Survey of Industrial and Service Firms in 2022

Statistics

Main results

In 2022, turnover and investment for Italian service firms and industrial firms excluding construction with 20 or more employees continued to grow, albeit at a slower pace than in the previous year. Economic activity was favoured by the easing of difficulties in the sourcing of production inputs, though it was held back by soaring energy prices, which contributed to widespread increases in selling prices. Total employment rose in 2022, recouping the contraction observed during the pandemic.

The share of firms willing to take on more debt in 2022 declined further, to the lowest figure ever reached since the data for this variable started being collected in 2010. The decrease reflected a worsening, in the second half of the year, of firms' assessments of overall borrowing conditions, especially with regard to the interest rates offered.

This year, firms expect sales volumes to be broadly stationary and selling prices to continue to increase, although more slowly than in 2022. Investment plans point to decreased spending for firms in industry excluding construction and continued expansion for service firms. Employment is expected to grow across all sectors.

In the construction sector, the upturn in production and employment that began in 2021 both in the residential construction and in the public works segments continued throughout 2022, albeit at a slower pace. According to firms, economic activity is likely to contract this year.

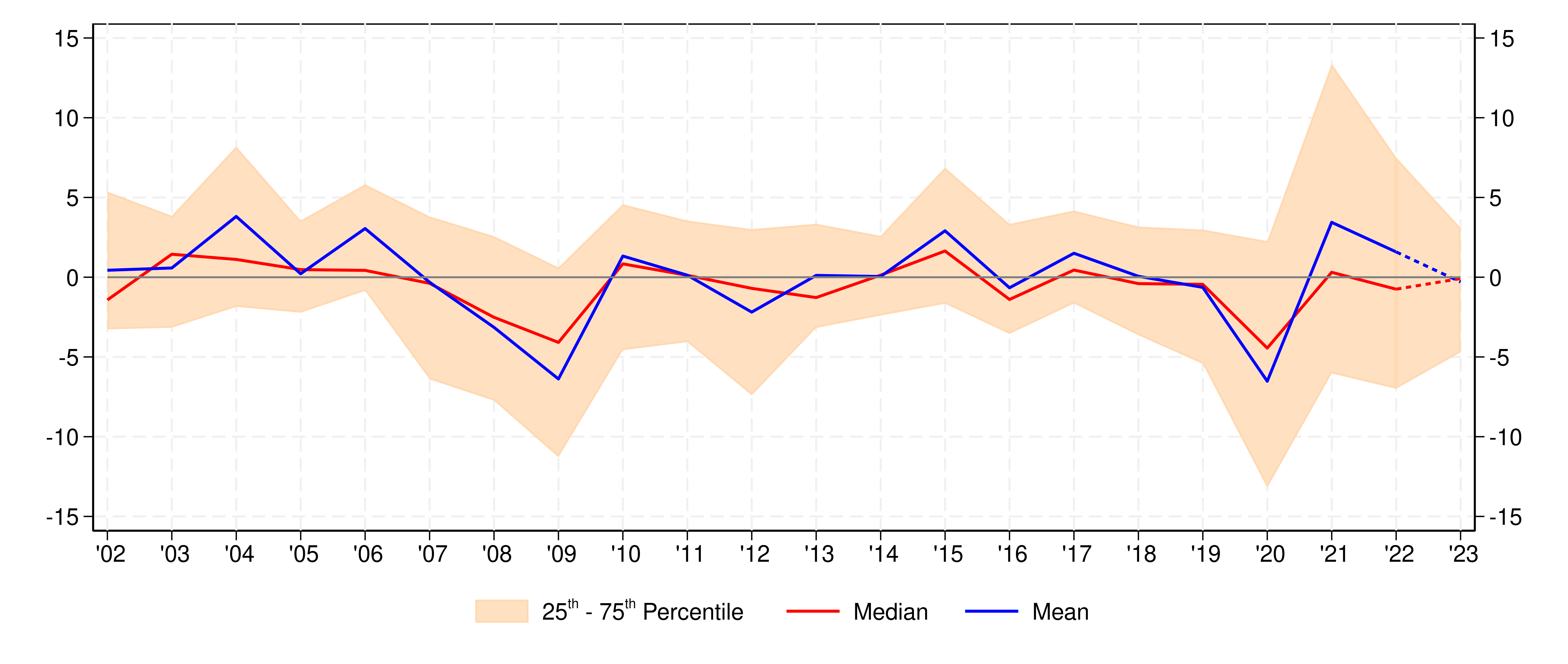

Turnover of Italian industrial firms excluding construction and non-financial private service firms

(percentage changes)

Notes: Data weighted by population weights and turnover. Values at constant prices calculated based on the average deflators obtained from the survey. Dotted lines indicate firms' expectations for 2023.

Reference period: 2022

Full text

-

30 June 2023

-

30 June 2023TablesZIP 247 KB

-

03 July 2017

-

30 June 2023

YouTube

YouTube

X - Banca d'Italia

X - Banca d'Italia

Linkedin

Linkedin