The Bank of Italy has identified the UniCredit, Intesa Sanpaolo, Banco BPM and Monte dei Paschi di Siena banking groups as other systemically important institutions (O-SIIs) authorized to operate in Italy in 2021.

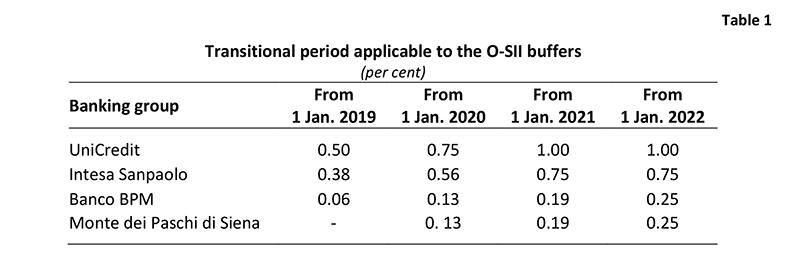

UniCredit, Intesa Sanpaolo, Banco BPM and Monte dei Paschi di Siena will have to maintain a capital buffer of 1.00, 0.75, 0.25 and 0.25 per cent, respectively, of their total risk-weighted exposure, to be achieved according to the transitional periods shown in Table 1.

The decision was taken pursuant to Bank of Italy Circular No 285/2013 (prudential regulations for banks), which implements Directive 2013/36/EU and specifies the criteria on which the methodology for identifying O-SIIs is based. The assessment was conducted in accordance with the European Banking Authority Guidelines (EBA/GL/2014/10), which set out the criteria and data required to identify O-SIIs in EU jurisdictions.

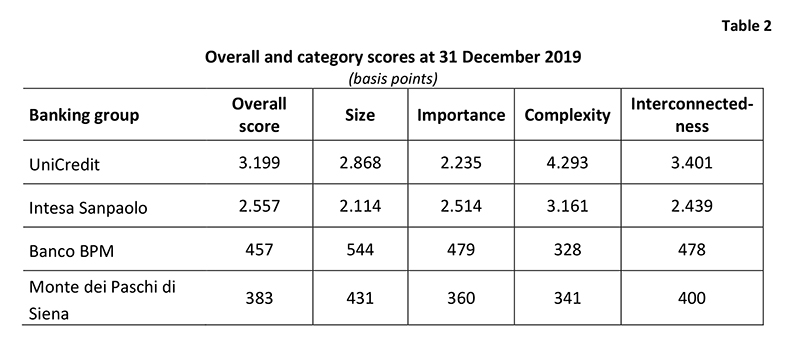

The assessment covered all banking groups, as well as banks not part of a banking group, operating in Italy. The identification considered, for each bank/banking group, the contribution of the four categories indicated in the EBA guidelines, i.e. size, importance for the Italian economy, complexity and interconnectedness with the financial system.

Considering the data as at 31 December 2019, the overall score that indicates the domestic systemic importance of UniCredit, Intesa Sanpaolo, Banco BPM and Monte dei Paschi di Siena is above the threshold of 350 basis points that the EBA Guidelines use to identify O-SIIs (see Table 2).

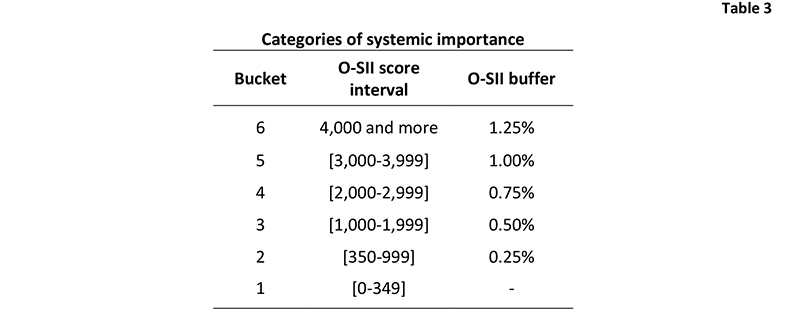

To calibrate the O-SII buffer, the framework proposed last year was maintained, based on six buckets of systemic importance. Each bucket is associated with a higher buffer, with increments of 0.25 percentage points (see Table 3).

Pursuant to the regulations, the identification of O-SIIs and the level of the O-SII buffers will be reviewed at least once a year.

Sezione di approfondimento

- Publish date::30 November 2020Identification of the UniCredit, Intesa Sanpaolo, Banco BPM and Monte dei Paschi di Siena banking groupspdf 136 KB

as other systemically important institutions authorized to operate in Italy

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin