almost €250 billion.

- The widening of the TARGET2 debtor position reflects the decrease in Italian banks’ foreign funding and the rebalancing of residents’ portfolios towards assets other than Italian government securities and bank bonds, which has gone hand in hand with increased asset purchases and liquidity injections on the part of the Eurosystem.

- These developments do not seem to be attributable to a preference for financial assets perceived as safer given the uncertainty surrounding the Italian economy. They instead reflect the difficulty investors face in achieving greater diversification and higher returns in a domestic financial market characterized by relatively few alternatives to bank bonds and public sector securities. They also reflect banks’ shift towards Eurosystem financing.

Over 350,000 interbank payment transactions are executed daily in the euro area, totalling almost €2 trillion. The system that enables these payments to ‘travel’ safely, reliably and efficiently is called TARGET2 (Trans-European Automated Real-Time Gross Settlement Express Transfer System) and is managed by the Bank of Italy together with the Deutsche Bundesbank and the Banque de France. In the TARGET2 system each Eurosystem national central bank (NCB) has a debtor or creditor position (‘balance’) vis-à-vis the ECB, which keeps track of the money entering and leaving each participant country.

The balance of each NCB reflects net liquidity inflows in their respective country following cross-border transactions settled in TARGET2 by NCBs or by credit institutions, either on own account or on behalf of their customers. In the last two years trends in TARGET2 balances have reflected the reallocation of the excess liquidity injected through the Eurosystem asset purchase programme and, to a lesser degree, targeted longer-term refinancing operations.

The Bank of Italy’s TARGET2 deficit reached €412 billion at the end of April 2017, increasing by €247 billion compared with the end of February 2015. Spain and Portugal displayed similar trends, accompanied by the expansion of the Eurosystem’s asset purchase programme.

For Italy, some observers see this as a symptom of capital flight linked to the uncertainty surrounding the country’s economic conditions. However, the available evidence does not support this interpretation.

Balance of payments data show that the widening TARGET2 deficit has primarily reflected outward portfolio investment by residents and banks’ reduced foreign funding, with sales of Italian public sector securities by non-residents playing a smaller part.

Outward investment by residents has reflected the shift in Italian households’ portfolios from government securities and bank bonds towards insurance and asset management products. Returns on government securities are lower as a result of the Eurosystem’s asset purchase programme. Bank bond placements have also decreased. Households are turning to insurance companies and professional advisors to invest their savings in mostly foreign assets. This shift does not appear attributable to a preference for financial assets deemed safer (residents actually made net sales of German public sector securities in the period considered), but instead to the pursuit of more balanced portfolios and higher yields than those normally offered on public sector securities. This reflects the difficulty investors face in achieving greater diversification in a domestic financial market characterized by relatively few alternatives to bank bonds and public sector securities.

Italian banks’ foreign funding decreased in both the interbank and bond markets, owing in part to the shift towards Eurosystem financing, mainly thanks to targeted longer-term refinancing operations.

Inflows of liquidity stemmed instead from Italy’s significant current account surplus, which in 2016 reached 2.6 per cent of GDP.

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin